Tube & Stick Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.60 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Tube & Stick Packaging Market Analysis

The Tube & Stick Packaging market was valued at USD 7.87 billion in 2020 and is expected to reach USD 10.91 billion by 2026, at a CAGR of 5.6% over the forecast period 2021 - 2026., owing to the increase in demand for convenience packaging.

- The use of multilayered laminated tubes and stick packaging has increased for the use in packaging of skincare, pharmaceutical products, food packaging, and others. Companies are investing in R&D for advanced packaging solutions, which are more naturally made.

- The application in the pharmaceutical industry is driving the growth of the market, especially medicines that are used in Dermatology, where tube packing is extensively used. Global pharmaceutical sales globally in 2018 were 110 billion USD, according to AstraZeneca, pharmaceutical and biopharmaceutical company. Further the future growth of the pharmaceutical sector will drive the demand especially for tubes and stick packaging.

- Furthermore, the increases in strict government regulations for the secure usage of the plastic packaging for various applications might challenge the market growth of tube & stick packaging. However, the increasing investments made by the packaging vendors might result in the improvement of the manufacturing process and coming out with better innovations for the tube & stick packaging materials.

Tube & Stick Packaging Market Trends

This section covers the major market trends shaping the Tube & Stick Packaging Market according to our research experts:

Plastic Packaging is Expected to Continue Significant Demand

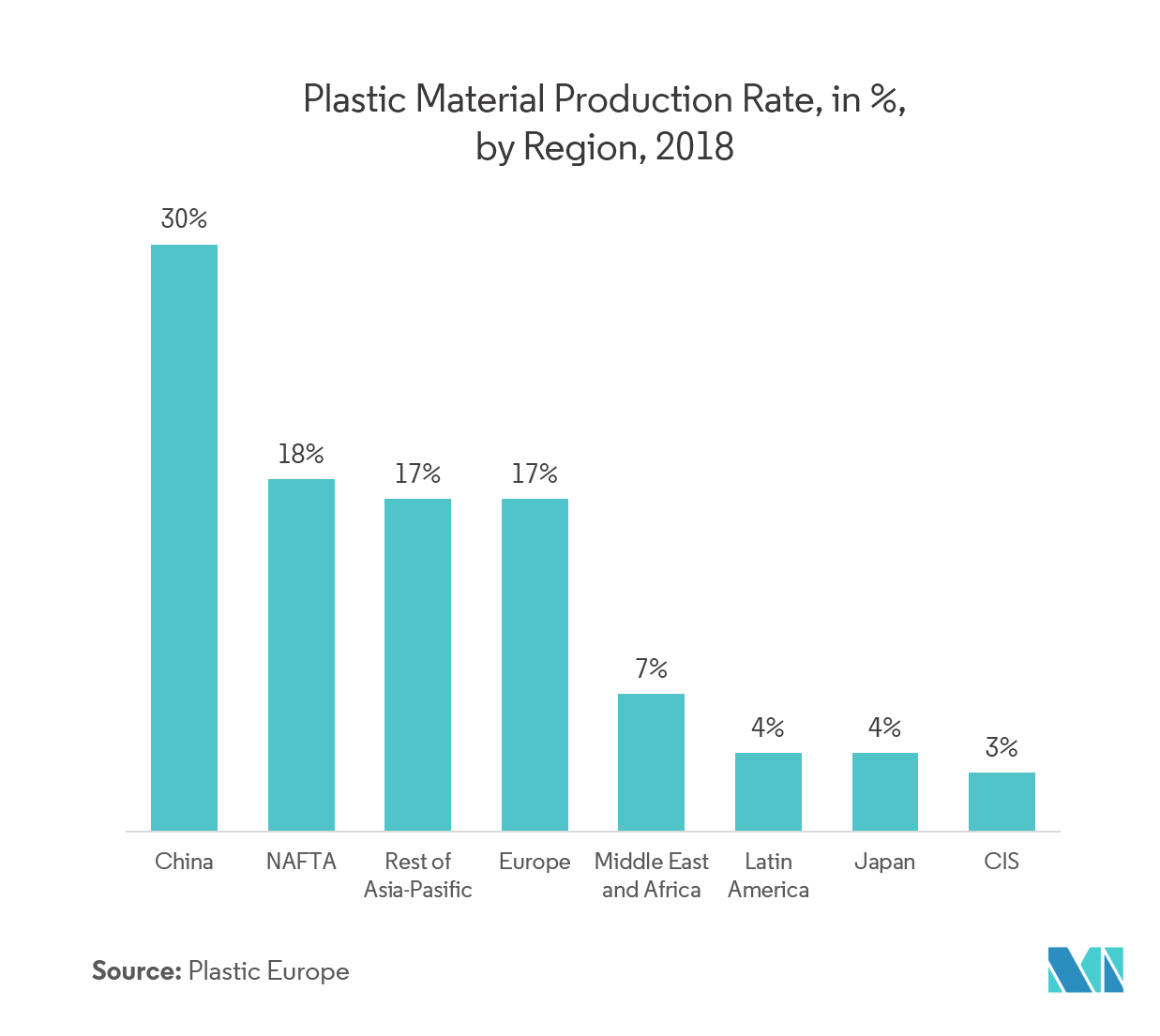

- Plastic is the material that is used the most in the production of tube & stick packaging due to its ability to be lightweight, flexible, durable, and other plastic properties. The manufacturing cost is low; besides, it is odor-free, can be transparent, and can have a pleasant demeanor.

- As convenience and regimen are gaining influence beyond regions, the demand for plastic tubes is thrusting, particularly in the cosmetic industry.

- However, over the last decade, the environmental consequences of plastic have transpired in a retardation of the segment. Nevertheless, sustainable packaging has ensured notable amounts of plastic recycling and innovations in material technology that have enabled the development of environment-friendly plastic packaging solutions.

- Furthermore, increased focus and developments in recycled plastic are overruling the drawbacks of plastics.

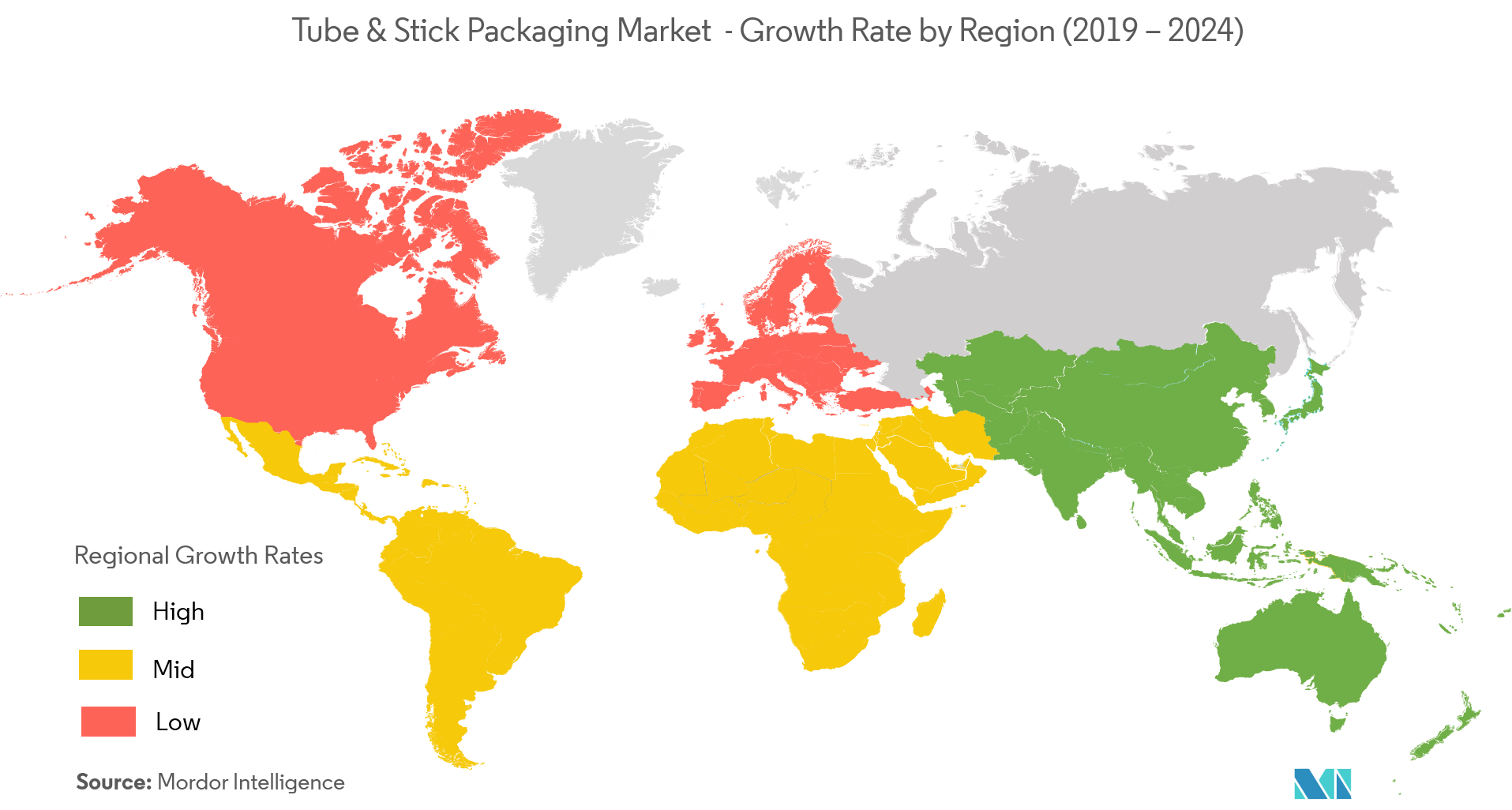

Asia-Pacific Expected to Hold a Significant Market Share

- Strong population and improvements in the lifestyle and living standards evident across the Asia-Pacific region, which are driving the demand for consumer products such as food and cosmetic. Further, increasing awareness for health and hygiene, are driving the market for pharmaceuitical products in the region. Therefore substantiating the high demand for packaging products.

- The region is also a strong export nation in terms of cosmetic products. The increase in the export of cosmetic products to the United States is likely to spur demand in the region. According to the International Trade Administration, over 20% of the US Global exports are via Asian countries.

- In China, with a population of 1.37 billion, the oral disease has a significant burden on the government healthcare system and is an even more significant economic burden on individuals. Therefore the demand for healthcare and hygiene in the country is also high. Furthermore, periodontal diseases are common in regions such as India. These factors have resulted in an increased demand for toothpaste and other oral care products that use a tube and stick packaging.

Tube & Stick Packaging Industry Overview

Thetube and stick packaging market is highly fragmented due to the presence of a multiple players across regions. Sustainable competitive advantage can be gained through innovation in the material used to make products as in design, technology, and application.Some key market players in the market are Amcor, Berry, Sonoco, Printpack, among others.Some key recent developments in the market include:

- June 2019 - Amcor acquired Bemis. The acquisition of Bemis by Amcor brings additionalcapabilities that will strengthen Amcor’s industry-leading value proposition and generate significant value for shareholders. Also, thisacquisition will bringother additional range, capabilities that will enhance Amcor’s industry-leading in terms of a value proposition.

- March 2018 -Packaging companies, Amcor and SIG, partnered for aluminum sourcing. The collaboration aimedat ensuring the supply chain of aluminum material meets the statutes of the Aluminum Stewardship Initiative (ASI).

Tube & Stick Packaging Market Leaders

-

Berry Global Inc.

-

Amcor PLC

-

Constantia Flexibles Group GmbH

-

Albae S.A.

-

Essel Propack Limited

*Disclaimer: Major Players sorted in no particular order

Tube & Stick Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Demand for Convenience Packaging

-

4.4 Market Challenges

- 4.4.1 Increase in Government Regulations in the Packaging Industry

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Packaging Type

- 5.1.1 Squeeze

- 5.1.2 Twist

- 5.1.3 Cartridge

- 5.1.4 Other Packaging Types

-

5.2 By Material Type

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Aluminium

- 5.2.4 Other Materials

-

5.3 By Application

- 5.3.1 Personal Care

- 5.3.2 Healthcare

- 5.3.3 Food

- 5.3.4 Homecare

- 5.3.5 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Armbrust Paper Tubes Inc.

- 6.1.3 Berry Global Inc.

- 6.1.4 Albea S.A.

- 6.1.5 CCL Industries Inc.

- 6.1.6 Essel Propack Limited

- 6.1.7 Constantia Flexibles Group GmbH

- 6.1.8 Clariant International Ltd

- 6.1.9 IntraPac International Corporation

- 6.1.10 The Plastek Group

- 6.1.11 Printpack Incorporated

- 6.1.12 World Wide Packaging, LLC

- 6.1.13 Plastube Incorporated

- 6.1.14 VisiPak Company

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityTube & Stick Packaging Industry Segmentation

The tube & stick packaging market study coversapplications in personal care,like creams, ointments, gels, and even thick liquids, eatables, pharma products, etc. A variety of packing products like squeeze, twist, stick, and are primarily made up of plastic, paper, and aluminum, etc., were analyzed as a part of the study.

| By Packaging Type | Squeeze |

| Twist | |

| Cartridge | |

| Other Packaging Types | |

| By Material Type | Plastic |

| Paper | |

| Aluminium | |

| Other Materials | |

| By Application | Personal Care |

| Healthcare | |

| Food | |

| Homecare | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Tube & Stick Packaging Market Research FAQs

What is the current Tube & Stick Packaging Market size?

The Tube & Stick Packaging Market is projected to register a CAGR of 5.60% during the forecast period (2024-2029)

Who are the key players in Tube & Stick Packaging Market?

Berry Global Inc., Amcor PLC, Constantia Flexibles Group GmbH, Albae S.A. and Essel Propack Limited are the major companies operating in the Tube & Stick Packaging Market.

Which is the fastest growing region in Tube & Stick Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Tube & Stick Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Tube & Stick Packaging Market.

What years does this Tube & Stick Packaging Market cover?

The report covers the Tube & Stick Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Tube & Stick Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Tube & Stick Packaging Industry Report

Statistics for the 2024 Tube & Stick Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Tube & Stick Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.