Unified Communication-as-a-Service in Banking Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 18.70 % |

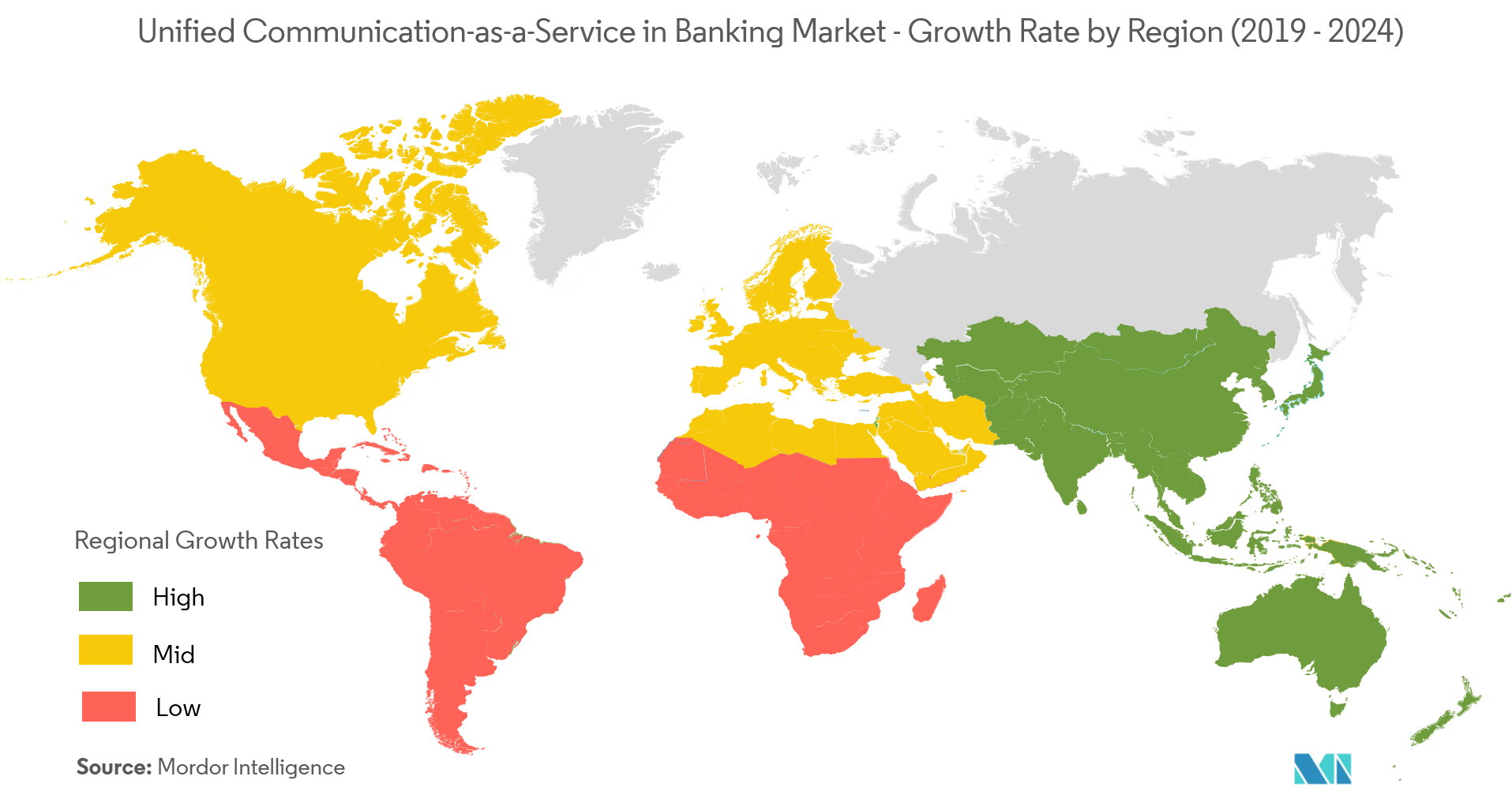

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

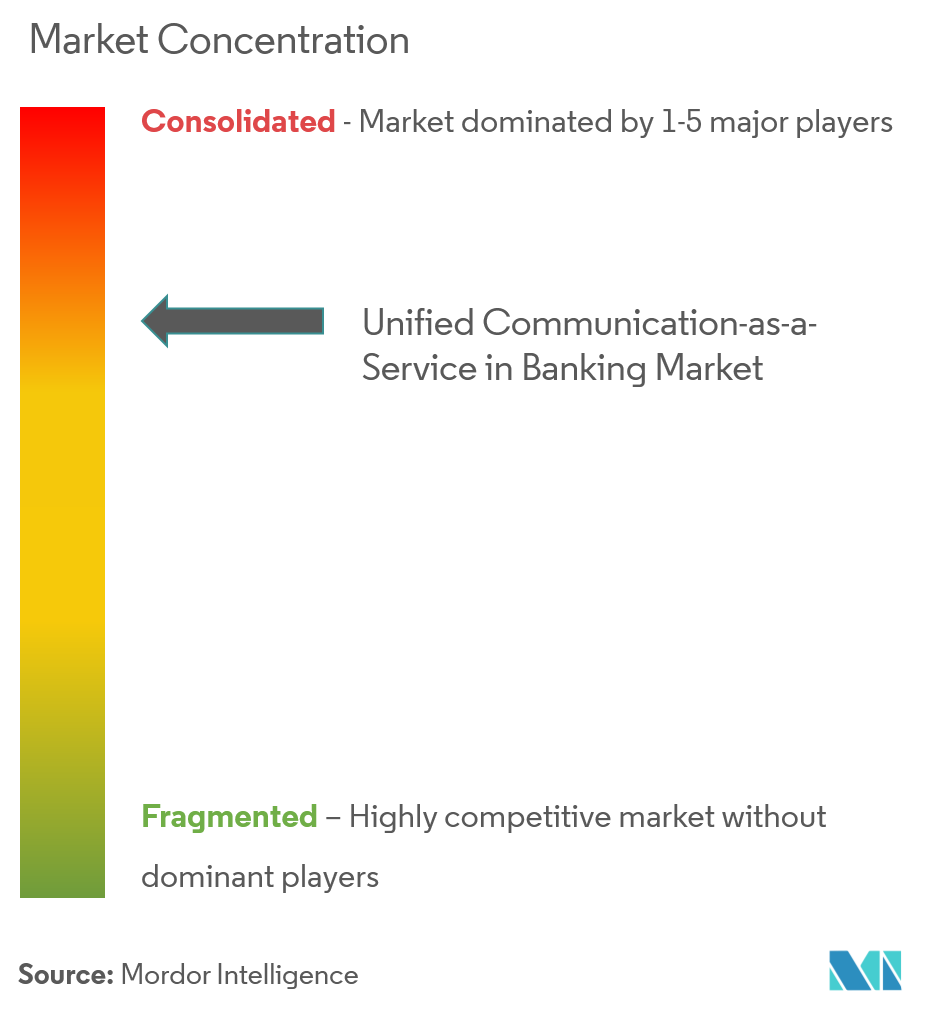

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Unified Communication-as-a-Service in Banking Market Analysis

The Unified Communication-as-a-Service in Banking Market is anticipated to witness a CAGR of 18.7% over the forecast period 2021-2026. The banking industry relies heavily on customer engagement. Customers have become the driving force behind the banking industry and banks are looking forward to enhancing their customer experiences and service costs reduction at the same time.

- Unified Communications (UC), since its inception, emerged as a cost-effective solution for the banking sector. Banks are now investing in UCaaS to get a bird's-eye view of customer communications across all channels to attain scalability required for large-scale implementation.

- Though functionality may vary on the degree of implementation, it broadly incorporates Interactive Voice Response (IVR), video conferencing, live chat, e-mails, unified messaging, VoIP services, and other client management capabilities.

- This technology helps increase availability and scalability while enhancing collaboration. UCaaS solutions are designed to allow enterprises to focus on the growth of their business rather than the maintenance of it. Businesses need not pay for UC software with features that they will never use, thereby aids in saving money.

- A Boston-based research and advisory firm estimated that global tech spending had reached around USD 261.1 billion in 2018, climbing almost 4.2% from the previous year.

Unified Communication-as-a-Service in Banking Market Trends

This section covers the major market trends shaping the Unified Communication-as-a-Service in Banking Market according to our research experts:

Proliferation of Cloud Based Ecosystem to Drive the Market Growth

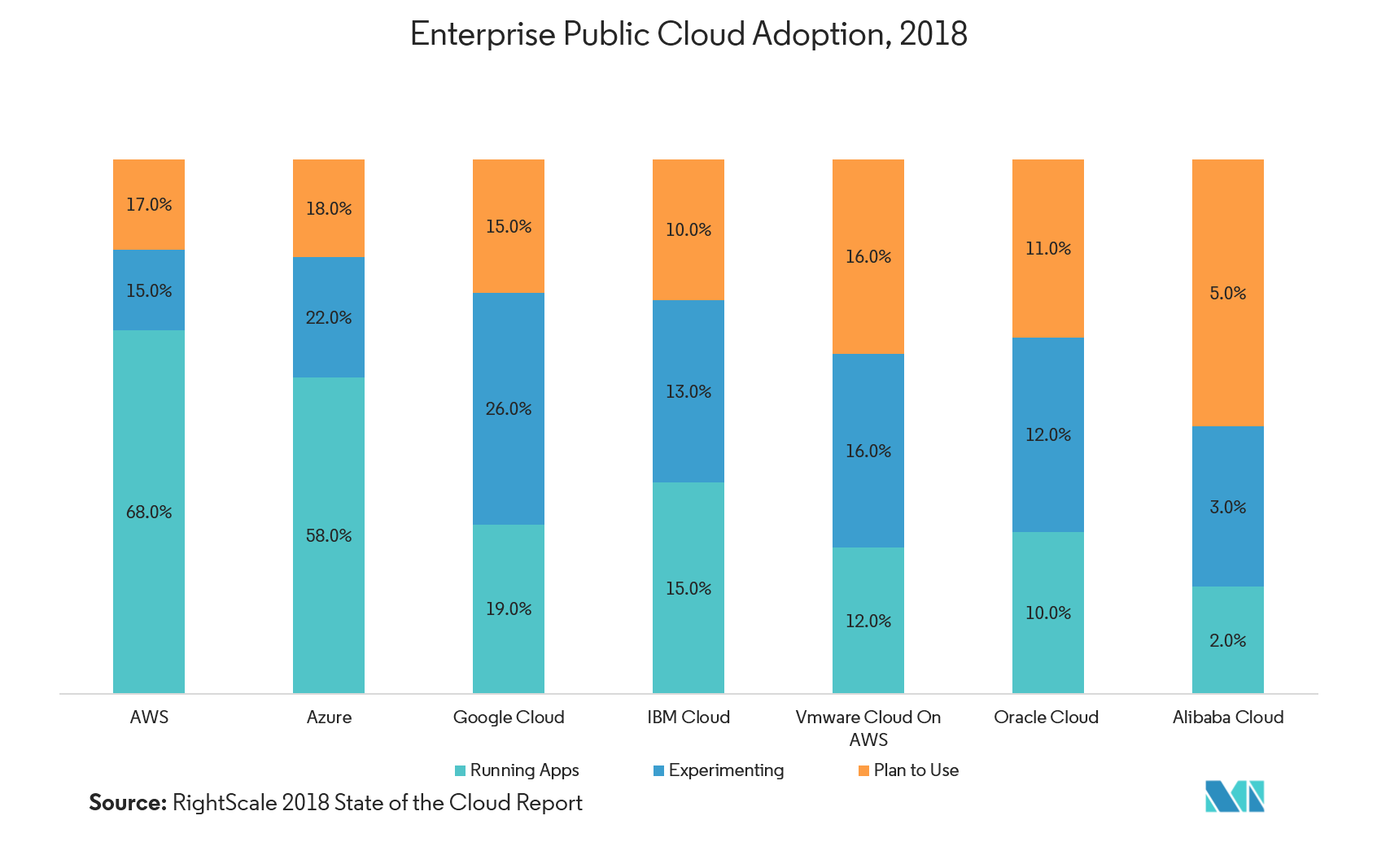

- Enterprises are searching for ways that cut down on expenses and has the potential to generate internal revenues. Making essential files and data accessible through the cloud was found to be a feasible solution, which in turn has led to the proliferation of the BYOD trend. The banks are quickly following suit, and given the globalized nature of their business, remote access of data becomes an essential feature for this industry. A cloud report published by Rightscale in 2018, stated that more than 68% of running applications used for communication are built on Cloud services of Amazon (AWS).

- Encouraging employees to bring their own devices is an efficient way of adding capacity to IT infrastructure. This will enable employees to work away from the office while still being able to access the system over the internet by accessing data and files they need. For instance, Team Sites comes with Office 365 and allows employees to edit the documents simultaneously while being in different locations, and taking part in online conferences.

- A new report from iPass, a commercial Wi-Fi network service provider, indicates that 70% of mobile workers adapt their companies' bring your own device (BYOD) policies. For some, BYOD is a must. This trend will also get increasingly reflected in the banking industry, as the lines between office and private spaces get blurred.

North America to Remain the Largest Market for UCaaS in Banking Industry

- The region of North America is a major revenue contributor and will lead the global UCaaS market in the banking industry during the forecast period, owing to the emergence of huge tech-savvy employees, high focus on innovations obtained from research and development and technology, and improved infrastructure in the region. Growth in the investment by enterprises in the banking industry and growing trends of mobility and BYOD is expected to drive the demand for UCaaS market.

- The US is one of the fastest growing markets with many of the major banks of the world headquartered there. The banks in the country are cash rich and tech-savvy and are most likely to adopt any new technology in the unified communications segment.

- Celent estimates that the overall bank IT spending in 2018, is approximately USD 104 billion. Citigroup Inc. estimates that around 20% of the expense budget is dedicated to technology spending, in 2018. Based on the data gathered from a research study on more than 600 end-user organizations in North America, it is understood that around 29% of the organizations are utilizing UCaaS already, by using cloud-based platforms for all of their collaboration needs.

Unified Communication-as-a-Service in Banking Industry Overview

The unified communication as-a-service in banking market is a consolidated market with a few players dominating the marketwith their technological expertise in unified communications.While innovation remains the prime factor for market domination in this industry, the major players are focusing on expanding their customer base by leveraging on strategic collaborative initiatives andby acquiring smaller players to strengthen their hold in the market further. The major players includeRingCentral, Inc., 8X8 Inc., West Unified Communications Services, Inc., Cisco Systems Inc., Fuze Inc., Avaya Inc., Voss Solutions, NetFortris, Inc., TetraVX, and Kurmi Software, among others.

- March 2019 - Avaya Holdings Corp. introduced a programthat providesfinancial organizations access to high-level communications across a variety of client touchpoints, thereby delivering banking reliability & security.

- March 2019 - Optus Business announced the launch of Optus Cloud Calling, a cloud-based calling and collaboration solution, that includes mobility, audio and video conferencing, collaboration, and enterprise telephony. This solution is based onCisco's BroadCloud and Webex portfolios.

- April 2019 -Momentum Telecom acquired Metro Optical Solutions, a leading provider of managed network, data, and internet solutions to enterprise and carrier customers globally. This acquisition is expected to further positionMomentum Telecomas a leader in the UCaaS market.

Unified Communication-as-a-Service in Banking Market Leaders

-

RingCentral, Inc.

-

8X8 Inc.

-

West Unified Communications Services, Inc.

-

Cisco Systems Inc.

-

Fuze Inc.

*Disclaimer: Major Players sorted in no particular order

Unified Communication-as-a-Service in Banking Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Trends Towards BYOD and Mobility

- 4.3.2 Increasing Need for Unified Communication Across the Organization

- 4.3.3 Increasing Use of Server Message Block (SMB)

-

4.4 Market Restraints

- 4.4.1 Lack of Awareness Regarding Cloud UC

- 4.4.2 Increasing Security Concerns for Cloud-Based Services

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Component

- 5.1.1 Telephony

- 5.1.2 Contact Center

- 5.1.3 Unified Messaging

- 5.1.4 Collaboration Platform

-

5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small & Medium Enterprises

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 RingCentral, Inc.

- 6.1.2 8X8 Inc.

- 6.1.3 West Unified Communications Services, Inc.

- 6.1.4 Cisco Systems Inc.

- 6.1.5 Fuze Inc.

- 6.1.6 Avaya Inc.

- 6.1.7 Voss Solutions

- 6.1.8 NetFortris, Inc.

- 6.1.9 TetraVX

- 6.1.10 Kurmi Software

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityUnified Communication-as-a-Service in Banking Industry Segmentation

UCaaS refers to a service model where the provider delivers different telecom or communications applications, software products and processes generally over the web.The UCaaS in banking market is segmented byvarious types of components used for UC, size of the organization, and geography.By type of components, the market studied is segmented into telephony, contact center, unified messaging, collaboration platform. By organization size, the market studied is segmented into large enterprises and small & medium enterprises. Integrated solutions offered by UCaaS vendors areconsidered in the scope of the study.

| By Component | Telephony |

| Contact Center | |

| Unified Messaging | |

| Collaboration Platform | |

| By Organization Size | Large Enterprises |

| Small & Medium Enterprises | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Unified Communication-as-a-Service in Banking Market Research FAQs

What is the current UCaaS in Banking Market size?

The UCaaS in Banking Market is projected to register a CAGR of 18.70% during the forecast period (2024-2029)

Who are the key players in UCaaS in Banking Market?

RingCentral, Inc., 8X8 Inc., West Unified Communications Services, Inc., Cisco Systems Inc. and Fuze Inc. are the major companies operating in the UCaaS in Banking Market.

Which is the fastest growing region in UCaaS in Banking Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in UCaaS in Banking Market?

In 2024, the North America accounts for the largest market share in UCaaS in Banking Market.

What years does this UCaaS in Banking Market cover?

The report covers the UCaaS in Banking Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the UCaaS in Banking Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Unified Communications for Financial Services Industry Report

Statistics for the 2024 Unified Communications for Financial Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Unified Communications for Financial Services analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.