United States Freight Brokerage Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 17.96 Billion |

| Market Size (2029) | USD 26.82 Billion |

| CAGR (2024 - 2029) | 8.35 % |

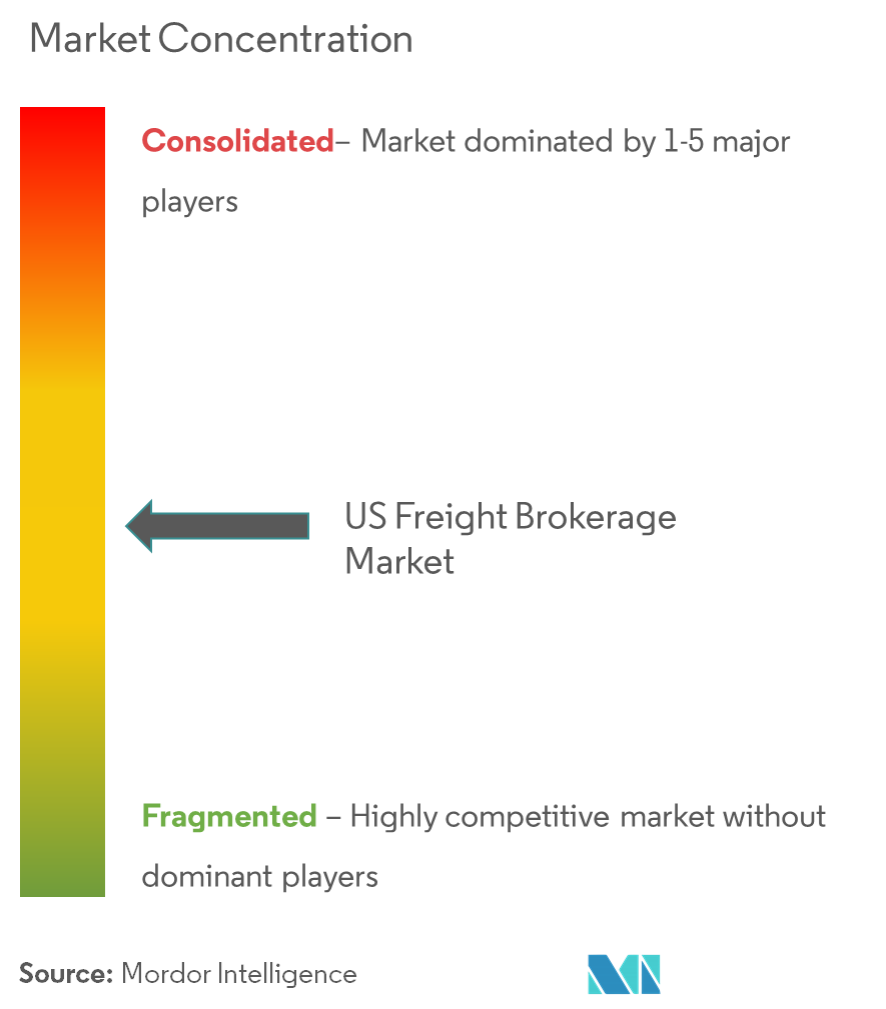

| Market Concentration | Low |

Major Players_-_Copy.webp)

*Disclaimer: Major Players sorted in no particular order |

United States Freight Brokerage Market Analysis

The United States Freight Brokerage Market size is estimated at USD 17.96 billion in 2024, and is expected to reach USD 26.82 billion by 2029, growing at a CAGR of 8.35% during the forecast period (2024-2029).

- As per industry sources, the penetration of the US freight brokerage sector in the total freight market is increasing. The number of entries processed by US market players has grown steadily over the years. The US-Mexico-Canada Agreement (USMCA) is further expected to streamline cross-border shipments and create uniformity for supply chains in North America.

- The ongoing shortage of truck drivers in the US market has an adverse effect on businesses like brokerages, which heavily depend on carriers. This scenario forces freight brokers to quote higher prices to shippers, leading to an increase in price and competition in the market.

- The US less-than-truckload (LTL) segment is facing intense competitive rivalry. LTL freight brokers are involved in innovations in North American LTL to drive the next leg of profit improvement.

United States Freight Brokerage Market Trends

FTL Service Has Gained Momentum in the Country in Recent Years

- In recent years, the United States has experienced substantial growth in full truckload (FTL) services owing to the demand for inland freight movement and cross-border trade between the United States, Canada, and Mexico. Full truckload freight brokerage is still in a growth phase and is a major attraction for new shippers to penetrate the domestic market. However, established shippers seek long-term contracts with brokerage firms and carriers to gain a leading position in the international freight forwarding industry.

- FTL brokers facilitate the transportation service for shippers and monitor the carriers' shipments. Many freight brokerage firms are strengthening their digital marketplace and are adopting technology, such as automated pricing, application programming interface (API) connectivity, data science, and internally facing technology. Some of the key players in the US truckload freight brokerage market are C.H. Robinson, XPO Logistics, Total Quality Logistics, Echo Global Logistics, and Coyote Logistics.

- In January 2023, Schneider National Inc. of Green Bay announced that it is investing in TuSimple, a San Diego self-driving technology company. Some of the company's customers include UPS, the US Postal Service, and McLain Co. The company also has partnerships with tech giants like Nvidia and Amazon. In November 2022, Google and JB Hunt announced a multi-year strategic alliance to accelerate JB Hunt's digital transformation and collaborate on supply chain platform technology. Powered by Google Cloud, JB Hunt is expected to expand its JB Hunt 360° platform that digitally connects shipments and available capacity. By leveraging Google's Data Cloud, JB Hunt 360 may use artificial intelligence and machine learning tools to predict outcomes, empower users, and make informed decisions.

Manufacturing and Automotive Segment is Driving the Market in the Future

- The booming automotive industry in the United States demands automotive logistics solutions with maximum availability and reliability for port-to-port transportation, just-in-time (JIT) deliveries, or just-in-sequence (JIS) deliveries. The growth in this market is mainly driven by factors such as the growing automobile production in emerging economies and strict regulatory standards imposed by governments on the automotive industry. For instance, in 2023, the US auto industry witnessed robust sales, with approximately 3.12 million cars sold. Furthermore, the total sales of cars and light trucks in the US market reached a notable 15.5 million units.

- The growing adoption of electric vehicles, increasing awareness among consumers regarding product quality and safety, and the incorporation of technological advancements, with the rising adoption of connected devices in the automotive industry, offer growth opportunities to the market players. The NAFTA rules of origin for automotive products are based on a tariff change alone or a tariff change and a regional value content requirement. The agreement requires that the regional value content for these products be calculated using the net cost method.

- The regional value content requirement for autos and light vehicles and their engines and transmissions will be 50% under the net cost method when the agreement enters into force; this percentage will be increased to 62.5% over an eight-year transition period. In 2022, factory activity in the United States grew at its slowest rate in more than a year and a half, owing to an increase in layoffs, and manufacturers were concerned about supply over the summer due to China's zero-tolerance policy.

- The decline of the US manufacturing industry has increased inequality and harmed the country's global competitiveness. Manufacturing revitalization could add 1.5 million well-paying jobs to the economy and revitalize marginalized communities. Manufacturing could experience a renaissance as a result of innovation and digitization. Years of uneven growth across sectors and geographies have resulted in some industries flourishing while others faltering.

United States Freight Brokerage Industry Segmentation

The US freight brokerage market is moderately fragmented, with the presence of large regional players, global players, and small and medium-sized local players with a few players in the market. C.H. Robinson dominates the industry, followed by XPO Logistics and Hub Group/Mode Transportation. The freight brokerage market is top-heavy, with the top 8 to 10 firms accounting for more than one-third of the total gross revenues.

As far as technology integration is concerned, new entrants such as Convoy, Uber Freight, and uShip, are trying to gain significant market share by offering price transparency, online load boards, and freight marketplaces for booking freight via mobile apps, with the goal of removing human interaction in the freight booking and payment process. Trucking-as-a-Service (TaaS) is expected to grow significantly in the country with technological developments and demand for digital freight forwarding.

United States Freight Brokerage Market Leaders

-

CH Robinson

-

Total Quality Logistics

-

XPO Logistics Inc.

-

Echo Global Logistics

-

Worldwide Express

*Disclaimer: Major Players sorted in no particular order

United States Freight Brokerage Market News

- August 2023: Digital logistics provider and freight brokerage Convoy unveiled an offering for just-in-time (JIT) trucking, with a pledge of delivery within 15 minutes of the set arrival time. Convoy spotted an opening for a more flexible service that gives shippers the ability to scale up and down in response to fast-changing conditions. Its new JIT service leverages a network of over 400,000 trucks and the IT infrastructure to find matching carriers to meet specific shipper requirements.

- February 2023: Echo Global Logistics Inc. (Echo), one of the leading providers of technology-enabled transportation and supply chain management services, launched EchoInsure+, a new and integrated, full-coverage cargo insurance product offered exclusively to Echo’s clients. By partnering with insurance group Falvey, EchoInsure+ offers an easy way for clients to access best-in-class protection for their LTL shipments through EchoShip, Echo's proprietary online shipping platform, and Echo’s representatives.

United States Freight Brokerage Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Current Market Scenario

-

4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growing Construction Across the Country

- 4.2.1.2 The Growing Number of Freight Brokers Across the Country

- 4.2.2 Restraints

- 4.2.2.1 Rerouting of Cargo and Other Factors

- 4.2.2.2 Reducing Freight Imports Across the Country

- 4.2.3 Opportunities

- 4.2.3.1 Growing Demand From the Oil and Gas Industry

- 4.2.3.2 Technological Advancements in Freight Brokerage Systems and Logistics

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 US Logistics Industry (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives

- 4.7 Insights on Freight Rates

- 4.8 Technology Snapshot (Digital Freight Brokerage, IoT, etc.)

- 4.9 Qualitative and Quantitative Insights on the US Customs Clearance Sector

- 4.10 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION (Market Size By Value)

-

5.1 By Service

- 5.1.1 LTL

- 5.1.2 FTL

- 5.1.3 Other Services

-

5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil and Gas, Mining, and Quarrying

- 5.2.3 Agriculture, Fishing, and Forestry

- 5.2.4 Construction

- 5.2.5 Distributive Trade (Wholesale and Retail Segments, FMCG included)

- 5.2.6 Other End Users (Telecommunications, Pharmaceuticals, etc.)

6. COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

-

6.2 Company Profiles

- 6.2.1 CH Robinson

- 6.2.2 Total Quality Logistics

- 6.2.3 XPO Logistics Inc.

- 6.2.4 Echo Global Logistics

- 6.2.5 Worldwide Express

- 6.2.6 Coyote Logistics

- 6.2.7 Landstar System Inc.

- 6.2.8 Schneider

- 6.2.9 SunteckTTS

- 6.2.10 GlobalTranz

- 6.2.11 J.B. Hunt Transport Inc.

- 6.2.12 Hub Group

- 6.2.13 BNSF Logistics LLC

- 6.2.14 KAG Logistics Inc.

- 6.2.15 Uber Freight*

- *List Not Exhaustive

- 6.3 Other Companies

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. APPENDIX

** Subject To AvailablityUnited States Freight Brokerage Industry Segmentation

Freight brokerage companies facilitate the shipment and delivery of goods across geographical borders for individuals and organizations. Freight brokers provide a service by linking customers with shippers and trucking companies.

The report provides a comprehensive background analysis of the United States freight brokerage market, covering the current market trends, restraints, technological updates, and detailed information on various segments and the competitive landscape of the industry. Additionally, the COVID-19 impact has been incorporated and considered during the study.

The report covers freight brokerage companies, and the market is segmented by service (less than truckload (LTL), full truckload (FTL), and other services) and end user (manufacturing and automotive, oil and gas, mining, and quarrying, agriculture, fishing and forestry, construction, distributive trade (wholesale and retail segments, FMCG included) and other end users (telecommunications, pharmaceutical, etc.)).

The report offers market sizes and forecasts in value (USD) for all the above segments.

| By Service | LTL |

| FTL | |

| Other Services | |

| By End User | Manufacturing and Automotive |

| Oil and Gas, Mining, and Quarrying | |

| Agriculture, Fishing, and Forestry | |

| Construction | |

| Distributive Trade (Wholesale and Retail Segments, FMCG included) | |

| Other End Users (Telecommunications, Pharmaceuticals, etc.) |

United States Freight Brokerage Market Research Faqs

How big is the United States Freight Brokerage Market?

The United States Freight Brokerage Market size is expected to reach USD 17.96 billion in 2024 and grow at a CAGR of 8.35% to reach USD 26.82 billion by 2029.

What is the current United States Freight Brokerage Market size?

In 2024, the United States Freight Brokerage Market size is expected to reach USD 17.96 billion.

Who are the key players in United States Freight Brokerage Market?

CH Robinson, Total Quality Logistics, XPO Logistics Inc., Echo Global Logistics and Worldwide Express are the major companies operating in the United States Freight Brokerage Market.

What years does this United States Freight Brokerage Market cover, and what was the market size in 2023?

In 2023, the United States Freight Brokerage Market size was estimated at USD 16.46 billion. The report covers the United States Freight Brokerage Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the United States Freight Brokerage Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

How does technology influence the US Freight Brokerage Industry?

Technology plays a significant role in the US Freight Brokerage Industry, enabling brokers to streamline operations, improve communication, and enhance visibility. Advanced technologies such as artificial intelligence, machine learning, and blockchain are being integrated into freight brokerage platforms to optimize processes and provide real-time insights.

United States Freight Brokerage Industry Report

The US freight brokerage market is experiencing significant growth, driven by increasing demand for efficient and cost-effective transportation solutions across various industries. This market is characterized by the role of freight brokers as intermediaries between shippers and carriers, leveraging advanced technologies such as artificial intelligence and machine learning to optimize logistics operations. Key market segments in the US freight brokerage market include commute modes like truck, air, rail, and water, with truck transport holding the largest share. Service types are divided into full truckload (FTL) and less-than-truckload (LTL), with LTL services showing the highest growth potential. End-use industries such as manufacturing, automotive, oil and gas, agriculture, and construction are major contributors to market demand. The US freight brokerage market is also witnessing a shift towards digital platforms and online freight marketplaces, enhancing transparency and efficiency. The integration of advanced technologies and the focus on sustainability present significant opportunities for growth and innovation in the freight brokerage industry. The US Freight Brokerage Market Size continues to expand, reflecting the dynamic and evolving nature of this sector. Statistics for the US Freight Brokerage market share, size, and revenue growth rate are created by Mordor Intelligence™ Industry Reports. Get a sample of this industry analysis as a free report PDF download.