Thin Wall Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.00 % |

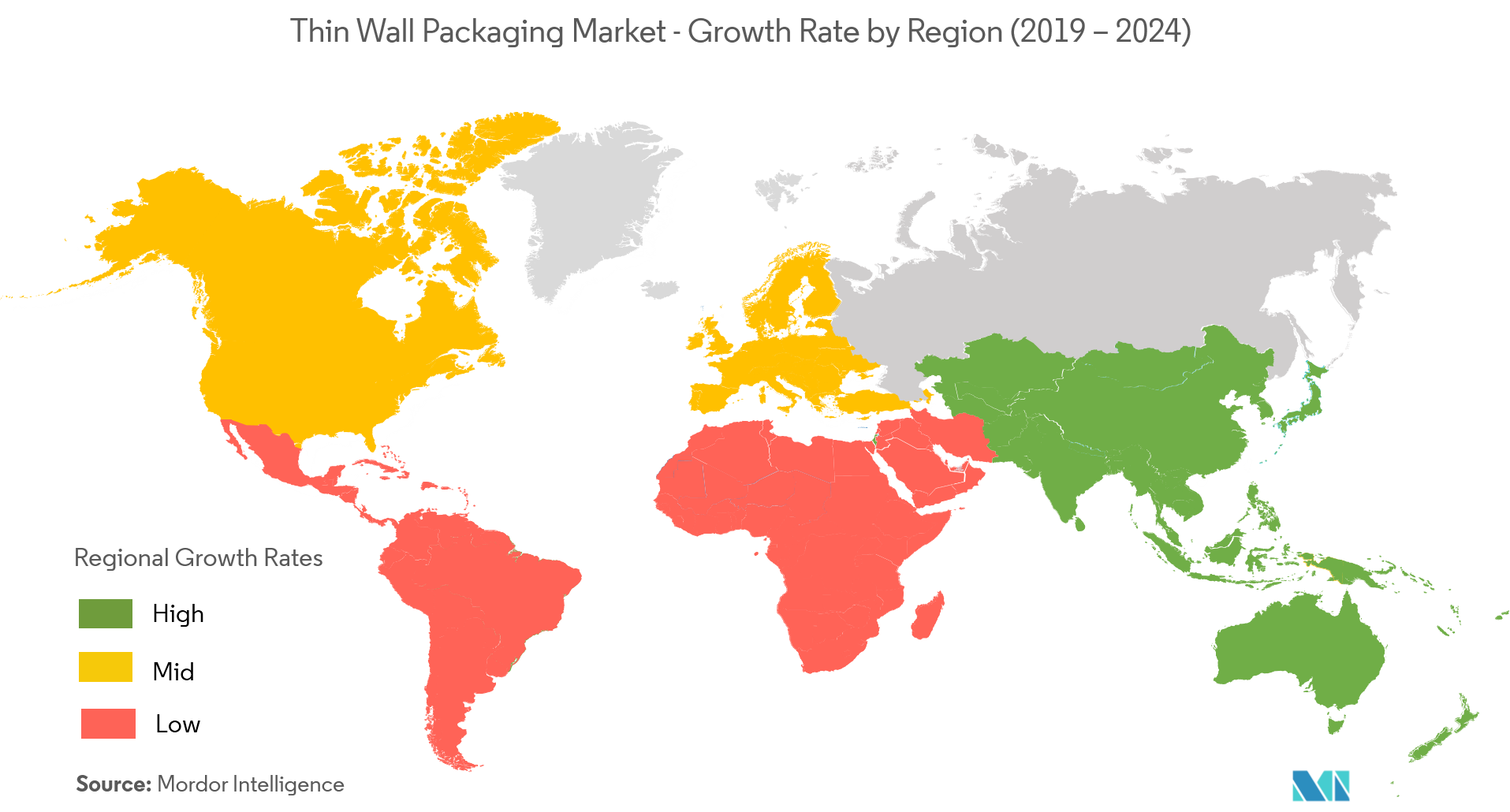

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Thin Wall Packaging Market Analysis

The thin wall packaging market was valued at USD 38.58 billion in 2020 and is expected to reach USD 55.92 billion by 2026, at a CAGR of 6% over the forecast period 2021 - 2026. The changing social and demographics coupled with the increase in the growing per capita income are some of the factors which are influencing the packaging industry on a greater scale.

- The increasing need for lightweight packaging coupled with an increase in the working population is some of the important factors that are responsible for fueling the demand for the thin wall packaging throughout the forecast period.

- The rise of e-commerce in the food and beverages have resulted in the increased consumption of the packaged goods that require packaging which could protect the products from contamination and damages. This trend is expected to boost the market over the forecast period.

- With the increasing research and development activities by the players in the packaging industry has resulted in the launch of innovative thin wall packaging products.

- For instance, in October 2018, Milacron Holdings Corp. a leading industrial technology company serving the plastics processing industry with a product brand named MOLD-MASTERS announced the launch of the new ThinPAK-Series thin-wall hot runner specifically designed for high-pressure applications like thin wall packaging.

- However, since the stringent regulations imposed on the packaging materials like plastics by the economies is expected to hinder the growth of the thin wall packaging products over the forecast period.

Thin Wall Packaging Market Trends

This section covers the major market trends shaping the Thin Wall Packaging Market according to our research experts:

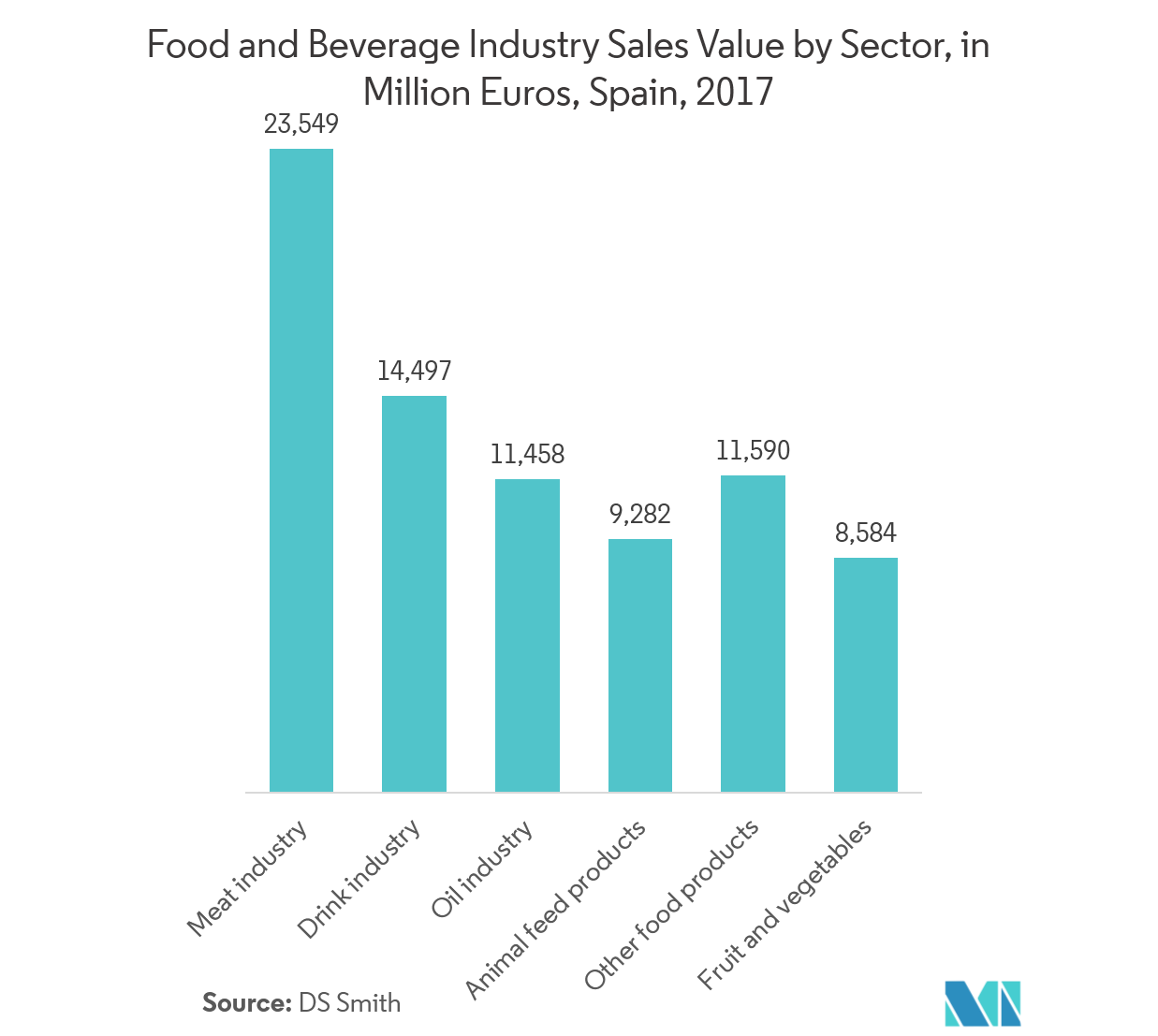

Food & Beverages Industry is Expected to hold the Major Share

- The increasing per capita income has resulted in an increase in the disposable income in the hands of the people allowing them to be able to afford imported food products, in turn, driving the growth of the thin wall packaging market over the forecast period.

- The beverage industry has seen an increase in the transportation cost in the shipping of glass bottles across the nation and returning them to the manufacturers due to increasing fuel prices. Therefore thin wall plastic containers offer an effective solution as they provide the convenience of one-way distribution and are light weighted and are also cost-effective.

- The companies in the thin wall packaging through efficient and effective research and development are launching new copolymers that would support the applications in the food industry thereby increasing the demand thin wall packaging products over the forecast period.

- For instance, in May 2017, Saudi Basic Industries Corporation expanded its PP polypropylene portfolio with two new high flow, injection-molding grades, SABIC PP 513MK46, and 512MK46, impact copolymers that are based on the phthalate free catalyst developed for thin-walled packaging applications its supports both food and non-food applications.

Asia-Pacific to Register Highest Growth Rate

- The various initiatives by the government against food safety procedures has resulted in the revision of the food safety laws in the region which now promote the companies to look for a better option in terms of packaging materials thereby boosting the demand for the thin wall packaging market in the region.

- For instance, China revised its food safety law in which Article 1 aims at securing food safety and ensure the public health and life safety, while article 2 specifies the applicable parties. One of which is the production and distribution of packaging materials, containers, detergents, and disinfectants used for food and of tools and equipment used for food production and distribution.

- Due to the improved economic environment and the increased spending by the people in the region is one of the significant factors fueling the growth of the thin wall packaging market over the forecast period.

- For instance, according to the World Bank, the GNI per capita in PPP dollars of India was 7,060 PPP dollars in 2017 as compared to the 6,500 PPP dollars in 2016.

Thin Wall Packaging Industry Overview

The competitive rivalry in the thin wall packaging market is high owing to the presence of some key players like Takween Advanced Industries, Berry Global Group, and many more. Their ability to innovate the products continually and the foresight of predicting the needs and wants of the market has allowed them to gain a competitive advantage over other players. Hefty investments in research and development coupled with mergers and acquisitions have allowed the companies to gain a strong foothold in the market.

- August 2018 -Berry Global Group, Inc. announced the acquisition ofLaddawn, Inc.,a manufacturer of blown polyethylene bags and films with a unique-to-industry e-Commerce sales platform. In a move that would help Berry Global Group in assistingsmall order fulfillmentfor the faster growing small and medium-sized customer base and providequicker customer response time.

Thin Wall Packaging Market Leaders

-

Berry Global Inc.

-

Sem Plastik Sanayi Ve Ticaret A S

-

Greiner Packaging International GmbH

-

Takween Advanced Industries

-

DOUBLE H PLASTICS, INC.

*Disclaimer: Major Players sorted in no particular order

Thin Wall Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rise of E-Commerce

- 4.3.2 Increasing Need for Light Weight Packaging

- 4.3.3 Increase in the Urban Population

-

4.4 Market Restraints

- 4.4.1 Stringent Regulations

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

-

4.7 Technology Snapshot

- 4.7.1 Thermoforming

- 4.7.2 Injection Molding

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Tubs

- 5.1.2 Jars

- 5.1.3 Pots

- 5.1.4 Cups

- 5.1.5 Trays

-

5.2 By Materials

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polystyrene (PS)

- 5.2.4 Polyethylene (PE)

- 5.2.5 Polyvinyl Chloride (PVC)

-

5.3 By End-user Industry

- 5.3.1 Food & Beverage

- 5.3.2 Cosmetics

- 5.3.3 Pharmaceutical

- 5.3.4 Other End-user Industry

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Novio Packaging B.V.

- 6.1.2 Groupe Guillin SA

- 6.1.3 Omniform SA

- 6.1.4 Takween Advanced Industries

- 6.1.5 Insta Polypack

- 6.1.6 JRD International

- 6.1.7 Dampack International Bv

- 6.1.8 Saudi Basic Industries Corporation

- 6.1.9 Sem Plastik Sanayi Ve Ticaret A S

- 6.1.10 Berry Global Group

- 6.1.11 Greiner Packaging International GmbH

- 6.1.12 Double H Plastics, INC.

- 6.1.13 Silgan Holdings Inc.

- 6.1.14 Faerch Plast A/S

- 6.1.15 Plastipak Industries INC.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityThin Wall Packaging Industry Segmentation

Thin wall packaging is responsible for the protection of the products that are contained in it from contamination or damages, thereby playing an important role for any product-based firm.The Thin wall Packaging Market is segmented by Type (Tubs, Cups, Pots, Jars, Trays), By Packaging Materials (Polystyrene (PS), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyethylene (PE)) End-user Industry (Food & Beverages, Cosmetics, Pharmaceutical, Other End-user Industries), and Geography.

| By Type | Tubs | |

| Jars | ||

| Pots | ||

| Cups | ||

| Trays | ||

| By Materials | Polypropylene (PP) | |

| Polyethylene Terephthalate (PET) | ||

| Polystyrene (PS) | ||

| Polyethylene (PE) | ||

| Polyvinyl Chloride (PVC) | ||

| By End-user Industry | Food & Beverage | |

| Cosmetics | ||

| Pharmaceutical | ||

| Other End-user Industry | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| Australia | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle-East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle-East & Africa |

Thin Wall Packaging Market Research FAQs

What is the current Thin Wall Packaging Market size?

The Thin Wall Packaging Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Thin Wall Packaging Market?

Berry Global Inc., Sem Plastik Sanayi Ve Ticaret A S, Greiner Packaging International GmbH, Takween Advanced Industries and DOUBLE H PLASTICS, INC. are the major companies operating in the Thin Wall Packaging Market.

Which is the fastest growing region in Thin Wall Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Thin Wall Packaging Market?

In 2024, the North America accounts for the largest market share in Thin Wall Packaging Market.

What years does this Thin Wall Packaging Market cover?

The report covers the Thin Wall Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Thin Wall Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Thin Wall Packaging Industry Report

Statistics for the 2023 Thin Wall Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Thin Wall Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.