USA Soy Beverages Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 6.01 % |

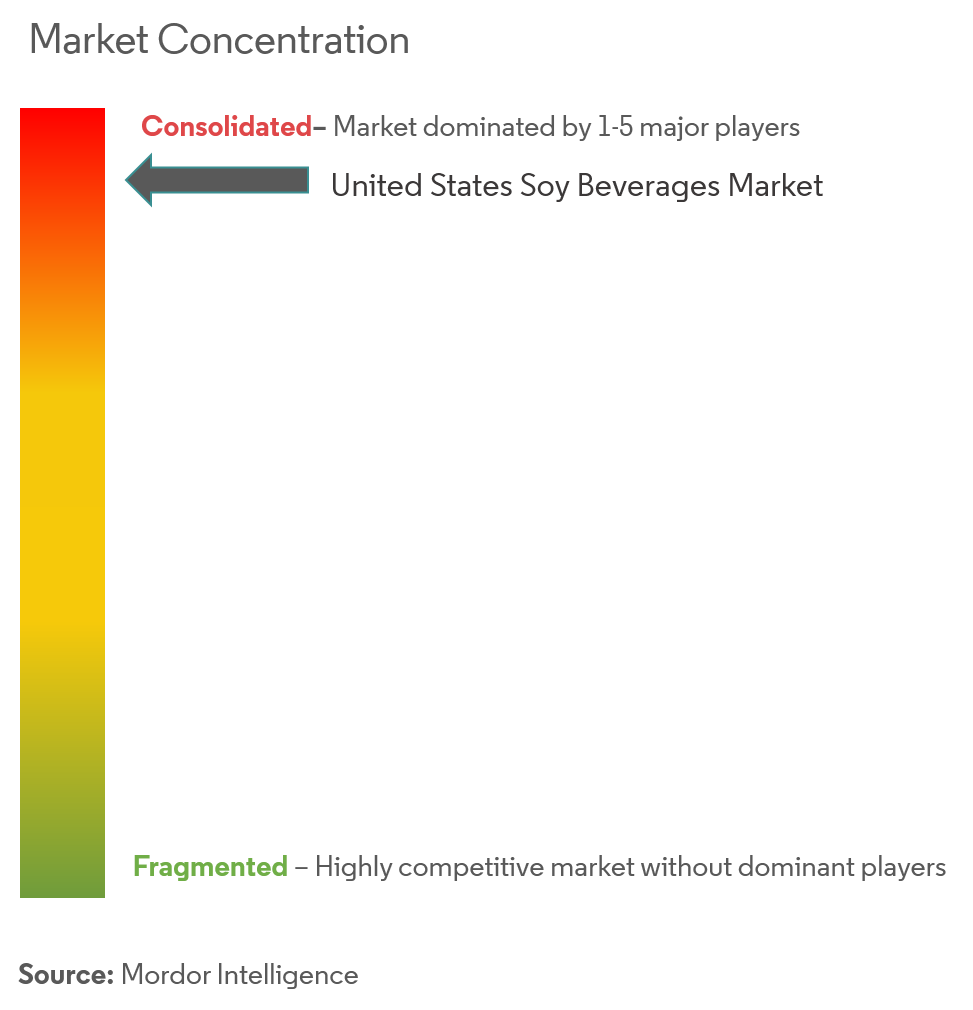

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

USA Soy Beverages Market Analysis

United States soy beveragesmarket is projected to register a CAGR of 6.01% during the forecast period (2020-2025).

- The various health benefits of soy milk such as less cholesterol, heart disease reduction and the increasing number of health-conscious consumers in the country is a driving factor for the market.

- Furthermore, the soy beverage market in the countryis driven by the people who prefer a plant-based diet or those suffering from dairy allergies, since it contains calcium and other vitamins.

USA Soy Beverages Market Trends

This section covers the major market trends shaping the US Soy Beverages Market according to our research experts:

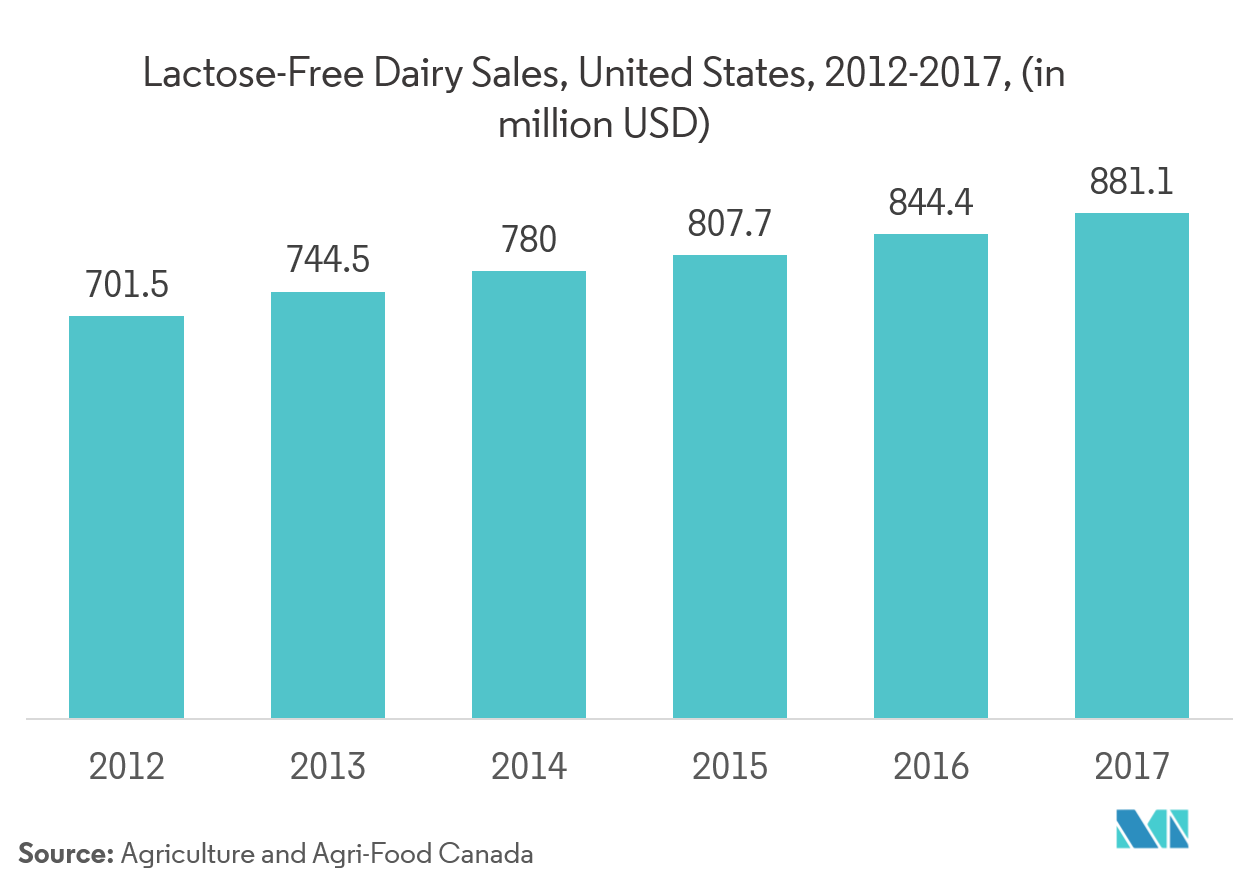

Increasing Demand for Lactose-Free Foods

The country is witnessing a higher percentage of lactose-intolerant consumers who are demanding lactose-free food products such as soy beverages to meet their special dietary requirements. Often, affected individuals have difficulty digesting fresh milk, thereby leading to decreased consumption of dairy products. This is because most of the dairy farm cows in the country produce milk that predominantly contains the A1 protein, thereby causing discomfort upon consumption. Thus, more lactose-intolerant individuals in the country are shifting towards dairy-free alternatives such as soy beverages to meet their dairy requirements through non-dairy sources.

Rising Inclination Towards Soy Beverages

Companies are focusing more on developing soy foods not only to meet the increased demand for the products but due to advances in food processing technology. These technology advances have lead to a wide range of soy foods that appeal to people across the United States. Organizations like the Soyfoods Association of North America are also promoting the consumption of soyfoods in the diet of consumers in the country while promoting its health benefits, thereby influencing consumers to purchase the products.

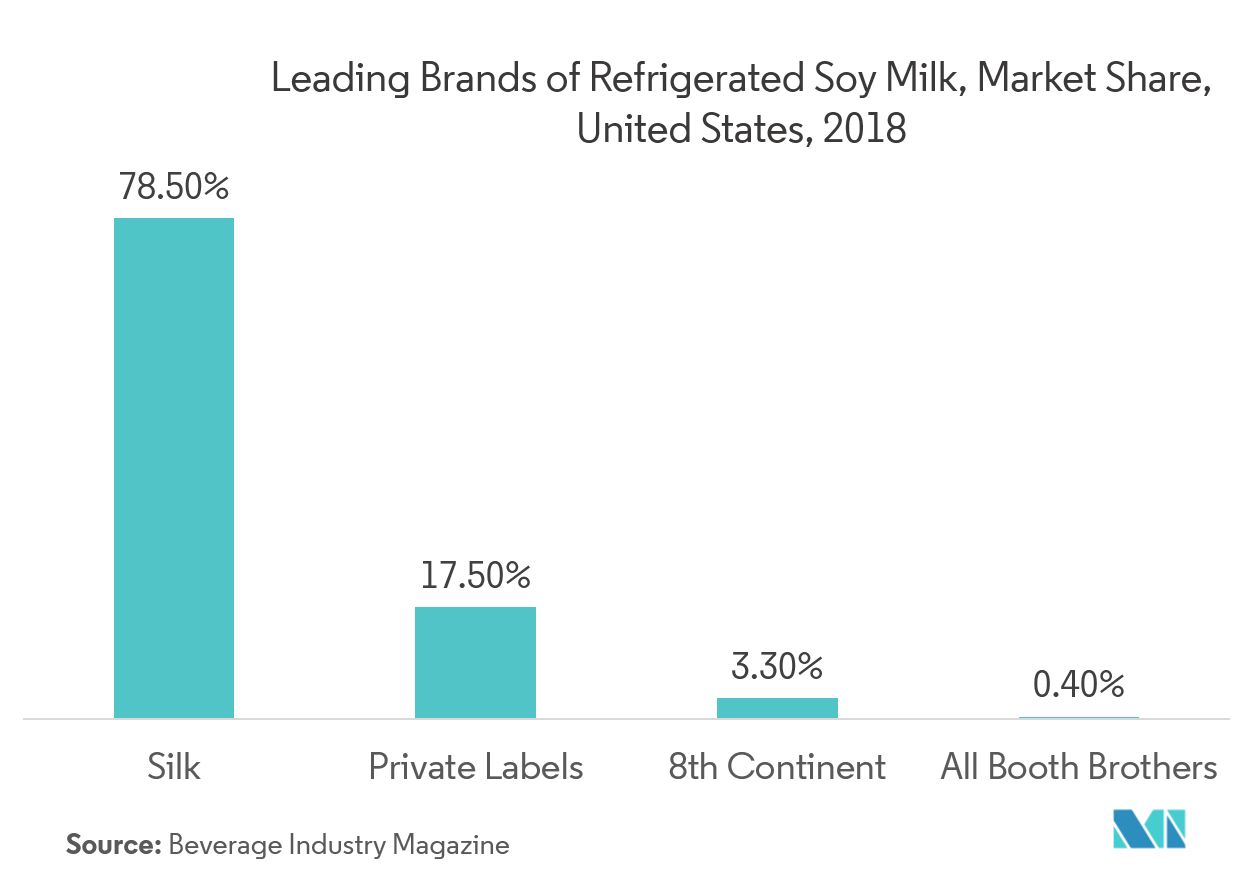

USA Soy Beverages Industry Overview

The United States soy beverages market is consolidated, owing to the number of giant players dominating the market. Some of the key players in the market are Danone and The Hain Celestial Group, Inc. Major players are embarking on market expansion and innovations in terms of online delivery as well as offering new varieties of soy beverages to achieve consolidation while optimizing their offerings respectively.

USA Soy Beverages Market Leaders

-

Danone S.A.

-

KIKKOMAN SALES USA, INC.

-

Hain Celestial

-

Eden Foods

-

Stremick's Heritage Foods

*Disclaimer: Major Players sorted in no particular order

USA Soy Beverages Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Soy Milk

- 5.1.2 Soy-Based Drinkable Yogurt

-

5.2 By Flavor

- 5.2.1 Plain Soy Beverages

- 5.2.2 Flavored Soy Beverages

-

5.3 By Distribution Channel

- 5.3.1 Supermarket/hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Pharmacies/Drug Stores

- 5.3.4 Online Stores

- 5.3.5 Others

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Key Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Danone S.A.

- 6.4.2 KIKKOMAN SALES USA, INC.

- 6.4.3 Hain Celestial

- 6.4.4 Eden Foods

- 6.4.5 PACIFIC FOODS OF OREGON, LLC.

- 6.4.6 Stremicks Heritage Foods

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityUSA Soy Beverages Industry Segmentation

United States soy beverage market is segmented by Product Type, flavor, and distribution channel. On the basis of product type, the market is segmented into Soy Milk and Soy-Based Drinkable Yogurt. On the basis of flavor, the market is segmented into Flavored and Plain/Unflavored. On the basis of distribution channel, the market is segmented into Supermarkets/Hypermarkets, Pharmacy, Retail Stores, Convenience Stores, online store, and Others.

| By Product Type | Soy Milk |

| Soy-Based Drinkable Yogurt | |

| By Flavor | Plain Soy Beverages |

| Flavored Soy Beverages | |

| By Distribution Channel | Supermarket/hypermarkets |

| Convenience Stores | |

| Pharmacies/Drug Stores | |

| Online Stores | |

| Others |

USA Soy Beverages Market Research FAQs

What is the current United States Soy Beverages Market size?

The United States Soy Beverages Market is projected to register a CAGR of 6.01% during the forecast period (2024-2029)

Who are the key players in United States Soy Beverages Market?

Danone S.A., KIKKOMAN SALES USA, INC., Hain Celestial, Eden Foods and Stremick's Heritage Foods are the major companies operating in the United States Soy Beverages Market.

What years does this United States Soy Beverages Market cover?

The report covers the United States Soy Beverages Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the United States Soy Beverages Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

US Soy Beverages Industry Report

Statistics for the 2024 US Soy Beverages market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Soy Beverages analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.