Traffic Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.10 % |

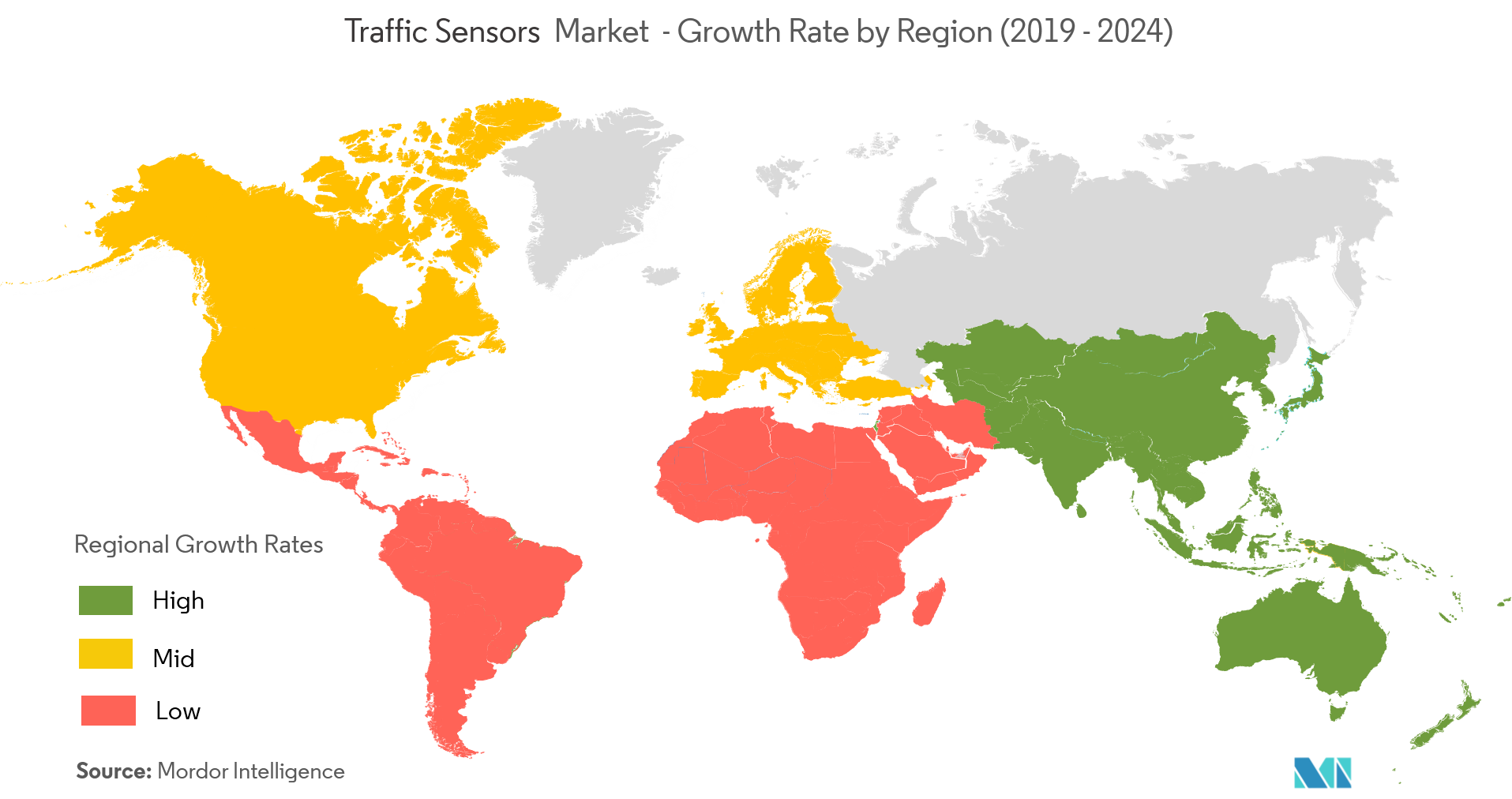

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

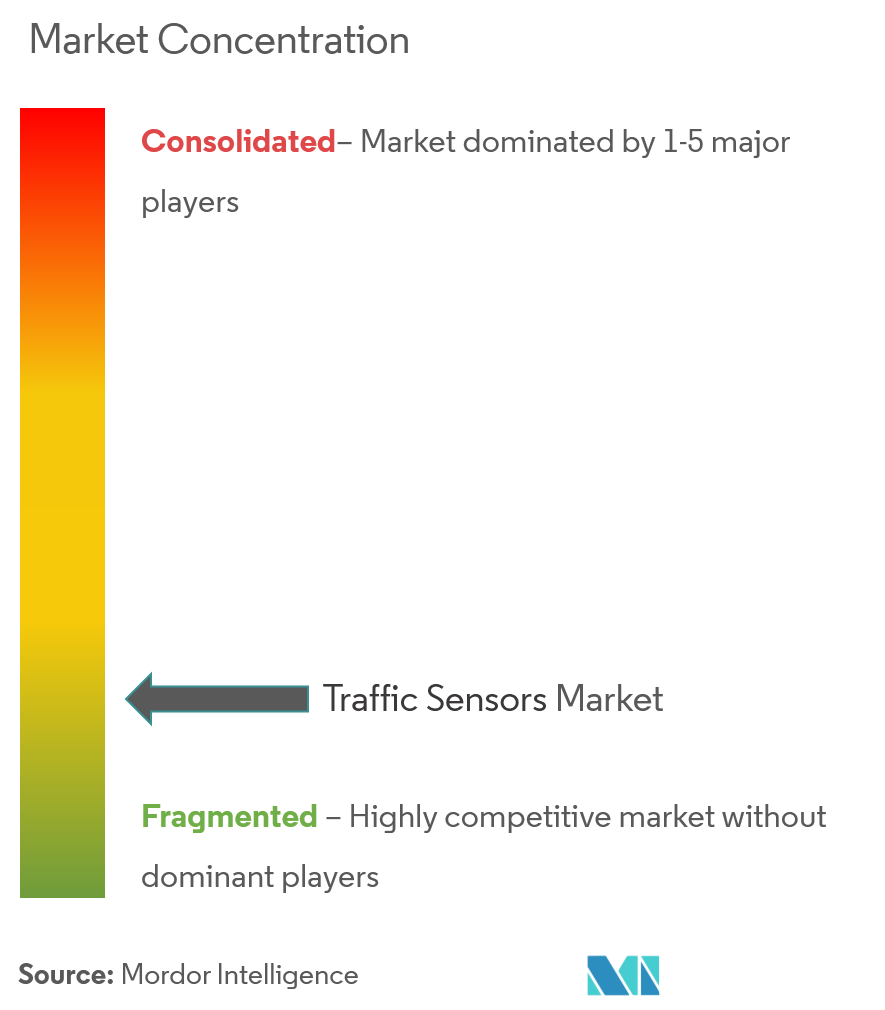

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Traffic Sensors Market Analysis

The Traffic Sensors was valued at USD 271.97 million in 2020 and is expected to reach USD 434.0 million by 2026 and grow at a CAGR of 8.1% over the forecast period (2021-2026). The increasing awareness of the adverse effect of road accidents on GDP is compelling several cities to implement sensor-based smart traffic signals.

- To obtain and enhance real-time traffic information, the utilization and integration of transportation surveillance are necessary wherein currently, the traffic sensors play a vital role to fulfill the requirement.

- These traffic sensors collect data which is used for several applications, such as flow monitor and anticipate any bottleneck and travel time estimation. However, the limited budget on infrastructure coupled with high initial investment and maintenance cost is likely to hamper the market growth.

- Due to the increase in urbanization and population, there is an increase in the number of vehicles. For which the government has taken initiatives to modify transport infrastructure. These factors act as drivers for the traffic sensors market.

- However, the setup cost is very high to implement this infrastructure which is a major challenge for the traffic sensors market.

Traffic Sensors Market Trends

This section covers the major market trends shaping the Traffic Sensors Market according to our research experts:

Traffic Monitoring to Witness Significant Growth

- Installation of traffic sensors will now be an integral part of traffic monitoring and to analyze the pattern of the moving vehicles and their interaction in the traffic. This is expected to help in enhancing the efficiency in traffic management, such as jams.

- Since there is a significantly increasing number of commercial vehicles, the players and institutions are coming up with advanced traffic monitoring systems. For instance, the Indian Institute of Technology (IIT) Delhi, India completed the prototype of smart traffic monitoring systems on the campus.

- Also, the major players and researchers are testing traffic monitoring using the latest emerging technologies. The researchers from the Texas Advanced Computing Center (TACC) commenced the test of traffic monitoring using AI, which in the future is likely to increase the utilization of traffic sensors.

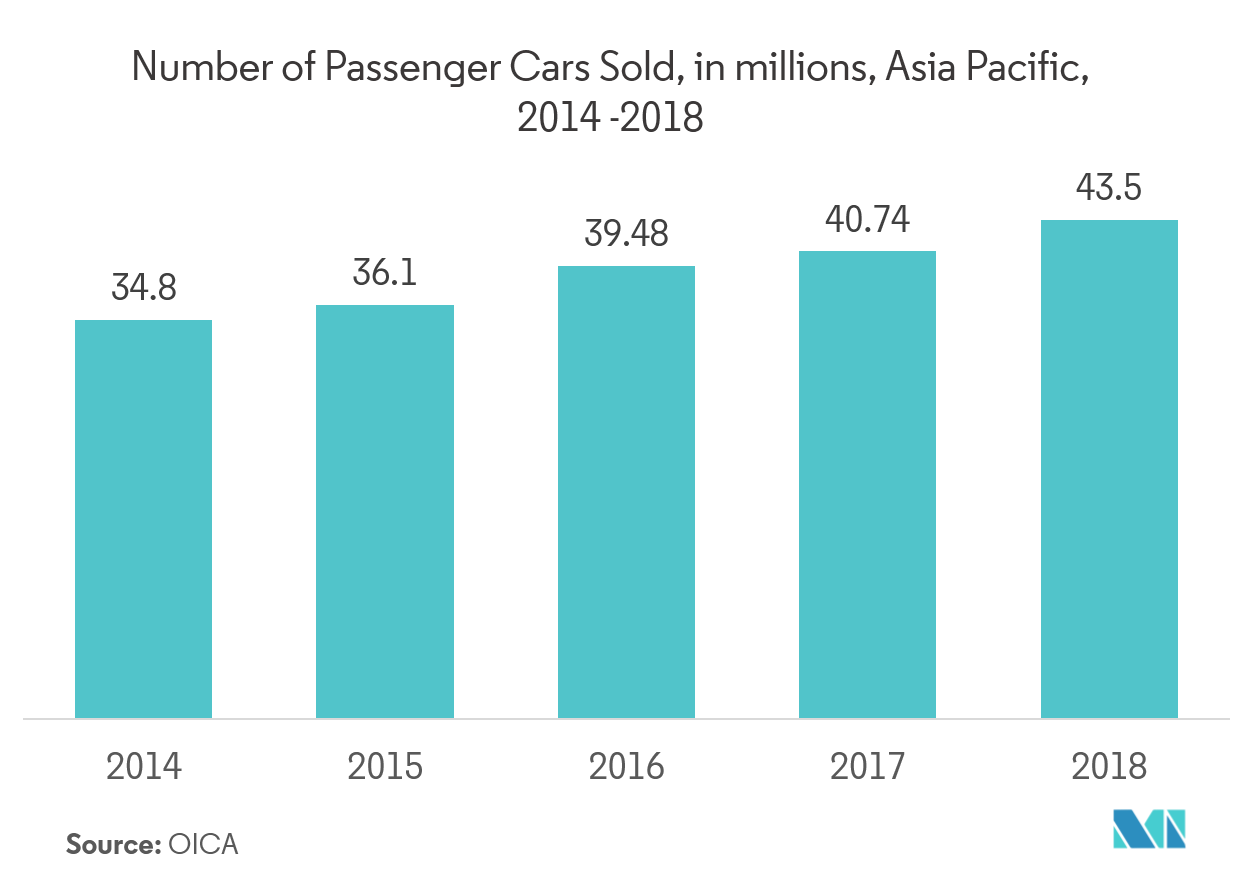

- The increasing number of passenger cars is driving the need for advanced and optimized traffic management system. Since 2015, the number of passenger cars has witnessed a growth of over 7% and is expected to increase owing to the emerging electric vehicles. As a result, it is likely to boost the demand for intelligent traffic monitor and control system, thereby having a positive impact on the utilization of traffic sensors.

- As a result, it creates an immense opportunity and potential in the region for the industry players in the region to invest and tap the early market garnering higher market share.

North America to Dominate the Traffic Sensor Market

- North America contains the most urbanized landscapes in the world. In the United States and Canada, approximately 80% of the population is in the urban areas. These volumes of urbanization create challenges for the government to manage traffic.

- The region is engaged in both internal and external research and development, in an effort to introduce new types of traffic sensors to enhance the effectiveness, ease of use, safety, and reliability of its existing traffic sensors and to expand applications for which the uses of current products are appropriate.

- Sometimes the urgent transport of goods, as well as the movement of people, is delayed because of the jams at traffic signals, so today it has been optimized to a large degree using traffic control and safety systems. Traffic sensors are installed at various places in the region for measuring different types of data extracted from the number of vehicles and regulates the signals accordingly. This would also help to maneuver the demand of the traffic sensors in North America.

Traffic Sensors Industry Overview

The major players includeKistler Group, Flir Systems Inc., TE Connectivity Ltd, SICK AG, Axis Communications AB, Raytheon Company, and Siemens AG, among others. The market is fragmentedsince it is competitive without dominant players. Hence, the market concentration will be low.

- August 2018 -TE Connectivity acquired ENTRELEC terminal block business from ABB which expands the company’s product portfolio and widens the consumer reach.

- January 2018 -Ericssonwill provide its Connected Urban Transport solution for the City of Dallas' Advanced Traffic Management System. The solution is designed to ease traffic congestion by the use of an interface to automate and facilitate systems monitoring, performance monitoring, management, and maintenance, with the ability to share data across cities and countries. The solution is expected to allow the City of Dallas to expand its knowledge about traffic issues and assist with operational decision making to improve traffic flow.

Traffic Sensors Market Leaders

-

Raytheon Company

-

Flir Systems Inc.

-

Siemens AG

-

TE Connectivity Ltd

-

Kistler Group

*Disclaimer: Major Players sorted in no particular order

Traffic Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Urbanization and Population

- 4.3.2 Growing Need for Real-Time Information System

- 4.3.3 Government Initiatives to Modify Transport Infrastructure

-

4.4 Market Restraints

- 4.4.1 High Setup Costs

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Sensor Type

- 5.1.1 Inductive Loop

- 5.1.2 Piezoelectric Sensor

- 5.1.3 Bending Plate

- 5.1.4 Image Sensor

- 5.1.5 Infrared Sensor

- 5.1.6 Other Types of Sensors

-

5.2 By Application

- 5.2.1 Vehicle Measurement and Profiling

- 5.2.2 Weigh in Motion

- 5.2.3 Traffic Monitoring

- 5.2.4 Automated Tolling

- 5.2.5 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Kapsch TrafficCom AG

- 6.1.2 International Road Dynamics, Inc.

- 6.1.3 Kistler Group

- 6.1.4 Flir Systems, Inc.

- 6.1.5 TE Connectivity Ltd

- 6.1.6 SWARCO AG

- 6.1.7 Q-Free ASA

- 6.1.8 SICK AG

- 6.1.9 Raytheon Company

- 6.1.10 Siemens AG

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityTraffic Sensors Industry Segmentation

The traffic signal consists of a sensor or timer to direct and monitor the traffic flow. In cities where there is too much traffic, it creates a deadlock despite the timer. Hence, the traffic sensor senses the number of vehicles in the queue and regulates the signal accordingly.

| By Sensor Type | Inductive Loop | |

| Piezoelectric Sensor | ||

| Bending Plate | ||

| Image Sensor | ||

| Infrared Sensor | ||

| Other Types of Sensors | ||

| By Application | Vehicle Measurement and Profiling | |

| Weigh in Motion | ||

| Traffic Monitoring | ||

| Automated Tolling | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Spain | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America | ||

| Geography | Middle-East & Africa |

Traffic Sensors Market Research FAQs

What is the current Traffic Sensors Market size?

The Traffic Sensors Market is projected to register a CAGR of 8.10% during the forecast period (2024-2029)

Who are the key players in Traffic Sensors Market?

Raytheon Company, Flir Systems Inc., Siemens AG, TE Connectivity Ltd and Kistler Group are the major companies operating in the Traffic Sensors Market.

Which is the fastest growing region in Traffic Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Traffic Sensors Market?

In 2024, the North America accounts for the largest market share in Traffic Sensors Market.

What years does this Traffic Sensors Market cover?

The report covers the Traffic Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Traffic Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Traffic Sensors Industry Report

Statistics for the 2024 Traffic Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Traffic Sensors analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.