Underwater Lighting Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 3.70 % |

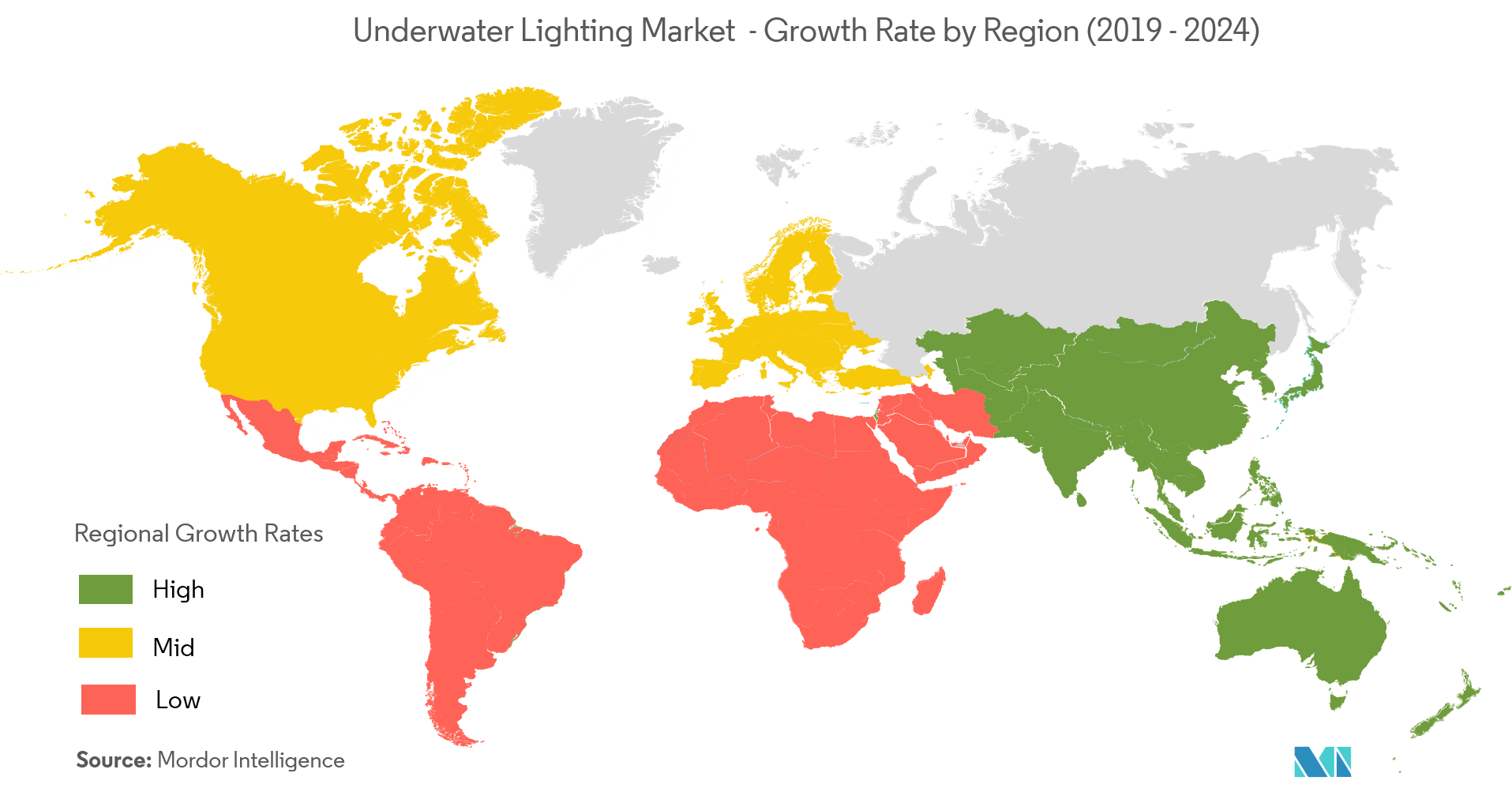

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Underwater Lighting Market Analysis

The Underwater Lighting market is expected to record a CAGR of 3.7% over the forecast period (2021 - 2026). The underwater lighting is used for the decoration purpose in the pools or recreational ponds. The underwater lights are also installed for aesthetic water-featured landscaping.

- Underwater lights are installed in swimming pools of residential apartments, sports facilities, hotels, and spas. Keeping the pools illuminated makes them attractive and safe for use. The lights are also installed in pools to create a pleasant atmosphere, thus, making it suitable to use pools round-the-clock. These lights create a specific light effect during the night that makes the surrounding more beautiful.

- LEDs are increasingly gaining traction for underwater lighting, and they are taking over as the industry standard. As compared to other lighting source, LEDs are inherently efficient with a long expected lifetime. For instance, Edmonds Pool and Community Centre in Canada is taking advantage of LED technology like other facilities. LED fixtures are used in the aquatic area in overhead lane lighting to guide swimmers and color-changing installations inside the pool tanks.

- In line with the growing adoption of LED lights in the underwater lighting market, companies such as Jandy, in 2018, launched Jandy Pro Series WaterColors Nicheless LED lights. These LEDs to allow pool owners to set the mood with nine vibrant colors and five color-changing light shows.

Underwater Lighting Market Trends

This section covers the major market trends shaping the Underwater Lighting Market according to our research experts:

LED is Expected to Hold a Significant Share

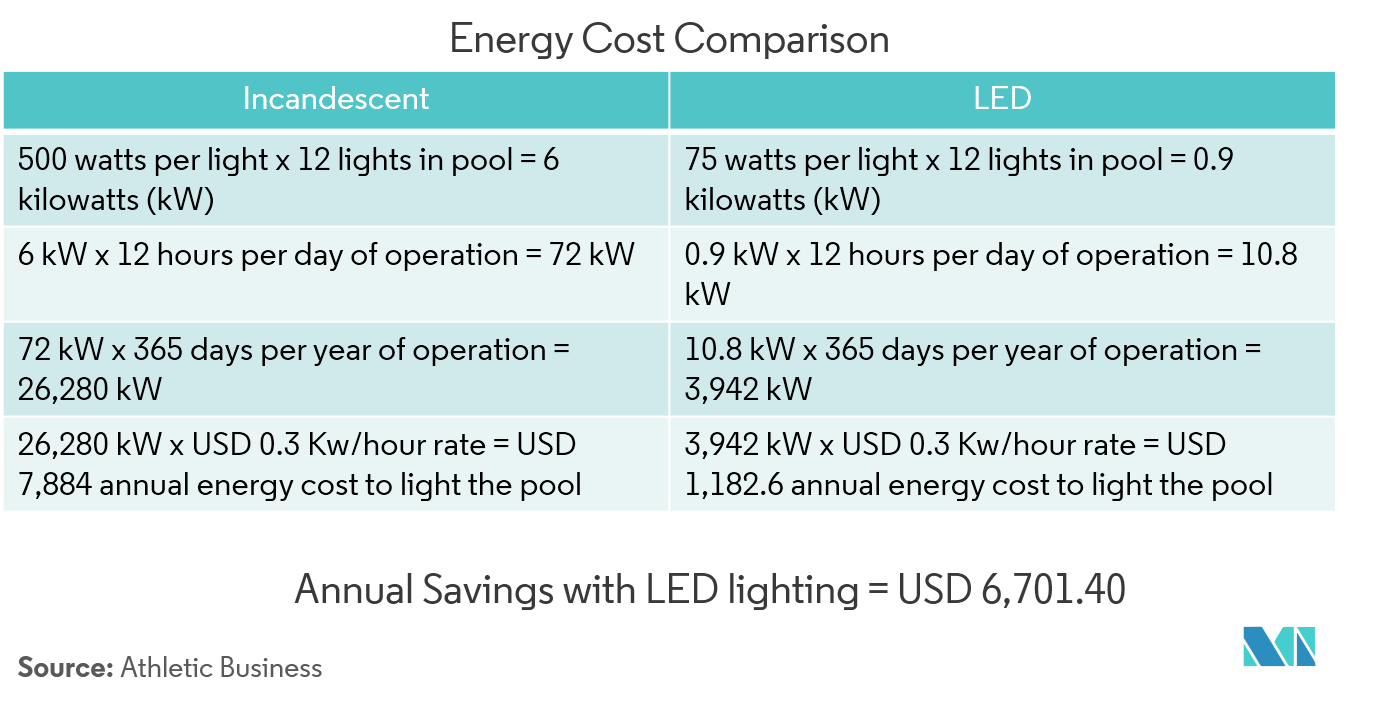

- LEDs have evolved as a major lighting technology as they are environmentally more beneficial as compared to halogen lights in terms of power consumption, durability, and longevity. LEDs are also safe as they do not get heated and can easily be switched on/off without waiting for them to cool down. They ensure energy-saving and require less maintenance.

- When compared to the electricity required to run a pool's pumps, lighting consumes a very small amount of energy, but, it cannot be neglected. With the push toward LEED and the growing trend towards green technology, people are turning towards LED-style lighting. The LED has revolutionized swimming pool lighting. The LED can produce the same amount of light as a 100-watt halogen bulb while using only six watts of power. This is because LEDs convert all the energy it uses into light rather than some of it being converted into heat.

Asia-Pacific is Expected to Experience a Rapid Growth

- The growing number of swimming pool construction projects in the region due to its thriving tourism industry and the development of luxurious residential complexes endowed with modern amenities, most often with large pools is expected to propel the demand for the underwater lighting market.

- The tourism sector is also impacting the growth of the construction sector in the region. The region is also aware of the fact that the priority for tourists is comfort with better amenities such as pools and spas. For instance, Bali accounts for more than 2,500 hotels with a pool.

- Singapore attracted 18.5 million visitors in 2018, a 6.2% increase from the previous year, according to the Singapore Tourism Board. This increasing number can result in the construction of new hotels, more elegant and luxurious than before. This, in turn, will provide ample opportunities to the underwater lighting market.

Underwater Lighting Industry Overview

The underwater lighting market is competitive and consists of several players. With the LED lighting gaining popularity as a lighting source for underwater lighting, companies are continuously investing in this technology. Companies are also increasing their market presence by expanding their operations, or by entering into strategic mergers and acquisitions.

- July 2019 -S.R. Smith launched a new category of the pool and spa lighting, called as the Mod-Lite. The company's Mod-Lite system provides an update to the LED lighting and maintenance. Mod-Lite combines modular design with wireless power technology to offer better convenience, safety, and savings.

Underwater Lighting Market Leaders

-

Eaton Corporation

-

Signify Holding (Koninklijke Philips N.V.)

-

Acuity Brands Inc.

-

Hayward Industries Inc.

-

Lumitec LLC

*Disclaimer: Major Players sorted in no particular order

Underwater Lighting Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Rising Demand for Underwater Lights in Pools and for Aesthetic Water-Featured Landscaping

- 4.2.2 Government Initiatives to Support Adoption of LEDs

-

4.3 Market Restraints

- 4.3.1 High Initial Costs

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Lighting Source

- 5.1.1 LED

- 5.1.2 Other Lighting Sources (Halogen, Incandescent Lights)

-

5.2 By Application

- 5.2.1 Swimming Pools

- 5.2.2 Fountains

- 5.2.3 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.5 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Lumitec LLC

- 6.1.2 Signify Holding (Koninklijke Philips N.V.)

- 6.1.3 Cooper Industries (Eaton Corporation)

- 6.1.4 Hydrel (Acuity Brands Inc.)

- 6.1.5 Hayward Industries Inc.

- 6.1.6 Huaxia Lighting Co. Ltd

- 6.1.7 Global Light & Power LLC

- 6.1.8 G1 Energy Solutions Private Limited

- 6.1.9 Wibre-Elektrogerate Edmund Breuninger GmbH & Co. KG

- 6.1.10 Dabmar Lighting Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityUnderwater Lighting Industry Segmentation

Underwater lighting refers to submersible lights to illuminate areas with poor visibility under the water. These lights can be used for decorative purposes such as illuminating water features that include ponds and swimming pools. Bumps on the walls of pool or accidental collisions with other swimmers can be avoided with this lighting.

| By Lighting Source | LED | |

| Other Lighting Sources (Halogen, Incandescent Lights) | ||

| By Application | Swimming Pools | |

| Fountains | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Mexico |

| Brazil | ||

| Geography | Middle-East & Africa |

Underwater Lighting Market Research FAQs

What is the current Underwater Lighting Market size?

The Underwater Lighting Market is projected to register a CAGR of 3.70% during the forecast period (2024-2029)

Who are the key players in Underwater Lighting Market?

Eaton Corporation, Signify Holding (Koninklijke Philips N.V.), Acuity Brands Inc., Hayward Industries Inc. and Lumitec LLC are the major companies operating in the Underwater Lighting Market.

Which is the fastest growing region in Underwater Lighting Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Underwater Lighting Market?

In 2024, the North America accounts for the largest market share in Underwater Lighting Market.

What years does this Underwater Lighting Market cover?

The report covers the Underwater Lighting Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Underwater Lighting Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Underwater Lighting Industry Report

Statistics for the 2024 Underwater Lighting market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Underwater Lighting analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.