Sulfur Fertilizers Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 4.49 Billion |

| Market Size (2029) | USD 5.65 Billion |

| CAGR (2024 - 2029) | 4.70 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Sulfur Fertilizers Market Analysis

The Sulfur Fertilizer Market size is estimated at USD 4.49 billion in 2024, and is expected to reach USD 5.65 billion by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

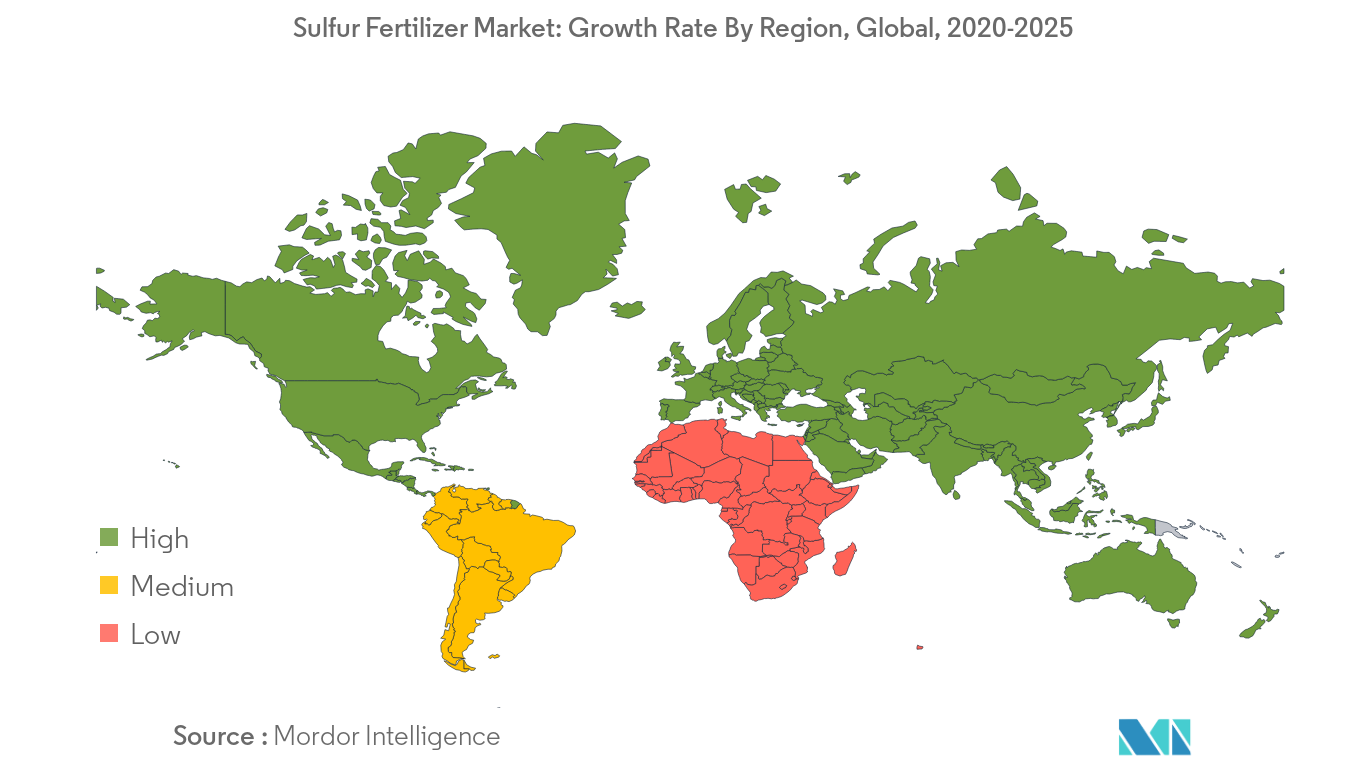

Major factors driving the growth of the sulfur fertilizer market are the rising demand from the fertilizer manufacturing sector. Rising demand from the fertilizer manufacturing sector is expected to grow during the forecast period. The main factors which will drive the market are Sulphur deficiency in soil across the globe and specific crops prone to Sulphur deficiency. On the flip side, stringent environmental regulations regarding emissions are expected to hinder the market growth. Europe and North America have a significant consumption of sulfur currently,while rapidgrowth has been projected in the Asia-Pacific regions.

Sulfur Fertilizers Market Trends

This section covers the major market trends shaping the Sulfur Fertilizer Market according to our research experts:

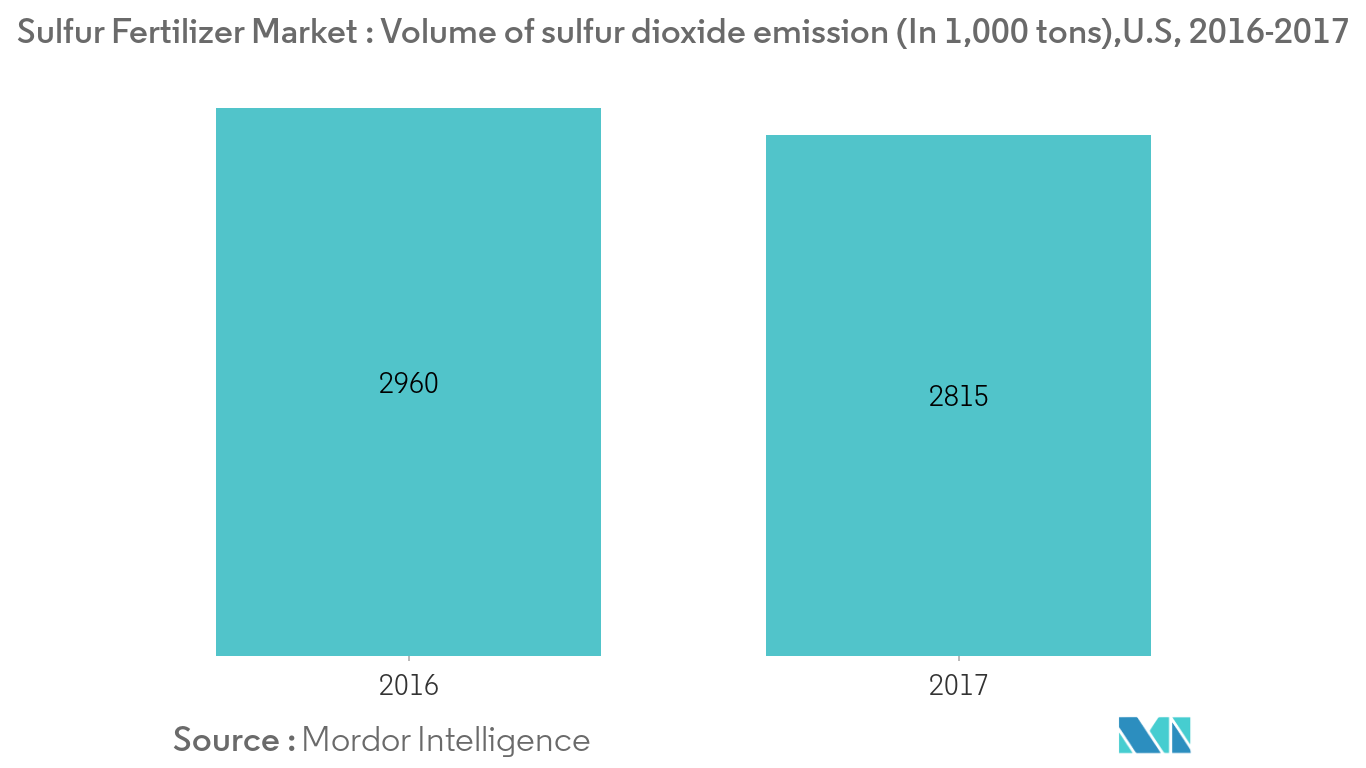

Reduction in Sulfur Emission

Sulfur emission has decreased significantly over the last decades. For instance, In the United States, Sulfur dioxide emission (SO2) has fallen to 2.82 million tons in 2017 from 31.22 million tons in 1970. The reduction in sulfur dioxide is mainly due to the Clean Air Act, which includes the implementation of the Acid Rain Programme. As the Clean Air Act is progressing positively, there has been a reduction in sulfur emission, so the amount of atmospheric sulfur deposited in the soil is only 25%. Crops are now deficient with sulfur and in the future, more deficiency of sulfur will continue due to the "Clean Air Act" which will drive the sulfur macronutrients market during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

North America dominates the market and holds the highest market share. Large agriculture area and awareness about the use of sulphur is the main reason for the growth of the specific market. The Asia-Pacific is projected to be the fastest-growing market as the region is driven by the increasing demand for high-quality agriculture produce with the increase in agriculture practices.

Sulfur Fertilizers Industry Overview

The global sulfur fertilizer market is slightly fragmented, with various small and medium-sized companies coining smaller shares. Global market players, such as Yara International, Nutrien Ltd, and Coromandel International are the leading market players in the segment, while smaller companies, such as Rural Liquid Fertilizers and Nutri-Tech Solutions also account for a formidable share in the market.

Sulfur Fertilizers Market Leaders

-

Coromandel International

-

Haifa Group

-

Yara International

-

The Mosaic Company

-

Nufarm

*Disclaimer: Major Players sorted in no particular order

Sulfur Fertilizers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Sulfate

- 5.1.2 Elemental Sulfur

- 5.1.3 Sulfate of micronutrients

- 5.1.4 Others

-

5.2 Application

- 5.2.1 Solid

- 5.2.2 Liquid

-

5.3 Crop Type

- 5.3.1 Cereals and Grains

- 5.3.2 Oilseeds and pulses

- 5.3.3 Fruits and Vegetables

- 5.3.4 Turf and Ornamental

- 5.3.5 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategy

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Nufarm

- 6.3.2 Haifa Chemicals

- 6.3.3 K+S Aktiengesellschaft

- 6.3.4 The Mosaic Company

- 6.3.5 Coromandel International

- 6.3.6 Yara International

- 6.3.7 Nutrien

- 6.3.8 Deepak Fertilisers and Petrochemicals

- 6.3.9 Israel Chemicals Ltd.

- 6.3.10 Koch Industries

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySulfur Fertilizers Industry Segmentation

For the purpose of this report, only sulphur fertilizer market has been considered. The report covers an extensive study of segments and factors driving the growth of the commercial secondary macronutrients market. An in-depth analysis of the futures market and trend was exclusively measured in this report. Factors driving region-wise analysis are also covered with great observations. The report includes market shares of the major players fromEurope, North America, Asia Pacific, South America, and the Middle East & Africa.

| Type | Sulfate | |

| Elemental Sulfur | ||

| Sulfate of micronutrients | ||

| Others | ||

| Application | Solid | |

| Liquid | ||

| Crop Type | Cereals and Grains | |

| Oilseeds and pulses | ||

| Fruits and Vegetables | ||

| Turf and Ornamental | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Egypt | ||

| Rest of Middle East and Africa |

Sulfur Fertilizers Market Research FAQs

How big is the Sulfur Fertilizer Market?

The Sulfur Fertilizer Market size is expected to reach USD 4.49 billion in 2024 and grow at a CAGR of 4.70% to reach USD 5.65 billion by 2029.

What is the current Sulfur Fertilizer Market size?

In 2024, the Sulfur Fertilizer Market size is expected to reach USD 4.49 billion.

Who are the key players in Sulfur Fertilizer Market?

Coromandel International, Haifa Group, Yara International, The Mosaic Company and Nufarm are the major companies operating in the Sulfur Fertilizer Market.

Which is the fastest growing region in Sulfur Fertilizer Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Sulfur Fertilizer Market?

In 2024, the North America accounts for the largest market share in Sulfur Fertilizer Market.

What years does this Sulfur Fertilizer Market cover, and what was the market size in 2023?

In 2023, the Sulfur Fertilizer Market size was estimated at USD 4.29 billion. The report covers the Sulfur Fertilizer Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Sulfur Fertilizer Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Sulfur Fertilizers Industry Report

Statistics for the 2024 Sulfur Fertilizers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Sulfur Fertilizers analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.