UAE Industrial Waste Management Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 2.46 % |

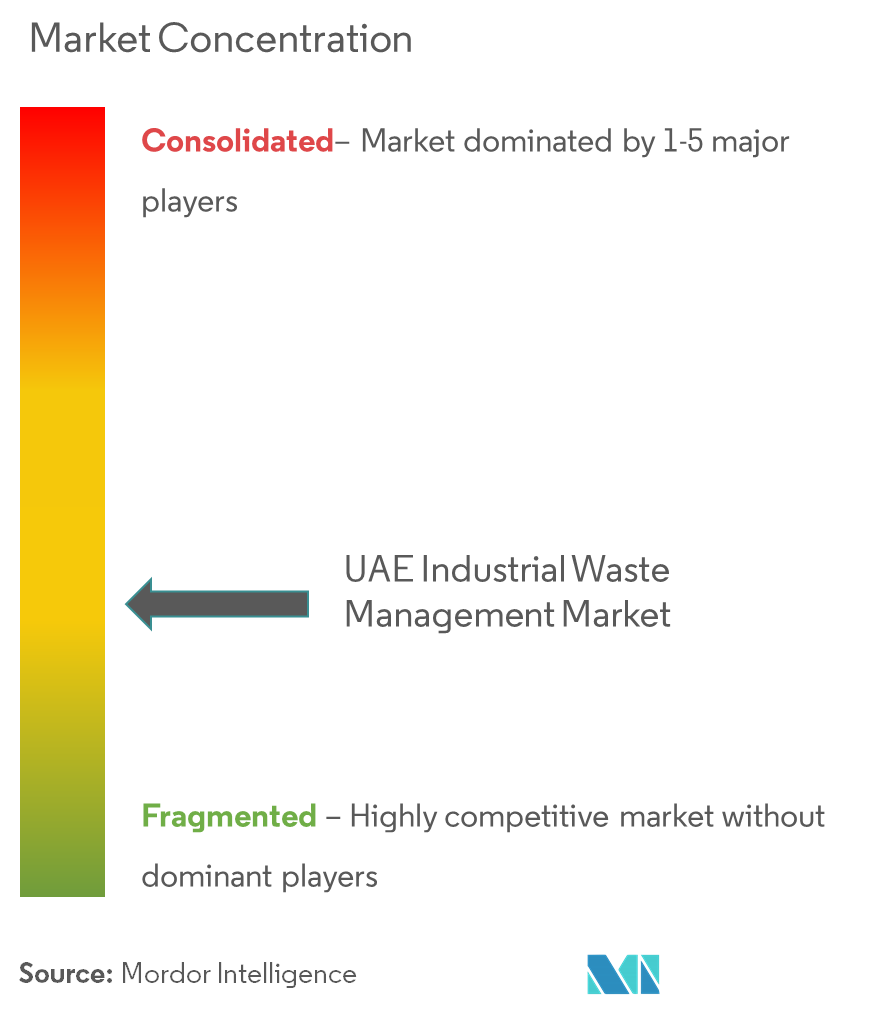

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

UAE Industrial Waste Management Market Analysis

The UAE waste management industry is eagerly aiming to reduce the adverse per capita environmental impact by the effective waste management of the various industrial wastes generated in the country. As the country is shifting focus toward the non-oil sector to reduce the over-dependency on the oil trade, it is increasing the operations in the industries, like heavy and light manufacturing, refineries, chemical plants, power plants, and mineral extraction and processing, which generate huge amounts of waste.

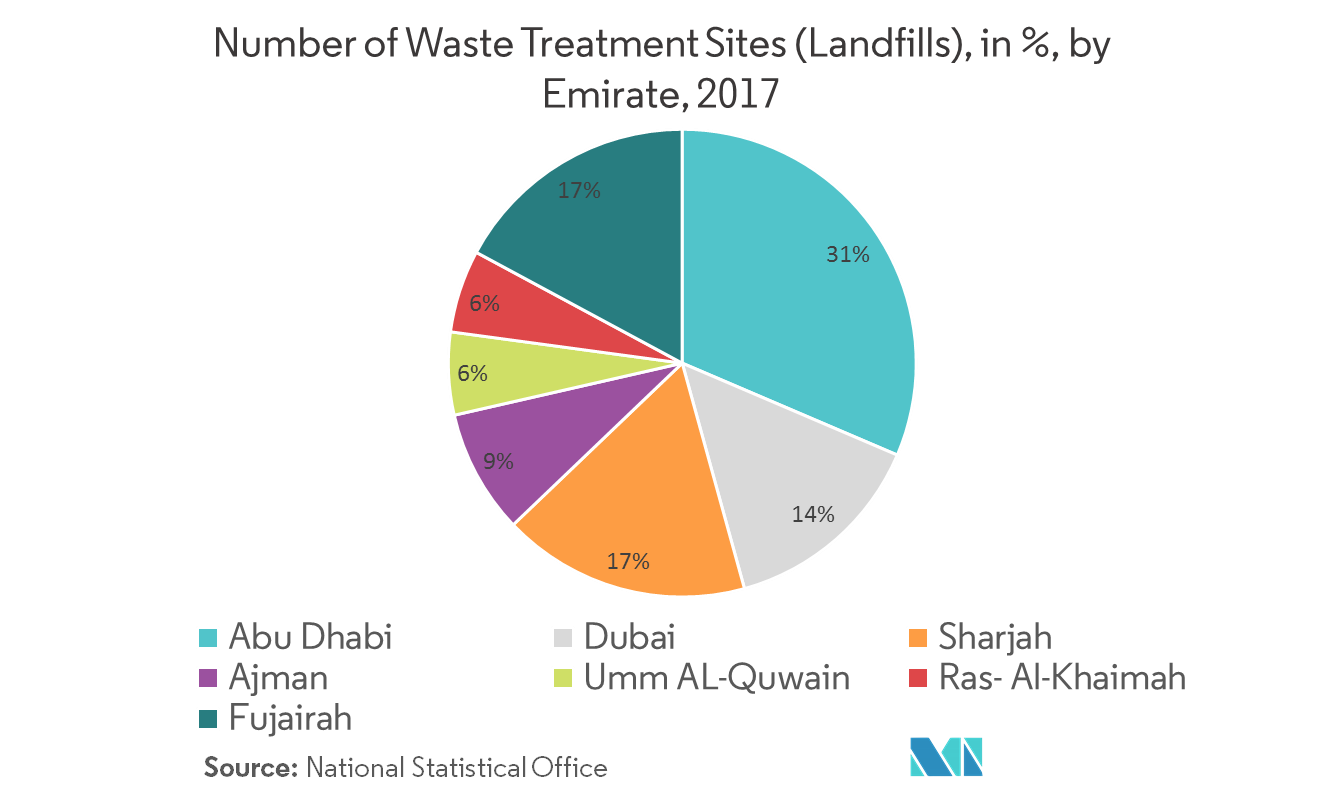

Abu Dhabi is the largest emirate in the United Arab Emirates, with the highest share of industrial activities in the country. It also generates large amounts of industrial wastes and demands eco-friendly techniques to treat wastes, both hazardous and non-hazardous. Tadweer, the center for waste management, plays a pivotal role in developing sustainable and integrated programs to render effective waste management in the country. It started off in 2008 and, since then, has achieved substantial growth, delivering safe and effective waste management. In 2017, the United Arab Emirates collected about 39.188 million metric ton of wastes, 90% of the total waste collected was accumulated from Abu Dhabi, Dubai, and Sharjah. Abu Dhabi alone contributed a share of 25% of the waste. In the hazardous waste category, Abu Dhabi had a share of 53.4%, while in the non-hazardous waste category, Dubai had the maximum share of 58.9%.

UAE Industrial Waste Management Market Trends

This section covers the major market trends shaping the UAE Industrial Waste Management Market according to our research experts:

Development of Innovative Technologies and Advanced Waste Collection Solutions

One of the key technological innovations launched in the region includes the creation of a new waste database by the Ministry of Climate Change and Environment. The bilingual system compiles and analyzes data regarding the waste generated across the country, and keeps track of the hazardous and non-hazardous waste levels. It creates monthly and yearly reports on the amount of waste generated, treatment methods used, and the percentage of treated waste in each emirate. Such initiatives drive the waste management sector, based on the need for dedicated waste management facilities. Effective waste management techniques are being encouraged across the country, thus improving the sustainability of the country’s environment and economy. Innovation to disrupt the traditional waste management techniques in the entire GCC region was led by Dubai Municipality’s efforts in installing electronic gates and smart weighbridges at all of its waste disposal sites, to make them smart and sustainable. The entire region is looking for an integrated waste management practice that greatly emphasizes the waste-to-value methods, such as recycling, refurbishment, and refining facilities, as well as various other waste-to-energy methods.

Construction and Demolition Waste Segment Holds Major Market Share

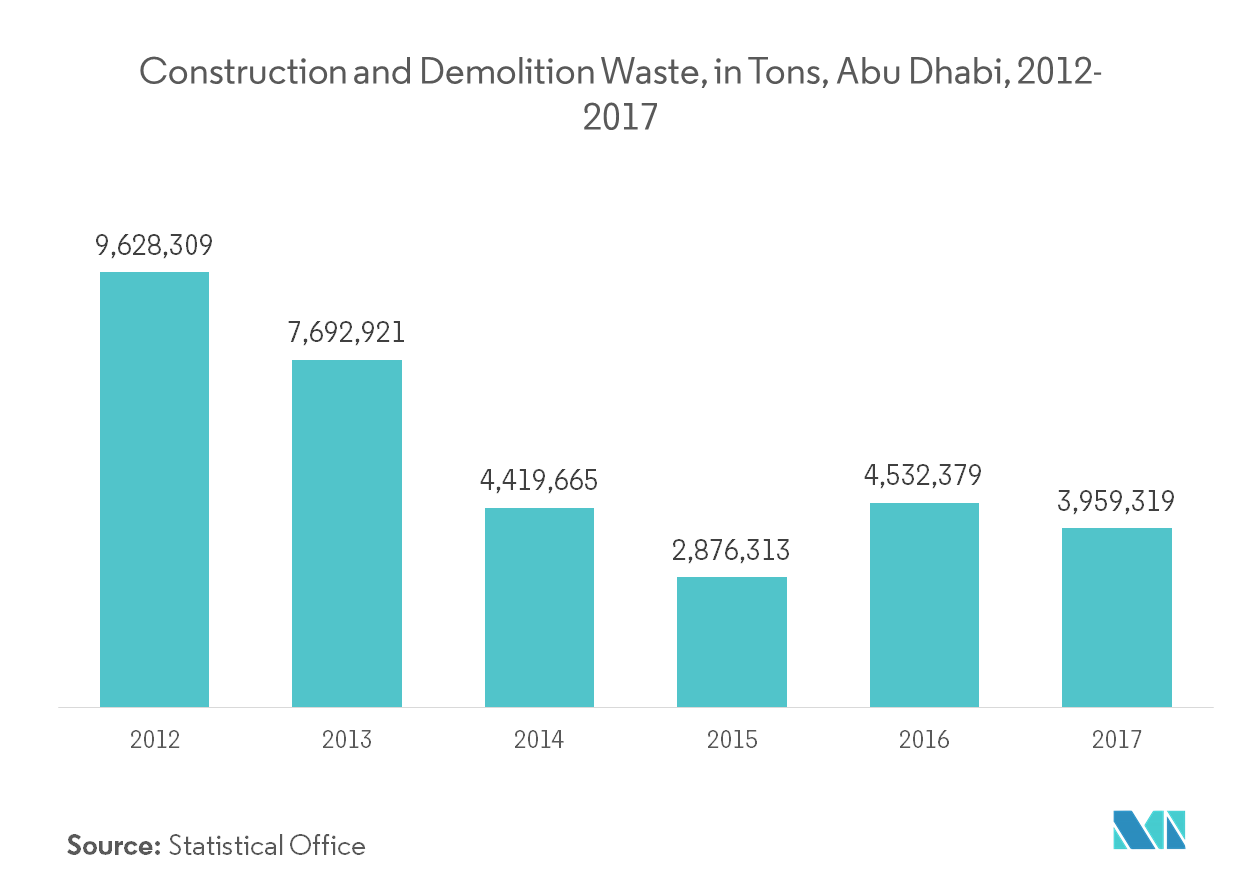

Out of the total non-hazardous solid wastes generated in Abu Dhabi, the construction and demolition (C&D) wastes account for 42% of the total weight. This includes building materials, such as insulation, nails, electrical wiring, and rebar, as well as waste originating from site preparation, such as dredging materials, tree stumps, and rubble. The construction and development activities and associated C&D waste production may continue to rise in the region. Hence, if not managed properly, the dumping of C&D may become uncontrolled. This will not only cause a negative environmental impact on soil, water, air, and the surrounding ecosystem, but also result in depletion of finite resources.

The Abu Dhabi Waste Management Center (Tadweer) opened a new facility to recycle construction and demolition waste in Ghayathi in the emirate’s Al Dhafra region. Located near the Ruwais oil fields and the UAE-Saudi Arabia border, the new facility may help ease the pressure on Al Dhafra landfill, which is anticipated to receive construction and demolition waste in the range of 60,000-70,000 metric ton per month, with an average daily inflow of 1,500-2,000 metric ton. The opening of the Ghayathi recycling facility is aligned with the strategic plan to implement a world-class waste management system in Abu Dhabi, and position the United Arab Emirates at the forefront of innovative recycling.

UAE Industrial Waste Management Industry Overview

The UAE industrial waste management market is fragmented in nature, with the presence of small-, medium-, and large-sized companies. The report provides an analysis of the company overview, key financial metrics, service offerings, industry solutions, geographical network, and recent developments of.some of the key players active in the market studied (Averda, Green Mountains, Adgeco Group, Veolia, SembCorp Industries, FiveM Waste Management and Environmental Consultancy, ADSSC, Terragon-Gulf, Bee’ah, and Blue LLC). The market studied is growing with increasing industrial activity. Hence, there is scope for the new players to enter the market, as well as for the existing players to expand their footprint and services.

UAE Industrial Waste Management Market Leaders

-

Averda

-

Greenmountains

-

Adgeco Group

-

Veolia

-

Sembcorp Industries

*Disclaimer: Major Players sorted in no particular order

UAE Industrial Waste Management Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Industry Policies and Government Regulations

- 4.5 Industry Value Chain Analysis

5. MARKET DYNAMICS

- 5.1 Introduction

- 5.2 Drivers

- 5.3 Restraints

- 5.4 Opportunities

- 5.5 Technological Innovations

6. MARKET SEGMENTATION

-

6.1 By Type

- 6.1.1 Hazardous

- 6.1.1.1 Industrial Waste

- 6.1.1.2 Medical Waste

- 6.1.1.3 Oil and Gas Waste

- 6.1.1.4 Other Hazardous Types (Sewage Sludge, Heavy Metal, and Exported Waste)

- 6.1.2 Non-hazardous

- 6.1.2.1 Construction

- 6.1.2.2 Industrial and Commercial

- 6.1.2.3 Agricultural

- 6.1.2.4 Other Non-hazardous Types (Municipal Waste)

-

6.2 By Service

- 6.2.1 Recycling

- 6.2.2 Collection

- 6.2.3 Landfill

- 6.2.4 Incineration

- 6.2.5 Other Services

7. INVESTMENT ANALYSIS

8. COMPANY PROFILES

- 8.1 Averda

- 8.2 Greenmountains

- 8.3 Adgeco Group

- 8.4 Veolia

- 8.5 Sembcorp Industries

- 8.6 Fivem Waste Management and Environmental Consultancy

- 8.7 ADSSC

- 8.8 Erragon-Gulf

- 8.9 Bee ah - Sharjah

- 8.10 Blue LLC

9. COST ANALYSIS OF SETTING UP A INDUSTRIAL WASTE MANAGEMENT COMPANY

10. FUTURE OF THE MARKET

11. APPENDIX

12. DISCLAIMER

** Subject To AvailablityUAE Industrial Waste Management Industry Segmentation

The market has been studied based on the hazardous and non-hazardous wastes generated by different industries. The report highlights the operational specialization of the key waste management companies in the country, to understand the business strategies and the upcoming technologies, which are used for the effective treatment of the numerous wastes generated by various industries.

| By Type | Hazardous | Industrial Waste |

| Medical Waste | ||

| Oil and Gas Waste | ||

| Other Hazardous Types (Sewage Sludge, Heavy Metal, and Exported Waste) | ||

| By Type | Non-hazardous | Construction |

| Industrial and Commercial | ||

| Agricultural | ||

| Other Non-hazardous Types (Municipal Waste) | ||

| By Service | Recycling | |

| Collection | ||

| Landfill | ||

| Incineration | ||

| Other Services |

UAE Industrial Waste Management Market Research FAQs

What is the current UAE Industrial Waste Management Market size?

The UAE Industrial Waste Management Market is projected to register a CAGR of 2.46% during the forecast period (2024-2029)

Who are the key players in UAE Industrial Waste Management Market?

Averda, Greenmountains, Adgeco Group, Veolia and Sembcorp Industries are the major companies operating in the UAE Industrial Waste Management Market.

What years does this UAE Industrial Waste Management Market cover?

The report covers the UAE Industrial Waste Management Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the UAE Industrial Waste Management Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

UAE Industrial Waste Management Industry Report

Statistics for the 2024 UAE Industrial Waste Management market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UAE Industrial Waste Management analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.