Tube Packaging Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 6.66 Billion |

| Market Size (2029) | USD 9.50 Billion |

| CAGR (2024 - 2029) | 7.39 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Tube Packaging Market Analysis

The Tube Packaging Market size is estimated at USD 6.66 billion in 2024, and is expected to reach USD 9.5 billion by 2029, growing at a CAGR of 7.39% during the forecast period (2024-2029).

Tubes are one of the most popular packaging formats in the cosmetic and personal care segment, primarily attributed to their convenience, portability, and flexibility to hold and dispense a wide variety of products.

- Factors like the increasing urbanization, growing millennial population, and rising disposable incomes of consumers are the major contributors to the growth of the market studied. Urbanization has been responsible for boosting disposable income and creating awareness about the availability of different cosmetics products, thus creating several opportunities for market players and significantly spurring the demand for Tube packing.

- The laminated tubes are currently governing the market owing to its multi-layered barrier structure. These tubes improve the shelf-life of the product by providing excellent barrier properties and minimize the transfer of oxygen and light, offering protection against bacteria, due to which the demand is rising.

- The pharmaceutical market is also driving the growth of the market especially medicines that are used in Dermatology where tube packing is extensively used. Global pharmaceutical sales globally in 2018 were 110 billion USD according to AstraZeneca and the future growth of the pharmaceutical sector will drive the demand for tubes and bottles packaging particularly.

- Further, technological advancements in cosmetic packaging due to focus on enhancing the user's experience such as by including a brush or sponge head, on a tube with a pump and other innovative applicators, are being requested more often.

- Urbanization has created several opportunities for market players, by boosting disposable income and creating awareness about the availability of different cosmetics products thereby significantly spurring the demand for Tube packing.

- However, regulations vary across regions and countries for packing which may hamper the growth of the market.

Tube Packaging Market Trends

This section covers the major market trends shaping the Tube Packaging Market according to our research experts:

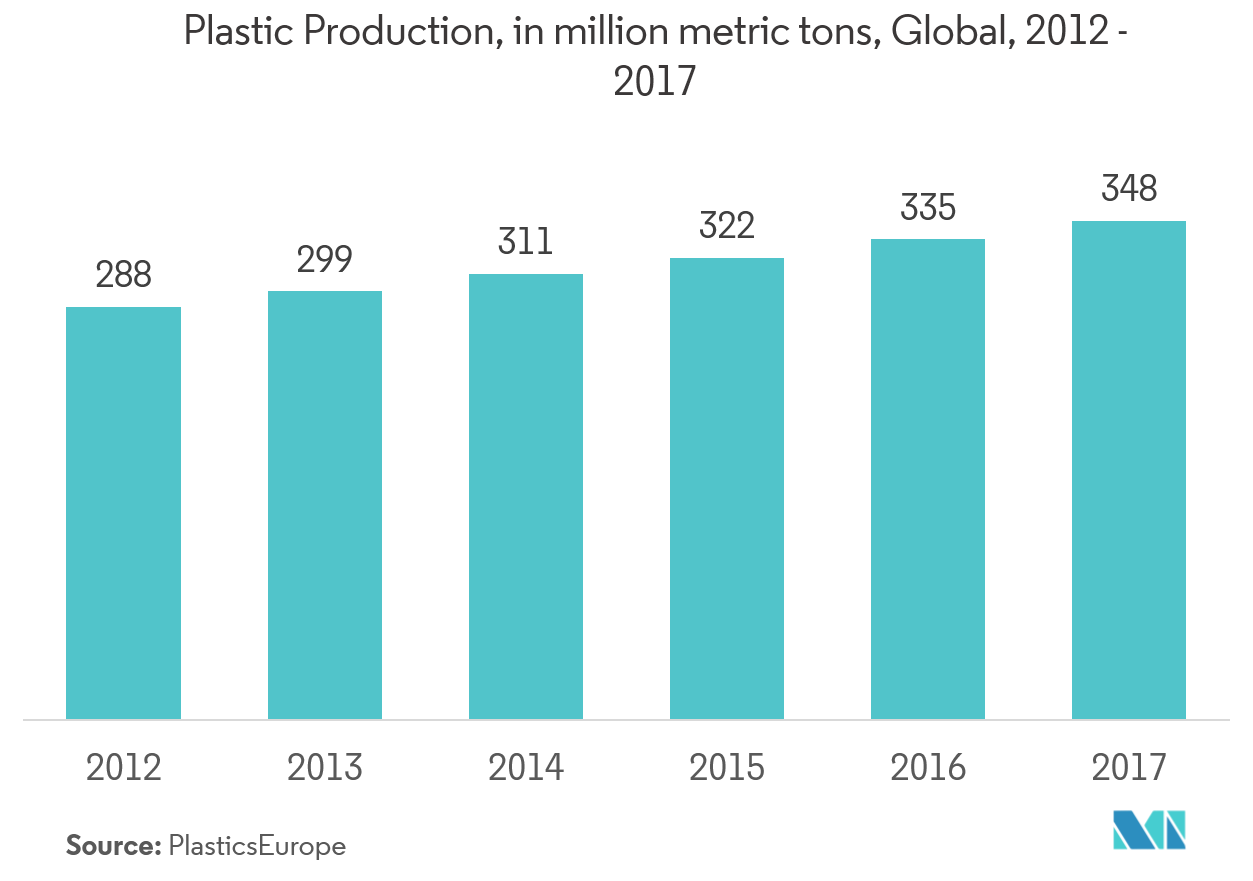

Plastics to Drive the Market Growth

- Plastic is a prominent material used in tube packaging, due to its low cost, lightweight, flexibility, durability, and other factors. In addition, it is odorless and offers a pleasant appearance.

- The usage of plastic tubes in various industries that include cosmetic and personal care, food, and pharmaceutical, among others, leads to fewer transportation costs and energy waste. This type of packaging also ensures product safety and prolongs shelf life.

- As convenience and hygiene are gaining importance across regions, the demand for plastic tubes is propelling, specifically in the cosmetic industry.

- Nevertheless, sustainable packaging has ensured significant amounts of plastic recycling and innovations in material technology that have enabled the development of environment-friendly plastic packaging solutions. Further, to strike a balance between better economics and sustainability, major players are shifting to recyclable packaging by using reusable and compostable plastic material.

- The European Union (EU) and the American Chemical Council’s Plastics Division recently announced the target of 100% use of recyclable, reusable and compostable plastics by 2025 and 2040 in their regions. These regulations are expected to shape the plastic tube packaging industry in the future.

- However, over the last decade, the environmental impacts of plastic have resulted in a slowdown of the segment.

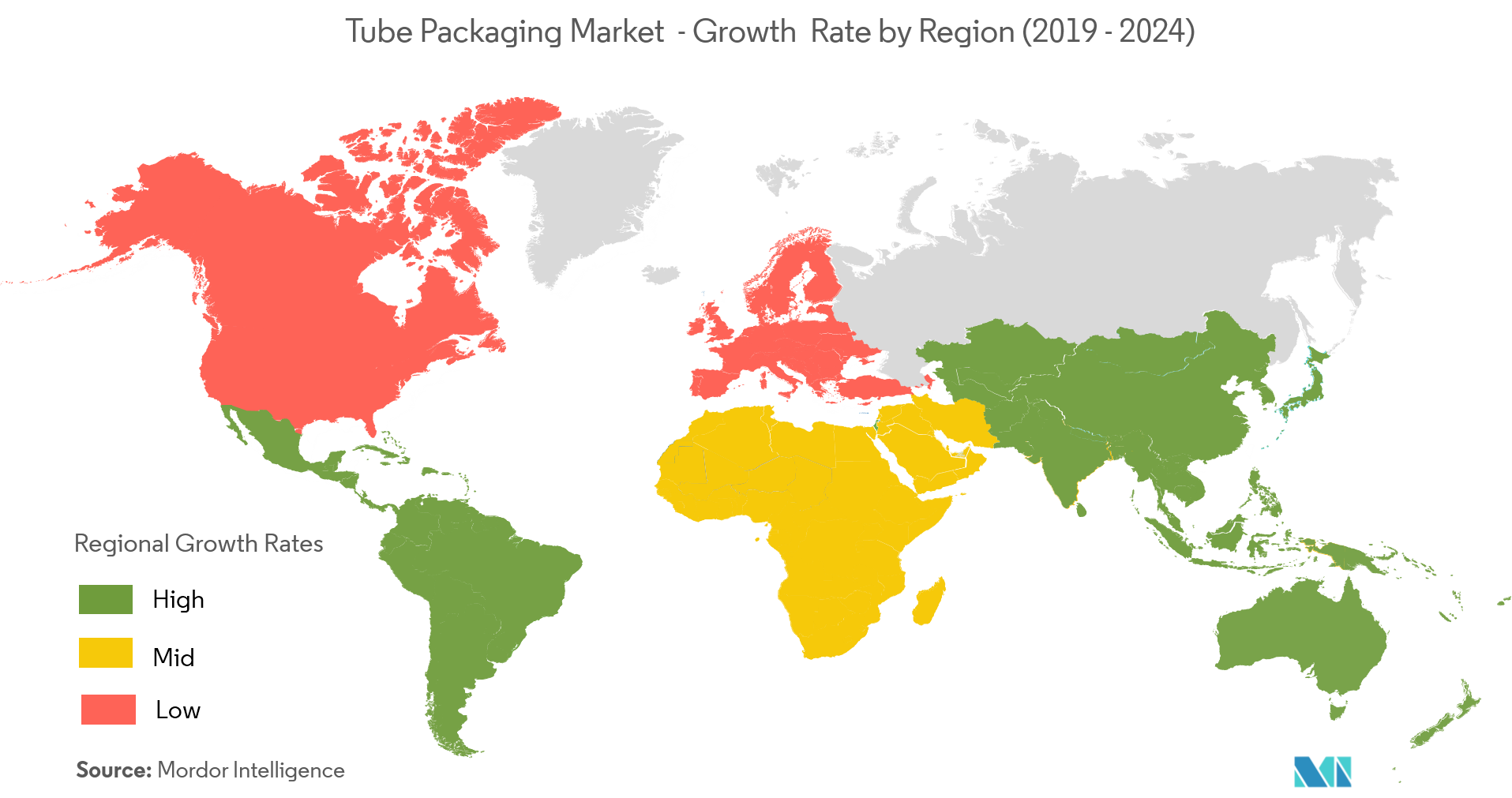

Asia-Pacific to Execute a Significant Growth Rate

- The population in Asia-Pacific is increasingly improving its lifestyle and living standards. This factor coupled with the rising trends in cosmetic and pharmaceutical products and awareness for health and hygiene is driving the market in the region.

- Apart from cosmetic demand from the region, Asia-Pacific countries are significantly exporting cosmetic products to the US. According to the International Trade Administration, over 20% of US. global exports are via Asian countries.

- Moreover, the demand for healthcare and hygiene in the country is also high. In China with a population of 1.37 billion, the oral disease has a large burden on the government healthcare system and is an even greater economic burden on individuals. Periodontal diseases are common in India as well. these factors have resulted in an increased demand for toothpaste and other oral care products that use tube packaging.

- Besides, China accounted for 52% of the world’s plastic scrap imports in 2018, according to the Institute of Scrap Recycling Industries. This emphasis on plastic recycling is also estimated to expand the plastic tube packaging sector, thereby, supporting the growth of tube packaging.

Tube Packaging Industry Overview

Thetube packaging market is highly fragmented due to the presence of a large number of players. Moreover, sustainable competitive advantage can be gained through innovation (design, technology, and application) and partnerships.In addition, there is a fairly high probability of new players entering the market studied, further intensifying the competition. Therefore, the market incumbents have been identified to adopt a powerful competitive strategy, characterized by acquisitions, mergers and acquisitions, and a strong emphasis on R&D.Some key market players in the market are Amcor, Bemis, Tetrapack among others.Some key recent developments in the market include:

- March 2018 -Packaging companies, Amcor and SIG, partnered for aluminum sourcing. The collaboration aimedat ensuring the supply chain of aluminum foil meets the statutes of the Aluminum Stewardship Initiative (ASI).

- February 2018 -Berry Global Group, Inc. acquired the Clopay Plastic Products Company, Inc. a subsidiary of Griffon Corporation for USD 475 million in cash on a debt-free, cash-free basis. The acquisition of Clopay is directly aligned with the company’s fundamental strategic initiatives.

Tube Packaging Market Leaders

-

Berry Global Group, Inc.

-

Coveris Holdings SA

-

Amcor PLC

-

CCL Industries Inc.

-

Essel Propack Limited

*Disclaimer: Major Players sorted in no particular order

Tube Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growth in Flexible Packaging

- 4.3.2 Increasing Demand for Convenience Packaging

-

4.4 Market Challenges

- 4.4.1 Regulations in the Packaging Industry

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type of Package

- 5.1.1 Squeeze

- 5.1.2 Twist

- 5.1.3 Stick

- 5.1.4 Cartridges

- 5.1.5 Others

-

5.2 By Material

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Aluminum

- 5.2.4 Others

-

5.3 By Application

- 5.3.1 Cosmetics & Toiletries

- 5.3.2 Healthcare & Pharmaceutical

- 5.3.3 Food

- 5.3.4 Homecare

- 5.3.5 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Berry Global Inc.

- 6.1.3 Essel Propack Ltd.

- 6.1.4 Clariant International Ltd.

- 6.1.5 Coveris Holdings SA

- 6.1.6 CPP Global Holdings Ltd.

- 6.1.7 Essel Propack Ltd.

- 6.1.8 CCL Industries Inc.

- 6.1.9 IntraPac International Corporation

- 6.1.10 Albea S.A

- 6.1.11 VisiPak Inc.

- 6.1.12 HCT Packaging Inc.

- 6.1.13 IntraPac International LLC

- 6.1.14 Printpack Inc.

- 6.1.15 Unicep Packaging, Inc.

- 6.1.16 Silgan Holdings Inc.

- 6.1.17 Fischbach KG.

- 6.1.18 CTL - TH Packaging Group SL

- 6.1.19 Viva Group Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityTube Packaging Industry Segmentation

Tube packaging is in widespread use for creams, ointments, gels, and even thick liquids. It is also used for solids as it offers a layer of protecting, preventing the contents from breakage. The tube packaging market is segmented by type of package, material, application, and geography. Bytype of package, the market studied is segmented into squeeze, twist, stick, cartridges, and others. By material, the market studied is segmented into plastic, paper, aluminum, and others.By application, the market studied is segmented into cosmetics & toiletries, healthcare and pharmaceutical, food, homecare, and others. The scope of the report covers detailed information pertaining to major factors influencing the tube packaging market, such as drivers and restraints. The study of the market also focuses on various trends in the market, such as increasing demand for convenience packaging and its effects on the market.

| By Type of Package | Squeeze | |

| Twist | ||

| Stick | ||

| Cartridges | ||

| Others | ||

| By Material | Plastic | |

| Paper | ||

| Aluminum | ||

| Others | ||

| By Application | Cosmetics & Toiletries | |

| Healthcare & Pharmaceutical | ||

| Food | ||

| Homecare | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle-East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| Rest of Middle-East & Africa |

Tube Packaging Market Research FAQs

How big is the Tube Packaging Market?

The Tube Packaging Market size is expected to reach USD 6.66 billion in 2024 and grow at a CAGR of 7.39% to reach USD 9.50 billion by 2029.

What is the current Tube Packaging Market size?

In 2024, the Tube Packaging Market size is expected to reach USD 6.66 billion.

Who are the key players in Tube Packaging Market?

Berry Global Group, Inc., Coveris Holdings SA, Amcor PLC, CCL Industries Inc. and Essel Propack Limited are the major companies operating in the Tube Packaging Market.

Which is the fastest growing region in Tube Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Tube Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Tube Packaging Market.

What years does this Tube Packaging Market cover, and what was the market size in 2023?

In 2023, the Tube Packaging Market size was estimated at USD 6.20 billion. The report covers the Tube Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Tube Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Tube Packaging Industry Report

Statistics for the 2024 Tube Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Tube Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.