UK Power EPC Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | 2.08 % |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

UK Power EPC Market Analysis

United Kingdom’s electricity system is witnessing a period of significant change as the country is undergoing a transitionfromalarge-scaleconventionalfossilfueldominated generationmix to intermittentrenewablegeneration. The installedpowergenerationcapacityoftheUnitedKingdom is expected to growat a CAGR of approximately 2.08% during the forecast period of 2019-2024. The growth is anticipated on account of a rising development of power generation systems, spurred by increasing demand for electricity in the country. However, the phasing out of coal-based power plants in the country, which had a major effect on demand for EPC services, a major source of revenue is being removed and in turn, is expected to hinder the growth of the market studied in the coming years.

- Over 13 GW capacity through interconnectors is planned for the UK to countries, such as France, Irelands, and the Netherlands with several projects expected to be commissioned in the coming years. This, in turn, is expected to significant opportunities for EPC services in the country in the future.

- The renewable energy sector is expected to witness a significant growth in the coming years owing to the country’s efforts and policies to increase the share of renewable energy sources in the energy mix.

UK Power EPC Market Trends

This section covers the major market trends shaping the UK Power EPC Market according to our research experts:

Growth in Renewable Energy Sector

- Production and consumption of energy from renewable sources has been steadily increasing in the United Kingdom, since 2000. The rise has been driven by both national and international incentives, including the EU Renewable Energy Directive, which requires EU as a whole to achieve 20% of its energy from renewable sources by 2020.

- The 2009 Renewable Energy Directive sets a target for the United Kingdom to achieve 15% of its energy consumption from renewable sources, by 2020. This compares to only 1.5% in 2005. Furthermore, the government has already announced the closure of all coal-fired power plants, by October 2025.

- Similarly, pledges, such as pledge to cut-down by 2050 to a ‘net-zero’ state, governments policies, such as establishment of Carbon Tax on thermal power plants and establishment of Contracts for Difference (CfD) mechanism, coupled with falling cost of equipment and energy storage systems, are expected to further supplement the demand for renewable energy growth in the country.

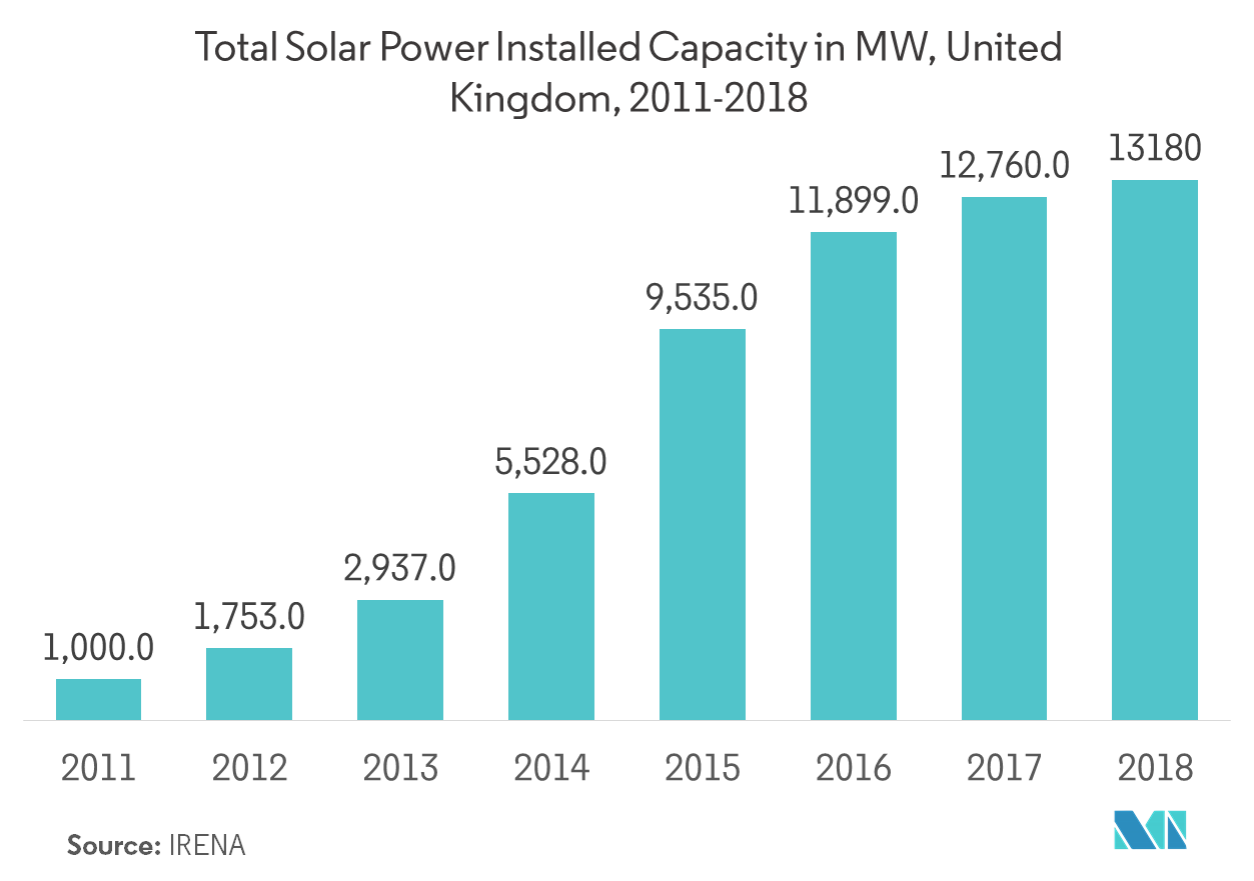

- Moreover, with the declining cost of solar equipment and establishment of capital market for electricity generation, the country is expected to witness increased uptake of subsidy-free solar projects in the coming years.

- Furthermore, with the opening up of competitive market in the country, several coal-based power plants are expected to be converted into bioenergy-based power plants. With the country’s increasing quest for carbon-free energy generation, the demand for installation of renewables is expected to further increase in the coming years.

UK Power EPC Industry Overview

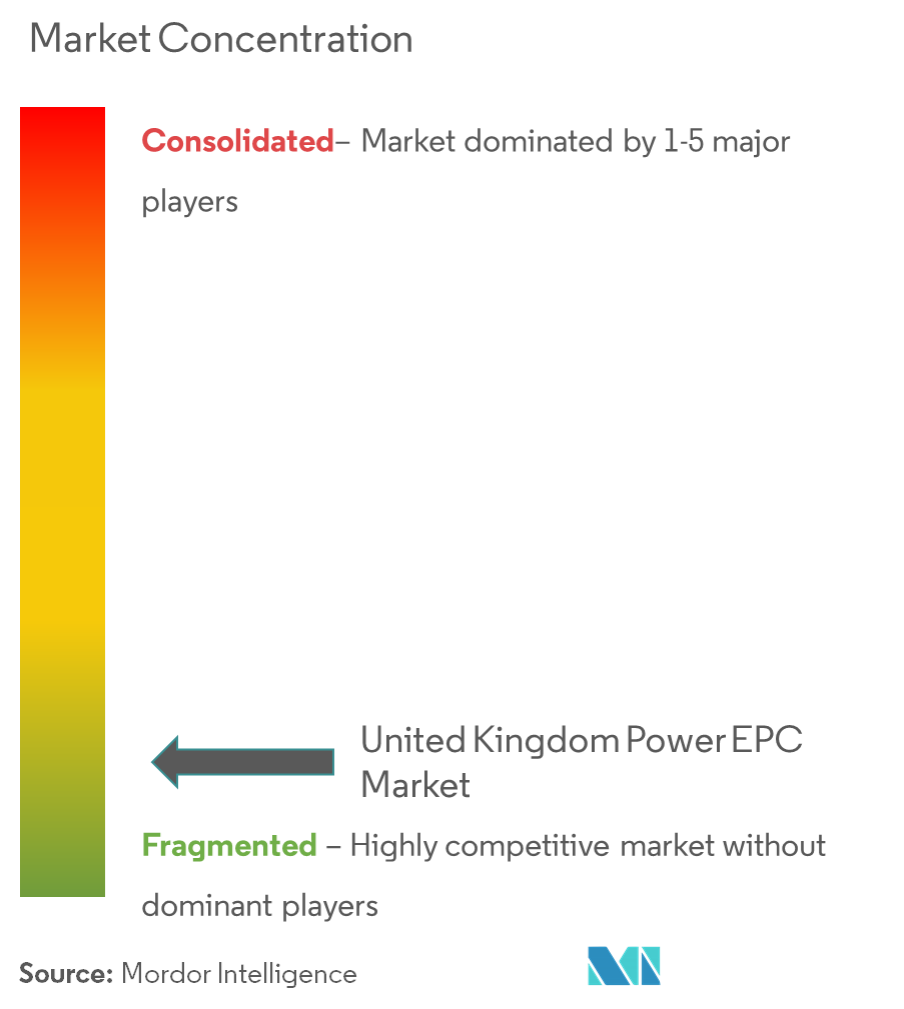

The United Kingdom power EPC market is fragmented. Some of the major companies include Ramboll UK Limited, Amec Foster Wheeler (Wood Group), Fluor Ltd, Doosan Babcock Ltd, and Bechtel Corporation.

UK Power EPC Market Leaders

-

Ramboll UK Limited

-

Amec Foster Wheeler (Wood Group)

-

Fluor Ltd

-

Doosan Babcock Ltd

-

Bechtel Corporation

*Disclaimer: Major Players sorted in no particular order

UK Power EPC Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

- 1.4 Study Deliverables

- 1.5 Research Phases

2. EXECUTIVE SUMMARY

3. RESEARCH METHODOLOGY

4. MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Power Capacity Forecast in GW, till 2024

- 4.3 Power EPC Tendering Process

- 4.4 Recent Trends and Developments

- 4.5 Investment Opportunities and CAPEX analysis

- 4.6 Government Policies, Regulations, and Targets

-

4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 PESTLE Analysis

5. MARKET SEGMENTATION

-

5.1 Sector

- 5.1.1 Power Generation

- 5.1.1.1 Thermal

- 5.1.1.2 Hydroelectric

- 5.1.1.3 Nuclear

- 5.1.1.4 Renewables

- 5.1.1.5 Key Projects

- 5.1.1.5.1 Existing Infrastructure

- 5.1.1.5.2 Upcoming Projects

- 5.1.1.5.3 Projects in the Pipeline

- 5.1.2 Power Transmission and Distribution

- 5.1.2.1 Key Projects

- 5.1.2.1.1 Existing Infrastructure

- 5.1.2.1.2 Upcoming Projects

- 5.1.2.1.3 Projects in the Pipeline

- 5.1.3 List of EPC Developers

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

-

6.3 Key Company Profiles

- 6.3.1 EPC Developers

- 6.3.1.1 Ramboll UK Limited

- 6.3.1.2 Amec Foster Wheeler (Wood Group)

- 6.3.1.3 Fluor Ltd

- 6.3.1.4 Doosan Babcock Ltd

- 6.3.1.5 Bechtel Corporation

- 6.3.1.6 Orsted AS

- 6.3.2 Original Equipment Manufacturers

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens AG

- 6.3.2.3 ABB Ltd

- 6.3.2.4 Ansaldo Nuclear Ltd

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityUK Power EPC Industry Segmentation

The United Kingdom power EPC market report include:

| Sector | Power Generation | Thermal | |

| Hydroelectric | |||

| Nuclear | |||

| Renewables | |||

| Key Projects | Existing Infrastructure | ||

| Upcoming Projects | |||

| Projects in the Pipeline | |||

| Sector | Power Transmission and Distribution | Key Projects | Existing Infrastructure |

| Upcoming Projects | |||

| Projects in the Pipeline | |||

| Sector | List of EPC Developers |

UK Power EPC Market Research FAQs

What is the current United Kingdom Power EPC Market size?

The United Kingdom Power EPC Market is projected to register a CAGR of 2.08% during the forecast period (2024-2029)

Who are the key players in United Kingdom Power EPC Market?

Ramboll UK Limited, Amec Foster Wheeler (Wood Group), Fluor Ltd, Doosan Babcock Ltd and Bechtel Corporation are the major companies operating in the United Kingdom Power EPC Market.

What years does this United Kingdom Power EPC Market cover?

The report covers the United Kingdom Power EPC Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the United Kingdom Power EPC Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Power EPC in UK Industry Report

Statistics for the 2024 Power EPC in UK market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Power EPC in UK analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.