Streaming Analytics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 32.67 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

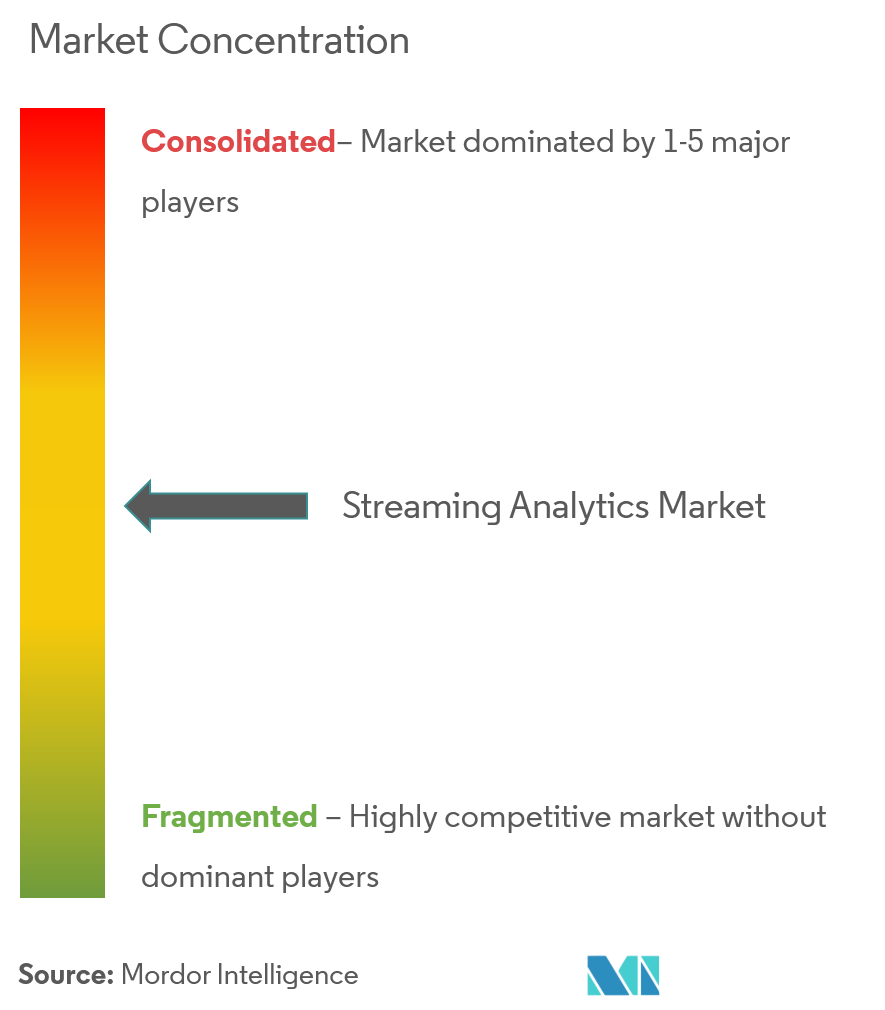

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Streaming Analytics Market Analysis

The streaming analytics market has been valued at USD 7.08 billion in 2020 and is expected to reach a value of USD 38.53 billion by 2026 at a CAGR of 32.67%, during the forecast period (2021-2026). Digitization has exponentially increased data generation and changed data utilization methods. Cloud is a vital catalyst in digital transformation. Streaming analytics aids flexibility by providing real-time synchronization across the cloud or on-premise, surpassing the traditional data processing and accessing options.

- The growth of industrial 4.0 practices across industries, is responsible for the creation of large amounts of data and is expected to provide more scope for the acceptance of real-time analytics over the forecast period.

- Many global companies are collaborating with governments to enhance the public and hybrid cloud markets and use real-time data streaming tools to deliver a practical solution in society. For instance, Alibaba Cloud, backed by Malaysia Digital Economy Corporation, has launched its Malaysia Tianchi Big Data Program - a big data platform that brings together data experts to collaborate and compete in developing solutions for real-world problems.

Streaming Analytics Market Trends

This section covers the major market trends shaping the Streaming Analytics Market according to our research experts:

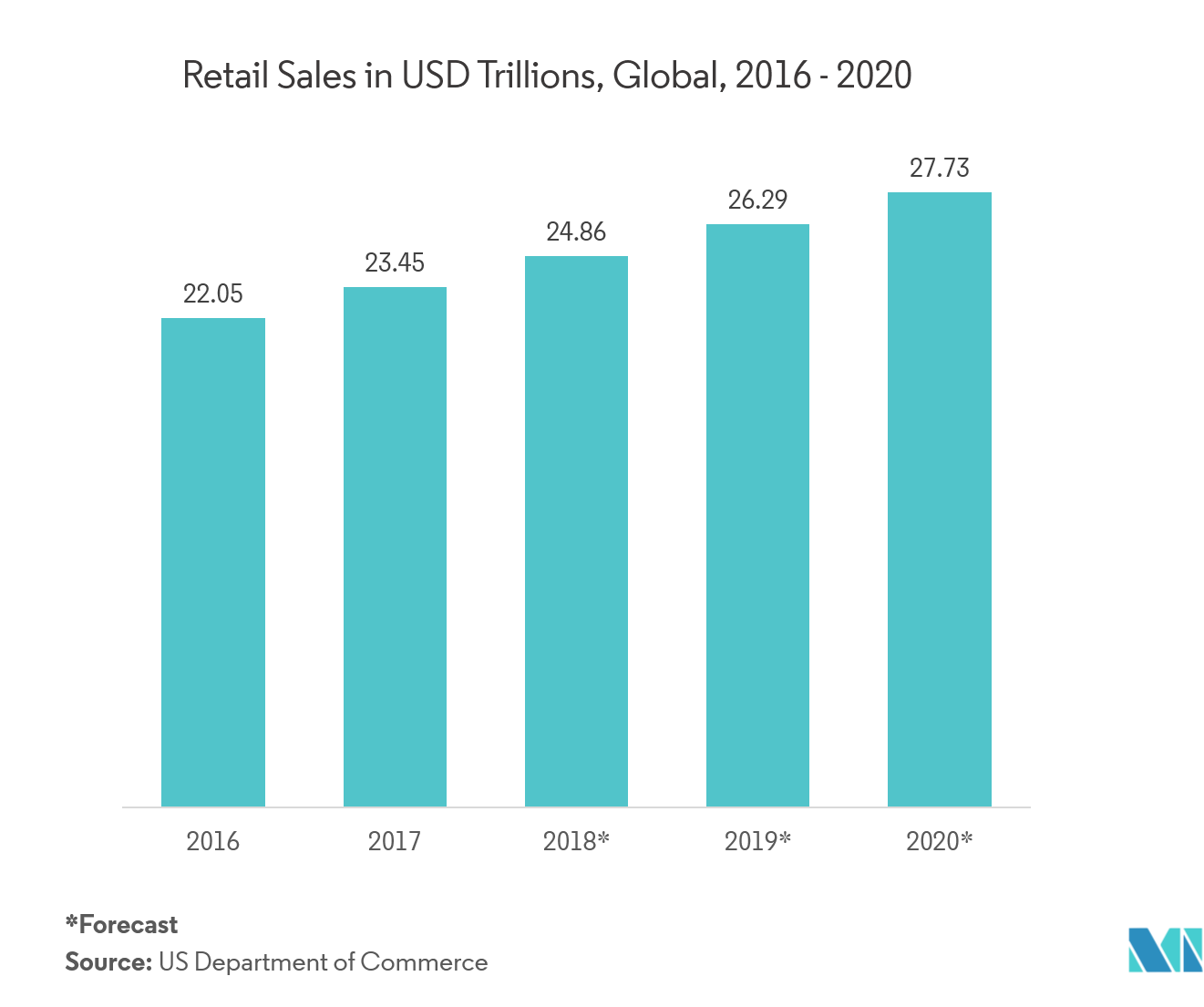

Retail to Hold a Significant Share

Retail is one of the most growing end users of streaming analytics tools and services with an extremely competitive environment with the presence of offline and online players. Due to the increasing number of fraud cases, worldwide, the retail sector finds itself confronting the ever-increasing challenges presented by technology.

- Companies belonging to the retail sector have multiple data streams like inventory reorder times, shortage predictions, shipment fulfillments, tracking customer activity and business trends for personalized offerings/discounts for customers, geo-targeted mobile marketing, etc. Retail is using streaming analytics for prevention and prediction of supply chain visibility, one to one marketing and fraud to a large extent.

- Fraud costs retailers significant revenues, in addition to the time and resources it takes to make up these lost revenues. According to the National Retail Federation (NRF), the financial impact of organized retail crime (ORC) costs retailers USD 777,877 per USD 1 billion in sales in 2018 study.

- Also, Retail accounts for USD 2.6 trillion to annual GDP of United States with retailers losing 1.33 percent of sales on average to inventory shrink, costing the U.S. retail economy a total of USD 46.8 billion in 2017, according to NRF. This would increase the adoption of streaming analytics among retailers.

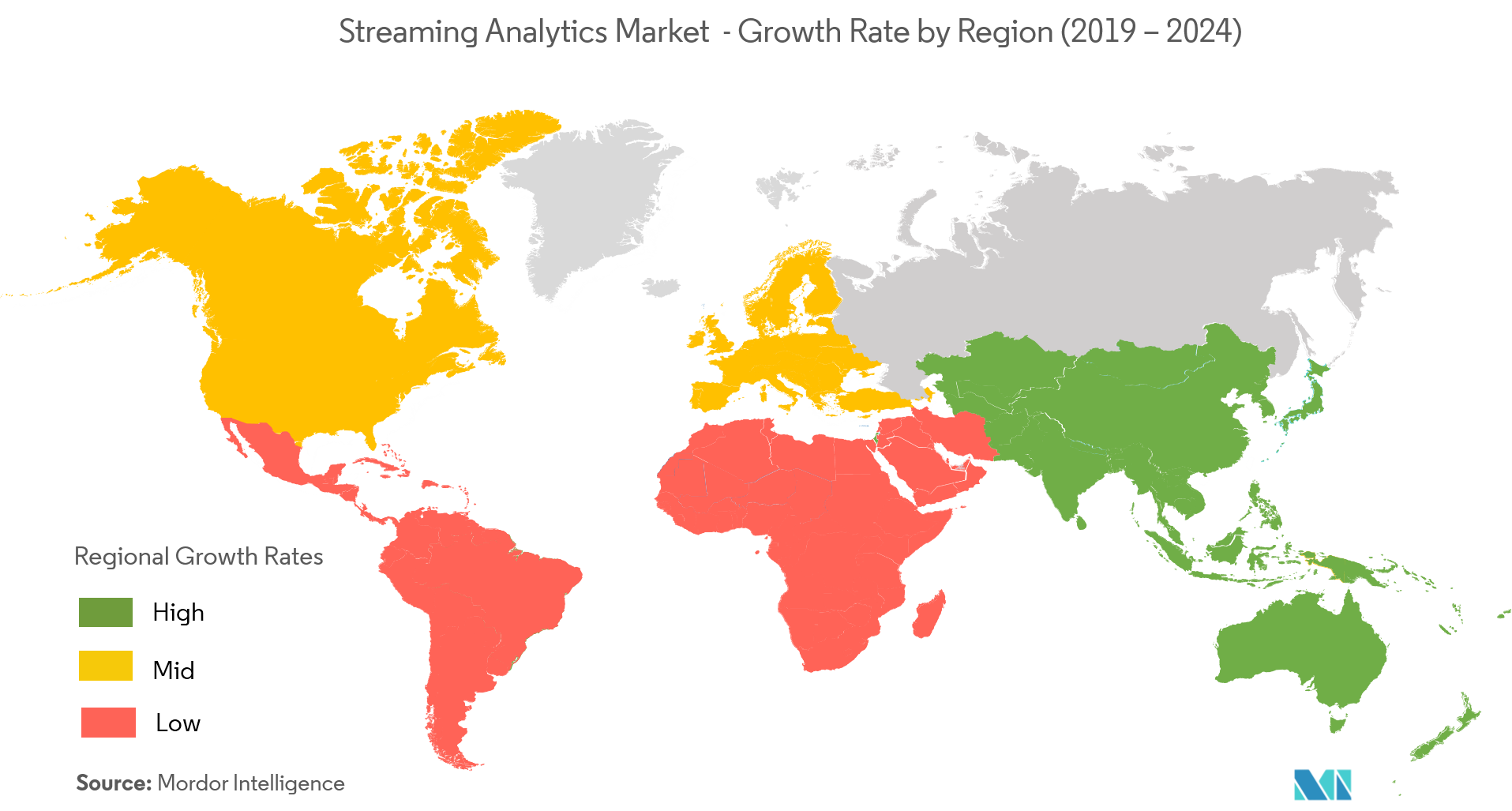

Asia Pacific is Expected to Witness Highest Growth Rate

Asia-Pacific is the fastest growing region in the streaming analytics market, due to the increased adoption of digital technologies among consumers and businesses.

- Prominent vendors of the streaming analytics market in the region are targeting technology and R&D activities to invest more and innovate their already existing technologies, all of which are fueling the growth of the market for streaming analytics in the region.

- Increasing awareness of streaming analytics among SMEs, which contribute significantly to economic growth with their share of GDP ranging from 20% to 50% in the majority of APEC members, and the need for data analytics solutions are driving the demand in this region.

- Asia is emerging as a hub for digital technology, globally. High internet penetration, especially in Southeast Asia, and increasing consumer purchasing power across the region, make the region ideal for creating and testing new innovations.

- Many foreign players are collaborating with local players to utilize emerging opportunities in Asia-Pacific. Intel and Lenovo have collaborated to create a real-time streaming architecture tailored to the financial services industry that uses machine learning to convert raw data into deep business insights, expediting fraud detection.

Streaming Analytics Industry Overview

The competitive rivalry in streaming analytics market observes a collaboration effort to expand the business geographically mostly due to technical capability shortage orgovernment regulations, continuous software upgrades for a wide array ofapplications and expansion to related market as well.

- In December 2018 -the Striim platform offers non-intrusive, real-time data collection and movement from databases,data warehouses, Salesforce, Amazon S3, log files, messaging systems, sensors, and Hadoop solutions by teaming with AWS to continuously deliver data to RedShift.

- In April 2019 -Microsoft's Azure Stream Analytics featured a geospatial index of reference data, providing faster processing to support a larger set of mobile assets and vehicle fleet.

Streaming Analytics Market Leaders

-

Microsoft Corporation

-

IBM Corporation

-

Oracle Corporation

-

SAP SE

-

TIBCO Software Inc.

*Disclaimer: Major Players sorted in no particular order

Streaming Analytics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

-

4.3 Market Drivers

- 4.3.1 Increasing Adoption of Advanced Analytic Tools by SMEs

- 4.3.2 Increasing Adoption of Cloud Services and IoT Applications

- 4.3.3 Growing Industrial Automation

-

4.4 Market Restraints

- 4.4.1 Stringent Government Regulations on Data Security

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Software

- 5.1.2 Services

-

5.2 Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-Based

-

5.3 End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail

- 5.3.3 Manufacturing

- 5.3.4 Banking, Financial Services and Insurance (BFSI)

- 5.3.5 Healthcare

- 5.3.6 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Latin America

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Striim Inc.

- 6.1.3 Tibco Software Inc.

- 6.1.4 Oracle Corporation

- 6.1.5 SAP SE

- 6.1.6 Software AG Inc.

- 6.1.7 Microsoft Corporation

- 6.1.8 Impetus Technologies Inc.

- 6.1.9 Apache Software Foundation

- 6.1.10 SAS Institute Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityStreaming Analytics Industry Segmentation

Streaming Analytics allows the organizations in the setting up of real-time analytics computations on data streaming from devices, websites, sensors, social media, applications and many more. it also provides language integration for intuitive specifications along with quick and appropriate time-sensitive processing. The scope includes Type of streaming analytics as Software and Services and Deployment modes of streaming analytics such as Cloud and on-premise.

| Type | Software | |

| Services | ||

| Deployment | On-Premise | |

| Cloud-Based | ||

| End-user Industry | Media and Entertainment | |

| Retail | ||

| Manufacturing | ||

| Banking, Financial Services and Insurance (BFSI) | ||

| Healthcare | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Middle East and Africa | Mexico |

| Brazil | ||

| Rest of Latin America | ||

| Geography | Latin America | United Arab Emirates |

| Saudi Arabia | ||

| Rest of Middle-East & Africa |

Streaming Analytics Market Research FAQs

What is the current Streaming Analytics Market size?

The Streaming Analytics Market is projected to register a CAGR of 32.67% during the forecast period (2024-2029)

Who are the key players in Streaming Analytics Market?

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE and TIBCO Software Inc. are the major companies operating in the Streaming Analytics Market.

Which is the fastest growing region in Streaming Analytics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Streaming Analytics Market?

In 2024, the North America accounts for the largest market share in Streaming Analytics Market.

What years does this Streaming Analytics Market cover?

The report covers the Streaming Analytics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Streaming Analytics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Streaming Analytics Industry Report

Statistics for the 2024 Streaming Analytics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Streaming Analytics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.