Structural Electronics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 15.30 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Structural Electronics Market Analysis

The structural electronics market is expected to register a CAGR of 15.3% during the forecast period (2021 - 2026). Improvements in 3D technology and the rise of IoT are the factors fueling the growth of structural electronics market. Additionally, there is an increase in the demand for lightweight, cost-effective, and compact products. Structural electronics offer these advantages, thereby augmenting their usage in a wide range of applications.

- Structural electronics are replacing the old components-in-a-box approach with smart materials, such as smart skin, load-bearing parts, and e-textiles. The key capability of structural electronics is to reduce the weight of the product and is expected to disrupt the automotive and aerospace sectors.

- Advancements in material science to develop stretchable conductive materials, application diversity, and government funding are expected to play important roles in driving the advancements in the structural electronics industry.

- For instance, one of the largest Japanese car companies experimented with a 3D printing of ultra-lightweight vehicle seats based on bird-bone structure. The car is expected to become the first 3D-PE (3D Printed Electronics) with electrics and electronics built into the seat.

- However, the lack of technological awareness might hamper the growth of the market during the forecast period.

Structural Electronics Market Trends

This section covers the major market trends shaping the Structural Electronics Market according to our research experts:

Automotive Sector to Account for a Significant Growth

- Structural electronics include electronic components and circuits that act as load-bearing protective structures by replacing the dumb structures (such as automobile bodies) conformally placed upon them.

- The critical capability of structural electronics to reduce the weight of a product is projected to disrupt the automotive sector. Structural electronics is expected to be next important thing in smart cars, as the elements of structural electronics would be integrated within the vehicle's body and undercarriage for resembling the human nervous system and enabling cars to instantly recognize touch and damage.

- In addition, in the future, hybrid/electric cars are expected to use structural electronics, with printed OLED (organic light emitting diode) incorporated inside and outside the car roof.

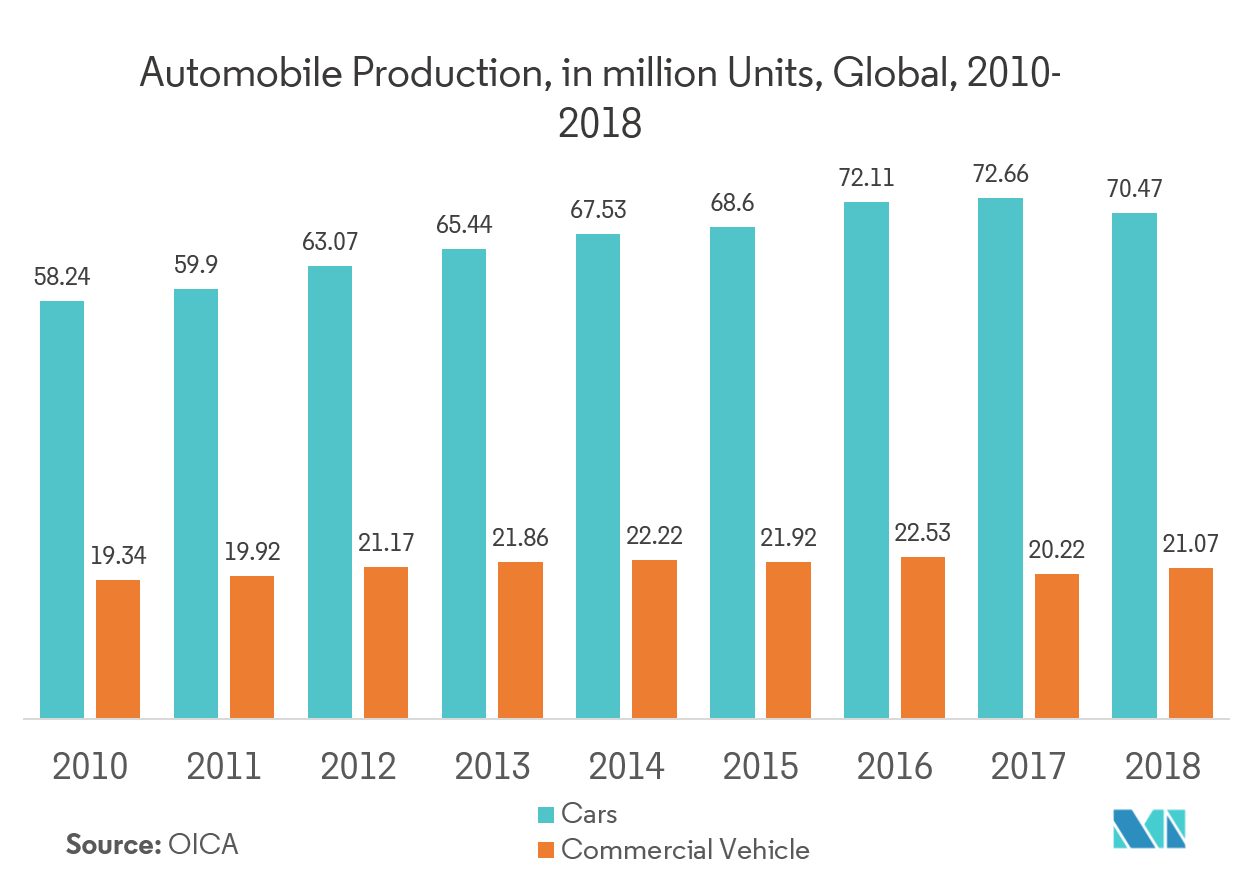

- Moreover, the boom in automobile production across the world with adaption to new technology has brought in changes. Lightweight and compact parts are expected to witness significant demands because of structural electronics over the forecast period.

- However, the global coronavirus outbreak has led to a mass shortage of automobile supply parts which has brought the production process to a major halt. Hence, this may hinder the market growth in the near future.

North America to Account for the Largest Share in Structural Electronics Market

- North America’s robust financial position enables it to invest heavily in advanced solutions and technologies. The higher penetration of structural electronics in the region can be attributed to the high adoption of such products in conductors, photovoltaic products, and sensors that are used in high-end cars and space vehicles.

- Structural electronics has shown tremendous progress in the United States, and issupported by vast R&D activities. For instance, in orderto drive the technology that couples flexible substrates, printed circuits, and thinned silicon die, NextFlex research center hasbeen formed with about USD 165 million in private and public backing.

- Moreover, primarily electric vehicles utilizestructural electronics.This factor is expected to propel the growth of the market studied, as the North Americans are increasingly adopting electric cars.

- In addition, the increasing usage of IOT and 3D technology across various industries is projected to fuel the demand for structural electronics over the forecast period.

Structural Electronics Industry Overview

The structural electronics market ishighly consolidated. The reason is that structural electronics is a highly sophisticated technology that makes it verytough for the new players to enter thismarket. Moreover, the top players have a major share in the market. Some of the key playersinclude The Boeing Company, Panasonic Corporation, TactoTek Oy, Canatu Oy, Neotech AMT GmbH,Toyobo Co. Ltd, among others.

- April 2019 -BÖ-LA and TactoTekjointly announced that they signed an agreement for BÖ-LA to market and sell injection molded structural electronics (IMSE) solutions. This partnership brings together the leaders in their respective technology domains to advance the market for integrating electronic functionality within molded plastics.

- April 2019 -Boeingand the Australian Space Agency signed a statement of strategic intent to help advance the agency’s goals to expand Australia’s domestic space industry.

Structural Electronics Market Leaders

-

TactoTek Oy.

-

Panasonic Corporation

-

Canatu Oy

-

Neotech AMT GmbH

-

Pulse Electronics (a Yageo Company)

*Disclaimer: Major Players sorted in no particular order

Structural Electronics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

-

4.4 Technology Snapshot

- 4.4.1 Technology Framework and Roadmap

- 4.4.2 Innovations

- 4.4.3 In-mold Electronics and Functional Materials

-

4.5 Market Drivers

- 4.5.1 Emerging Need for Lightweight, Compact, Cost-effective Products

- 4.5.2 Improvements in 3D Technology

-

4.6 Market Restraints

- 4.6.1 Lack of Technological Awareness

- 4.7 Assessment of Impact of Covid-19 on the Industry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Automotive

- 5.1.2 Aerospace

- 5.1.3 Consumer Electronics

- 5.1.4 Healthcare

- 5.1.5 Other Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 TactoTek Oy

- 6.1.2 Canatu Oy

- 6.1.3 Neotech AMT GmbH

- 6.1.4 Pulse Electronics (a Yageo Company)

- 6.1.5 T-ink Inc.

- 6.1.6 Molex LLC

- 6.1.7 Panasonic Corporation

- 6.1.8 Odyssian Technology LLC

- 6.1.9 Optomec Inc.

- 6.1.10 Aconity3D GmbH

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityStructural Electronics Industry Segmentation

The term, structural electronics (SE), refers to a next-generation based electronics technology, which involves the printing of functional electronic circuitries, across irregular-shaped architectures. SE is expected to replace bulky load-bearing structures within a circuitry with smart electronic components that can conform to complex shapes for ensuring optimum space utilization. SE offers different and better ways of implementing electronic functionalities into the products.

| By Application | Automotive |

| Aerospace | |

| Consumer Electronics | |

| Healthcare | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Structural Electronics Market Research FAQs

What is the current Structural Electronics Market size?

The Structural Electronics Market is projected to register a CAGR of 15.30% during the forecast period (2024-2029)

Who are the key players in Structural Electronics Market?

TactoTek Oy., Panasonic Corporation, Canatu Oy, Neotech AMT GmbH and Pulse Electronics (a Yageo Company) are the major companies operating in the Structural Electronics Market.

Which is the fastest growing region in Structural Electronics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Structural Electronics Market?

In 2024, the North America accounts for the largest market share in Structural Electronics Market.

What years does this Structural Electronics Market cover?

The report covers the Structural Electronics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Structural Electronics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Structural Electronics Industry Report

Statistics for the 2024 Structural Electronics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Structural Electronics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.