Unmanned Marine Vehicles Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 4.93 Billion |

| Market Size (2029) | USD 7.41 Billion |

| CAGR (2024 - 2029) | 8.51 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Unmanned Marine Vehicles Market Analysis

The Unmanned Marine Vehicles Market size is estimated at USD 4.93 billion in 2024, and is expected to reach USD 7.41 billion by 2029, growing at a CAGR of 8.51% during the forecast period (2024-2029).

With rapid technological development, acoustic sensors for high underwater navigation are on trend. The aim is to reduce the cost and latency of current underwater navigation systems that typically employ high accuracy.

- Oceanic surveillance is driving the market for defense purposes as unmanned marine vehicles offer greater capacity for surveillance, identification, and interception than traditional systems. They can be equipped with stabilized weapons systems, surveillance systems, and electro-optical tracking systems capable of monitoring day and night using infrared vision.

- In addition to operational cost reductions and platform design, improvements in sensors would reduce costs by reducing science payload power requirements and enable the usage of progressively smaller platforms. Improved sensors, platforms' interoperability, and interfaces would significantly reduce costs.

- The ideal sensor for future autonomous platforms would be cost-effective, interoperable, compact, web-enabled, and self-identifying. Cost-effective sensors may be suitable for the large-scale production of unmanned marine vehicles and could utilize features of modern electronics, such as positioning, communication, and miniaturization. Various sensor types, such as vision sensors, Light Detection and Ranging (LiDAR), infrared, sonar, and radar, are used on USVs to navigate while avoiding obstacles safely.

- Increased usage of unmanned marine vehicles for underwater mapping, particularly for marine geoscience studies, is expected to drive the market's growth. More emphasis in the future will be directed toward documenting the various stable states of Earth's systems, discovering what events trigger evolution from one stable state to another, and identifying the linkages between the states of very different systems like climate and tectonics activity, which will drive the need for unmanned marine vehicles.

- However, the high cost of UMVs and the associated maintenance issues may hinder the market in the short term. This challenge is expected to minimize its impact on the market in the long run as companies develop more advanced systems and gain more expertise in providing maintenance services.

- The COVID-19 pandemic has negatively impacted the overall marine industry, and crewless marine vehicles are no exception. Various preventive measures that various governments took across the world to contain the spread of the virus severely disrupted the supply chains across industries and hampered the manufacturing operations of several companies globally.

Unmanned Marine Vehicles Market Trends

This section covers the major market trends shaping the Unmanned Marine Vehicles Market according to our research experts:

The Defense Industry is Expected to Grow Significantly in the Market

- The Navy and Defense departments are increasingly investing in the use of unmanned surface vehicles (USVs) for various missions and applications. The autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are often designed to be deployed for intelligence, surveillance, and reconnaissance (ISR) operations, apart from being used for mine countermeasure (MCM) operations and anti-submarine warfare (ASW).

- The primary defense forces across the world are experiencing maritime security threats such as torpedo threats, underwater mines, diesel-electric submarine attacks, and short-range anti-ship missiles, which is driving the market by gearing more of its investments toward autonomous, robotic platforms that operate at sea and depths well below the surface.

- The robotic platforms are designed to accomplish specific tasks, such as identifying and neutralizing potential underwater threats. The successful completion of these missions depends on the peripheral subsystems, which provide location awareness, accurate positional information, and target guidance, such as positioning beacons and tracking systems.

- In December 2020, Turkey announced the launch of its first armed unmanned maritime vehicle (SIDA), which will be operated remotely using artificial intelligence systems. The vessel is expected to contribute to the country's defense network, especially in the troubled waters of the eastern Mediterranean, where Turkey's sovereignty rights have come under threat from countries like Greece and France.

- Moreover, in March 2021, the Navy and the Marine Corps published the Unmanned Campaign Framework to guide their investments in and integration of unmanned platforms in the United States. Further, increasing investments in strengthening the navy and the country's defense systems shall aid in developing the demand for unmanned marine vehicles for defense purposes.

- Various companies are making efforts to get unmanned marine vehicle contracts from the defense industry. This is also resulting in the growth and development of the market. In August 2022, Leidos was announced to have been selected by the U.S. Naval Sea Systems Command (NAVSEA) for designing and building a medium-size unmanned undersea vehicle. The cost-plus-fixed-fee contract holds an approximate value of USD 358 million.

Europe is Expected to Witness Significant Growth Rate

- Europe is gaining market growth due to the defense and commercial sector demand. The ASV marine system is a rapidly growing United Kingdom Industry. The United Kingdom's Maritime Autonomy Surface Testbed (MAST), which is an unmanned surface vessel (USV) inspired by the innovative BLADERUNNER hull shape, has already undergone trials in the Tidal Thames. With the help of research funding from the Defense Science and Technology Laboratory (Dstl), MAST was developed by Portchester-based ASV Ltd to provide a testbed to host multiple new technologies.

- Also, in May 2021, the German Federal Ministry for Economic Affairs and Energy announced facilitating EUR 12.0 million for the Maritime Research Program to develop a novel autonomous submersible robotics system. The technology is expected to enable autonomous monitoring of underwater installations in the deep sea with a significant carbon footprint reduction without costly support vessels. The funding decision was announced to the project's nine participants in the CIAM (Cooperative Development of a Comprehensive Integrated Autonomous Underwater Monitoring Solution).

- The NATO Centre for Maritime Research and Experimentation, located in La Spezia, Italy, has invested steadily to advance the technology of UUVs for military applications like MCM and antisubmarine warfare (ASW). CMRE is currently investing in helping warfighters get a clearer picture of what lies in the depths below, with the help of the fleet of unmanned vehicles that can communicate and cooperate with each other.

- In the case of the maritime environment, as the prime focus of combat has evolved from ocean to coastal areas, it is getting difficult for the existing naval forces to operate in shallow waters effectively. Therefore, unmanned underwater vehicles (UUVs) are being required by European nations such as France at an increasing pace.

- Along with industry and international partners, the Royal Navy has created an opportunity for engineers and scientists to demonstrate the technology during the Unmanned Warrior Event and explore the ideas to implement in the future of naval warfare. It is linked with the regular Joint Warrior Fleet Exercise and aims to test systems in an operational environment.

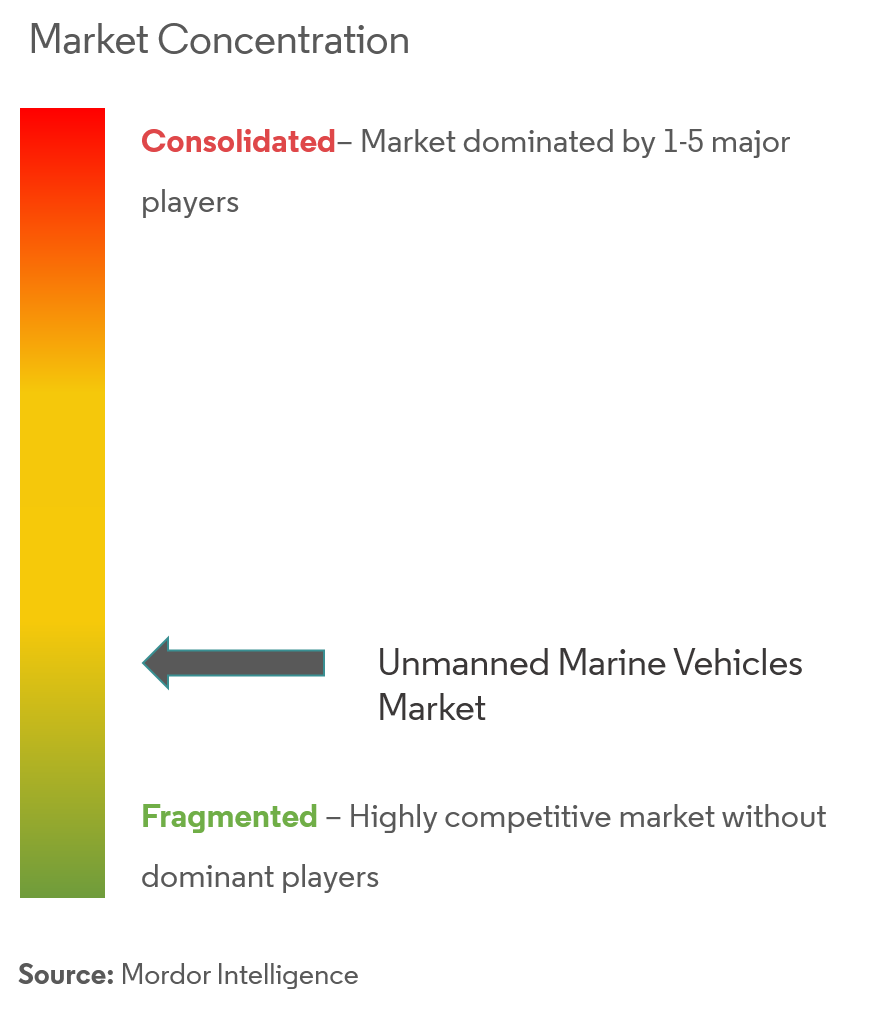

Unmanned Marine Vehicles Industry Overview

The unmanned marine vehicles market is fragmented due to the presence of several well-established players. These players incorporate strategic initiatives such as acquisitions, partnerships, expansions, and product/technology launches to maintain their positions and gain a competitive advantage in this market. Key players in the market are General Dynamics, Atlas Elektronik, Sea Robotics Inc., etc. Recent developments in the market are -

- November 2021 - SeaRobotics Corporation announced the SR-Utility 3.0, next-generation Utility Class ASV. The latest addition to the SRC portfolio is intended to broaden the scope and versatility of unmanned coastal marine survey activities by providing professional surveyors with a configurable platform that supports interchangeable payloads and sensors and incorporates existing instrumentation.

- March 2021 - General Dynamics Mission Systems delivered the Knifefish surface mine countermeasure unmanned underwater vehicle system under a contract awarded by the Navy on August 26, 2019. The contract, which was awarded immediately following a successful Milestone C decision and approval to enter low-rate initial production (LRIP), calls for the purchase of five Knifefish systems (10 total UUVs) and support equipment.

Unmanned Marine Vehicles Market Leaders

-

General Dynamics

-

Atlas Elektronik

-

Sea Robotics Inc.

-

Liquid Robotics

-

Rafael Advanced Defense Systems

*Disclaimer: Major Players sorted in no particular order

Unmanned Marine Vehicles Market News

- August 2022 - Austal USA announced to partner with California-based Saildrone for building Saildrone Surveyor autonomous 'uncrewed' surface vehicle in Alabama. The partnership aims to provide a cutting-edge solution for maritime domain awareness, hydrographic survey, and other missions requiring persistent wide area coverage to the U.S. Navy and other government agency customers.

- November 2021 - Teledyne Marine partnered with Seatronics to increase the distribution of Bowtech underwater cameras, lights, and underwater strobes range in Europe, the Americas, and the Asia-Pacific. The partnership also strengthened the company's after-sale care globally, using its regional service centers in the United Kingdom, Singapore, and the United States.

- July 2021 - Textron Systems announced that it had pre-awarded the United States Marine Corps Advanced Reconnaissance Vehicle (ARV) prototype agreement for its purpose-built CottonmouthTM vehicle. The company may be producing a Cottonmouth vehicle for the Marine Corps that may go through rigorous testing and evaluation. The data gained from the ARV competitive prototyping efforts may be used to inform a USMC decision point in 2023.

- March 2021 - BAE Systems announced its unmanned undersea vehicle (UUV) portfolio, the Riptide UUV-12. The Riptide UUV-12 is easily adaptable to many mission requirements, including those requiring more significant and power-hungry payloads.

Unmanned Marine Vehicles Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Oceanic Surveillance for Defense Purposes

- 5.1.2 Increased Usage of Unmanned Marine Vehicles for Underwater Mapping for Marine Geoscience Studies

-

5.2 Market Restraints

- 5.2.1 High Cost for the Equipment and Maintenance Issues

6. TECHNOLOGICAL OVERVIEW

7. MARKET SEGMENTATION

-

7.1 Type

- 7.1.1 Surface Vehicle

- 7.1.2 Underwater Vehicle

-

7.2 Control Type

- 7.2.1 Remotely Operated

- 7.2.2 Autonomous

-

7.3 Application

- 7.3.1 Defense

- 7.3.2 Research

- 7.3.3 Commercial

- 7.3.4 Other Applications

-

7.4 Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.2 Europe

- 7.4.2.1 Germany

- 7.4.2.2 Italy

- 7.4.2.3 France

- 7.4.2.4 Rest of Europe

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 Japan

- 7.4.3.3 India

- 7.4.3.4 Australia

- 7.4.3.5 Rest of Asia-Pacific

- 7.4.4 Latin America

- 7.4.4.1 Brazil

- 7.4.4.2 Rest of Latin America

- 7.4.5 Middle-East and Africa

- 7.4.5.1 South Africa

- 7.4.5.2 Rest of Middle-East and Africa

8. COMPETITIVE LANDSCAPE

-

8.1 Company Profiles*

- 8.1.1 General Dynamics

- 8.1.2 Atlas Elektronik

- 8.1.3 Sea Robotics Inc.

- 8.1.4 Liquid Robotics

- 8.1.5 Rafael Advanced Defense Systems

- 8.1.6 BAE Systems

- 8.1.7 Ocean Aero Inc.

- 8.1.8 Pelorus Naval Systems

- 8.1.9 Thales Group

- 8.1.10 ECA Group

- 8.1.11 Textron Inc.

- 8.1.12 Teledyne Technologies Inc.

- 8.1.13 Northrop Grumman

- 8.1.14 ASV Global

9. INVESTMENT ANALYSIS

10. FUTURE OF THE MARKET

** Subject To AvailablityUnmanned Marine Vehicles Industry Segmentation

The unmanned marine vehicles market includes autonomous underwater vehicles, remotely operated vehicles, semi-submersibles, and unmanned surface craft. The defense sector is increasingly adopting, in addition to commercial sectors, to map and monitor the conditions of the sea or ocean and explore various oil and gas sites.

The study covers unmanned marine vehicles that include surface vehicles and underwater vehicles. Unmanned vehicles that operate completely on the surface are part of surface vehicles (USV). Subsurface and underwater vehicles are part of the underwater vehicle segment (UUV). Further, the study covers the applications of unmanned marine vehicles that include defense, commercial, and research.

| Type | Surface Vehicle | |

| Underwater Vehicle | ||

| Control Type | Remotely Operated | |

| Autonomous | ||

| Application | Defense | |

| Research | ||

| Commercial | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| Italy | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Rest of Latin America | ||

| Geography | Middle-East and Africa | South Africa |

| Rest of Middle-East and Africa |

Unmanned Marine Vehicles Market Research FAQs

How big is the Unmanned Marine Vehicles Market?

The Unmanned Marine Vehicles Market size is expected to reach USD 4.93 billion in 2024 and grow at a CAGR of 8.51% to reach USD 7.41 billion by 2029.

What is the current Unmanned Marine Vehicles Market size?

In 2024, the Unmanned Marine Vehicles Market size is expected to reach USD 4.93 billion.

Who are the key players in Unmanned Marine Vehicles Market?

General Dynamics, Atlas Elektronik, Sea Robotics Inc., Liquid Robotics and Rafael Advanced Defense Systems are the major companies operating in the Unmanned Marine Vehicles Market.

Which is the fastest growing region in Unmanned Marine Vehicles Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Unmanned Marine Vehicles Market?

In 2024, the North America accounts for the largest market share in Unmanned Marine Vehicles Market.

What years does this Unmanned Marine Vehicles Market cover, and what was the market size in 2023?

In 2023, the Unmanned Marine Vehicles Market size was estimated at USD 4.54 billion. The report covers the Unmanned Marine Vehicles Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Unmanned Marine Vehicles Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Unmanned Marine Vehicles Industry Report

The Armored Unmanned Underwater Vehicle Market analysis, segmented by type, control type, application, and geography, provides a comprehensive overview of the industry trends and market forecast. The industry analysis indicates significant growth rate and market growth in the coming years. The market report highlights the market leaders and their contributions to the market value.

The industry outlook and market outlook suggest a positive trend, supported by detailed market segmentation and market data. The market research includes insights into market size, market share, and market analysis. The report pdf offers a sample of the industry research and industry statistics, essential for understanding the market trends and market review.

The market forecast and market predictions are based on extensive industry information and industry research. The industry reports provide a historical overview and future market forecast, essential for market leaders and research companies. The industry sales and market value are expected to rise, driven by advancements in unmanned marine vehicles.

For a detailed market overview and industry size, the report example in the industry reports offers valuable insights. The market segmentation and market data are crucial for understanding the market dynamics and industry trends. The market review and market growth highlight the key factors influencing the market outlook and market predictions.

This comprehensive industry analysis and market forecast provide a clear picture of the market trends and industry outlook. The report pdf is a valuable resource for understanding the market segmentation, market value, and market data, essential for making informed business decisions.