Office Furniture Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | 4.60 % |

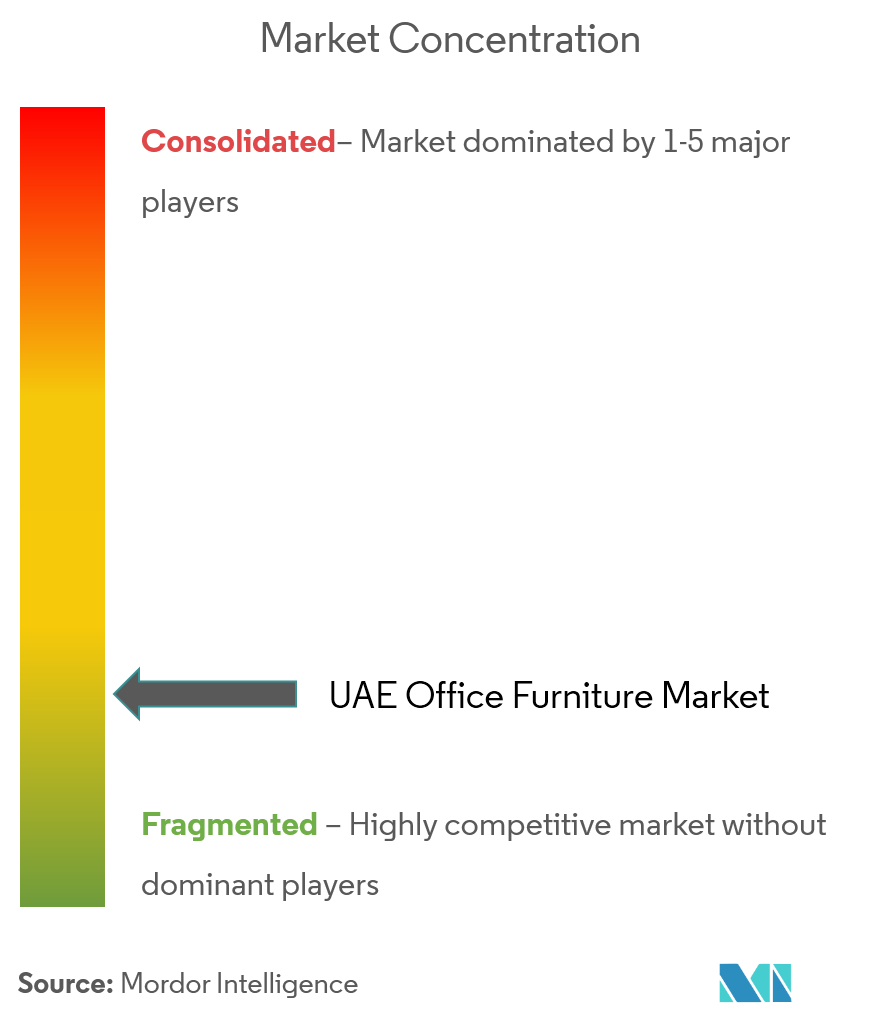

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Office Furniture Market Analysis

The United Arab Emirates Office Furniture Market has generated a revenue of USD 320 Million in the current year and is poised to grow at a CAGR of greater than 4.6% during the forecast period.

The increasing employment rate and rising usage of office spaces are some of the major factors attributing to the growth of UAE office furniture market. Launch of innovative office furniture, such as 3D/2D office furniture, is expected to further increase the demand for office furniture in the region. The government regulations on FDI in free zones are one of the major drivers that may increase the number of business activities, such as establishment of new businesses and business expansions, in the country, which in turn, may directly impact the growth of the UAE office furniture market. Currently, the country majorly meets its demand by importing its office furniture requirements from countries, such as China, Italy, Germany, Malaysia, and Lithuania. The country also reexports imported office furniture to other Gulf countries and countries, like Kenya and Lebanon.

In the Post-COVID scenario, the UAE office furniture market is likely to witness a transformation in workplace dynamics. With the rise of remote work and flexible arrangements, there may be a growing demand for ergonomic furniture that promotes comfort and productivity. Additionally, there could be a greater emphasis on sustainable designs, as companies increasingly prioritize environmental responsibility. Online sales platforms and virtual showrooms might also become more prevalent, offering convenient options for browsing and purchasing office furniture.

Office Furniture Market Trends

Office Spaces in Dubai and Abu Dhabi to Witness Strong Growth

The strong growth in office spaces in Dubai and Abu Dhabi is indeed driving the office furniture market in the UAE. The expanding commercial sector, increasing number of businesses, and the rise in foreign investments have led to a higher demand for office spaces in these cities. As a result, there is a corresponding need for office furniture to furnish and equip these work environments. The growing number of offices and corporate establishments has created opportunities for office furniture suppliers and manufacturers in the UAE. They cater to the diverse requirements of businesses, providing ergonomic and functional office furniture solutions. Additionally, the emphasis on creating modern and aesthetically pleasing workspaces has further boosted the demand for stylish and contemporary office furniture.

Dubai and Abu Dhabi are known for their ambitious infrastructure projects and business-friendly environments, attracting multinational companies and startups alike. This influx of businesses has fueled the need for office spaces and, subsequently, the demand for office furniture. Furthermore, the UAE government's focus on economic diversification and the development of various industry sectors has contributed to the growth of the office furniture market. Initiatives such as the Dubai Expo 2020 and the Abu Dhabi Vision 2030 have stimulated commercial activities and increased the demand for office spaces, driving the furniture market's expansion.

Rising Startup Ecosystems in the United Arab Emirates

The rising startup ecosystems in the UAE have indeed had a positive impact on the office furniture market. The UAE government has been actively promoting entrepreneurship and innovation, creating a favorable environment for startups to thrive. This has resulted in a significant increase in the number of startups in the country, particularly in cities like Dubai and Abu Dhabi.

As startups emerge and expand, they require office spaces that are conducive to collaboration, productivity, and employee well-being. This has created a demand for office furniture that caters to the specific needs and preferences of these startups. From ergonomic workstations and versatile seating options to flexible modular furniture, startups often seek innovative and adaptable solutions to optimize their workspace.

The startup culture also places a strong emphasis on creating vibrant and inspiring office environments that foster creativity and team spirit. This has led to an increased demand for aesthetically appealing and design-centric office furniture that reflects the startup's brand identity and values. Moreover, the rise of coworking spaces and business incubators in the UAE has further driven the office furniture market. These shared office spaces often require furniture that is functional, flexible, and able to accommodate the needs of multiple businesses and individuals.

Office Furniture Industry Overview

The UAE Office Furniture Market is Fragmented. The report covers the major players operating in the UAE office furniture market. The market is comprised of both international and local players. Some of the prominent international companies present in the market include Herman Miller and Steel Case. Some of the local players have a strong market presence including Bafco, Almana Maples, and StarOffice.

Office Furniture Market Leaders

-

Bafco

-

Herman Miller

-

Steelcase

-

Workspace.ae

-

Highmoon Furniture

*Disclaimer: Major Players sorted in no particular order

Office Furniture Market News

- June 2023: THE FITOUT, one of the leading providers of comprehensive interior solutions in the Middle East and a subsidiary of Union Properties, has collaborated with the Gurian, an Italian furniture manufacturing company, to expand its product offerings and introduce Italy's finest luxury furniture to the UAE market.

- Sep 2022: Dubai's leading office furniture importer and manufacturer BAFCO recently joined forces with pioneering furniture giant Kano, establishing an exclusive new partnership between BAFCO and Kano in the UAE.

Office Furniture Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Demand for Creative Office Furniture

- 4.2.2 Growing Working Population is Boosting the Market

-

4.3 Market Restraints

- 4.3.1 High Competitive with a Large Number of Domestic and International Players

- 4.3.2 Changing Work Habits

-

4.4 Market Opportunities

- 4.4.1 E-commerce and Online Sales

- 4.4.2 Commercial Construction Boom

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Porters 5 Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 Material

- 5.1.1 Wood

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Other Materials

-

5.2 Product

- 5.2.1 Seating

- 5.2.2 Tables

- 5.2.3 Storage Units

- 5.2.4 Desks

- 5.2.5 Other Office Furniture

-

5.3 Distribution Channel

- 5.3.1 Supermarkets and Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

-

6.2 Company Profiles

- 6.2.1 Almana Maples

- 6.2.2 Bafco

- 6.2.3 Highmoon Furniture

- 6.2.4 Workspace.ae

- 6.2.5 Herman Miller

- 6.2.6 Bene

- 6.2.7 SteelCase

- 6.2.8 Sedus

- 6.2.9 StarOffice

- 6.2.10 KPS*

- *List Not Exhaustive

7. MARKET FUTURE TRENDS

8. APPENDIX

9. DISCLAIMER

** Subject To AvailablityOffice Furniture Industry Segmentation

Office furniture includes desks, chairs, storage cabinets and shelving, lighting, and work environment products such as cubicle dividers. This report aims to provide a detailed analysis of the UAE office furniture market. It focuses on the market dynamics, emerging trends in the segments, and insights into various product and application types. Also, it analyzes the key players and the competitive landscape in the UAE office furniture market. United Arab Emirates Office Furniture Market is segmented By Material (Wood, Metal, Plastic, and Other Materials), By Product (Seating, Tables, Storage Units, Desks, and Other Office Furniture), and By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online and Other Distribution Channels). The report offers Market size and forecasts for the UAE Office Furniture Market in terms of revenue (USD million) for all the above segments.

| Material | Wood |

| Metal | |

| Plastic | |

| Other Materials | |

| Product | Seating |

| Tables | |

| Storage Units | |

| Desks | |

| Other Office Furniture | |

| Distribution Channel | Supermarkets and Hypermarkets |

| Specialty Stores | |

| Online | |

| Other Distribution Channels |

Office Furniture Market Research FAQs

What is the current UAE Office Furniture Market size?

The UAE Office Furniture Market is projected to register a CAGR of greater than 4.60% during the forecast period (2024-2029)

Who are the key players in UAE Office Furniture Market?

Bafco, Herman Miller, Steelcase, Workspace.ae and Highmoon Furniture are the major companies operating in the UAE Office Furniture Market.

What years does this UAE Office Furniture Market cover?

The report covers the UAE Office Furniture Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the UAE Office Furniture Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Office Furniture Industry Report

Statistics for the 2023 Office Furniture market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Office Furniture analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.