Sports Optic Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 2.94 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

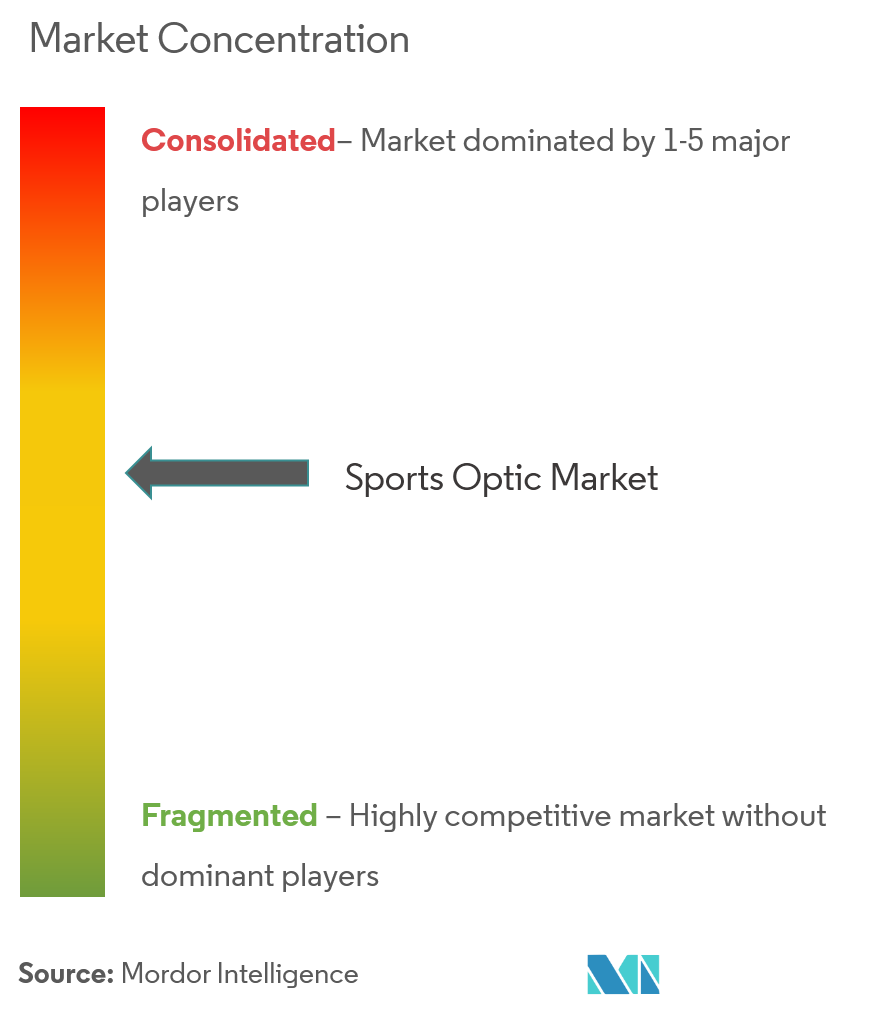

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Sports Optic Market Analysis

The Sports Optic Market size is estimated at USD 2.16 billion in 2023 and is expected to reach USD 2.50 billion by 2028, growing at a CAGR of 2.94% during the forecast period (2023-2028).

Investments by Governments globally to offer top-notch facilities and training to athletes competing in numerous sports disciplines at various levels are anticipated to strengthen the market further. Advances in astronomical projects require gadgets to view and record observations with perfection. Astronomical telescopes enable us to view distant objects accurately, which a human eye can never do.

- August 2022 - NASA is constantly working on new research projects to explore the universe. A custom-built test chamber for a new NASA space telescope is designed to help ready the spacecraft for launch in 2025. The telescope is designed to create a unique 3D map of the entire sky. The survey will map 100 million stars in the Milky Way and out galaxies, star-forming regions, and other cosmic phenomena.

- February 2022 - US-based cycling eyewear, Tifosi Optics, launched Rail, the sport sunglass. The product is designed especially for cyclists. However, they are also helpful for other long-distance sports. The rimless design of this eyewear breaks that barrier and lowers the weight. The frame's rim can produce an airflow-restricting seal against a face.

- Covid-19 caused worldwide turmoil in the sports industry. Major sporting events at all levels were postponed or canceled. However, post-pandemic things normalized, and a series of sports events were organized. The sports gear companies came back with innovation and technology to secure their businesses and signed deals to recover revenue loss. For instance, Aussie Divers Phuket collaborated with Kraken Underwater Sports in Thailand.

Sports Optic Market Trends

Telescopes to Drive the Market Growth

- Telescopes can spot everything that the human eye can't. Based on functionality and use, telescopes can be classified as Refracting Telescope and Reflecting Telescope. On one side, various astronomical projects are creating demand, while on the other, travelers and sports enthusiasts also add to the user base of these telescopic devices. Telescopes give a more detailed view of the galaxies, planets, stars, and other heavenly bodies. With higher magnification capability, birds can be viewed at a greater distance.

- June 2022 - NASA plans to launch a balloon bigger than a football field to send a new telescope over the South Pole. Astrophysics Stratospheric Telescope for High Spectral Resolution Observations at Submillimeter (ASTHROS) will be put 40,000 meters over Antarctica to research a process that stops star formation in some galaxies. It will further study far-infrared light wavelengths blocked by Earth's atmosphere.

- September 2022 - Kowa Optics revised its telescope portfolio by introducing a flagship spotting scope at the world-famous Falsterbo Bird Show. The Telescope features an image free of negative optical distractions allowing the user to immerse in the scene.

North America hold the major market share.

- The US government announced a one-billion-dollar investment in public-private partnerships to achieve national conservation goals. The program will attempt to protect, connect, and restore the country's lands, waters, and wildlife. The United States Fish and Wildlife Service, the United States Forest Service, the National Oceanic and Atmospheric Administration, and the United States Department of Transportation signed a 2 billion USD partnership for fish passage and culvert removal. These investments will boost wildlife tours and other forestry activities in the region, ultimately driving the use of sport optics.

- Astronomy is another field that will invite a significant contribution of Sport optics. In December 2022, The African Astronomical Society (AfAS) and the American Astronomy Society (AAS) organized a submission to planning a vision for 2024. It was decided to establish an African astronomical committee that promotes teamwork among scientists and engineers throughout the continent.

- January 2023 - Bushnell launched a live cellular Trail Camera, CelluCore Live, with an optimized antenna for better signal transmission and dual SIM Connectivity. Users can live stream video and receive immediate visibility of the property with the Bushnell Trail Cameras App on their smartphone.

- December 2022 - Sportsbox AI and Foresight Sports partnered to develop a sport optic exclusively for Golf players that will feature swing and shot analysis. With this application, golfers and their instructors will better comprehend how a swing change can affect ball flight.

Sports Optic Industry Overview

There is a high level of competition in the Sports Optics Market, making it even more crucial for a firm operating in this sector to have strategic goals and to achieve a competitive advantage. There is intense exposure by the governments to encourage youths for national and international sports activities. Increasing efforts to offer top-notch facilities and training to athletes competing in numerous sports disciplines at various levels are anticipated to strengthen the market further. Nikon Corporation, Carl Zeiss AG (ZEISS), Bushnell Corporation, and Trijicon are some of the dominant players in the market.To keep the competition on, manufacturers are enhancing products with technologies like vibration reduction that controls the hand movement-related vibrations of the image and reduces these movements.

- September 2022 - Apex Optics, the Canadian Sports Optic brand, announced the release of high-performance binoculars. The product was promoted through various international trade shows. It was displayed at TACCOM, the largest industry trade show in Canada. This initiative will generate competition for the rivals.

- May 2022 - Taking it to the next level, Leica Sport Optics launched Leica Geovid PRO 32, compatible with the Leica Ballistics App, created in partnership with Applied Ballistics. This will be most suited combination for hunters.

Sports Optic Market Leaders

-

Nikon Corporation

-

Carl Zeiss AG

-

Bushnell Corporation (VISTA OUTDOOR)

-

TRIJICON inc.

-

SWAROVSKI OPTIK

*Disclaimer: Major Players sorted in no particular order

Sports Optic Market News

- January 2023 - ZEISS launched Smart Focus Lightweight (SFL) binoculars. These are specially designed for wildlife enthusiasts and travelers. The company claims this to be the lightest series of SFL. Improved optical design, high-quality glass, and special coating are some of the other vital features of the product.

- December 2022 - UK based Panda Optics introduced Snowsport visual solution to provide the ultimate in goggle vision, comfort, and performance. It comes with the Eye technology, which uses a larger lens and a more petite inner frame, which provides a wide field of vision in both the vertical and horizontal directions.

- October 2022 - National Research Council of Canada (NRC) developed an experimental adaptive optics system that will clear the air for telescopes to take crisp, pure images of the universe. The application uses advanced cameras, high-speed computers, and bendable mirrors to correct the effects of atmospheric turbulence.

Sports Optic Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Increased Performance Specifications such as Clarity, Sharpness, and Magnification

- 5.1.2 Enhanced Fan Experience

-

5.2 Market Challenges

- 5.2.1 High Cost of Sports Optic Products

6. MARKET SEGMENTATION

-

6.1 By Product Type

- 6.1.1 Telescopes

- 6.1.2 Binoculars

- 6.1.3 Rifle Scopes

- 6.1.4 Rangefinders

- 6.1.5 Other Product Types

-

6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Nikon Corporation

- 7.1.2 Carl Zeiss AG

- 7.1.3 Bushnell Corporation (Vista Outdoor)

- 7.1.4 Trijicon Inc

- 7.1.5 Swarovski Optik

- 7.1.6 Celestron, LLC

- 7.1.7 Burris Optics

- 7.1.8 Vortex Optics

- 7.1.9 Leica Camera AG

- 7.1.10 Karl Kaps GmbH & Co. KG

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. FUTURE OF THE MARKET

** Subject To AvailablitySports Optic Industry Segmentation

Optical tools that enhance a user's ability to track, acquire, and understand targets in their environment can be referred to as Sports Optics. Rifle scopes, binoculars, and protective eyewear are some of the products comprised of sports optics. These are used in various activities like water sports, snow sports, hunting, etc. Even golfers use sports optics to estimate the distance of their next shot and determine its perfect trajectory. They primarily use handheld laser range finders.

The Sports Optic Market is segmented by Product Type (Telescopes, Binoculars, Rifle Scopes, Rangefinders) and Geography. The market sizes and forecasts are provided in terms of value (USD) for all the segments.

| By Product Type | Telescopes |

| Binoculars | |

| Rifle Scopes | |

| Rangefinders | |

| Other Product Types | |

| By Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Sports Optic Market Research FAQs

What is the current Sports Optic Market size?

The Sports Optic Market is projected to register a CAGR of 2.94% during the forecast period (2024-2029)

Who are the key players in Sports Optic Market?

Nikon Corporation, Carl Zeiss AG , Bushnell Corporation (VISTA OUTDOOR) , TRIJICON inc. and SWAROVSKI OPTIK are the major companies operating in the Sports Optic Market.

Which is the fastest growing region in Sports Optic Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Sports Optic Market?

In 2024, the North America accounts for the largest market share in Sports Optic Market.

What years does this Sports Optic Market cover?

The report covers the Sports Optic Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Sports Optic Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Sports Optic Industry Report

Statistics for the 2024 Sports Optic market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Sports Optic analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.