USA Aftermarket Automotive Parts & Components Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 2.00 % |

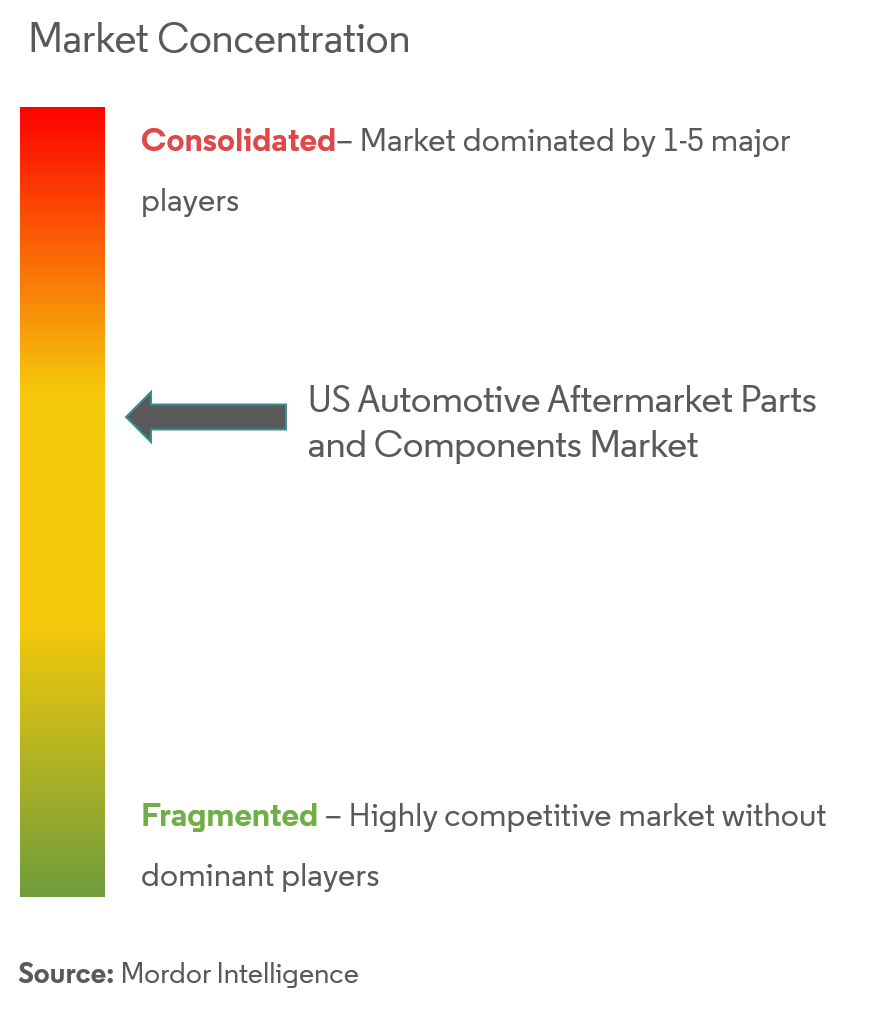

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

USA Aftermarket Automotive Parts & Components Market Analysis

Currently, the United States Aftermarket Automotive Parts and Components market is valued at USD 17.5 billion. It is expected to reach USD 20 billion in the next five years, registering a CAGR of around 2% during the forecast period.

The impact of the COVID-19 pandemic on the US aftermarket automotive market was severe, and this can be attributed to several productions halts in the manufacturing industry due to lockdowns and travel restrictions imposed by governments across the world. The supply chain of the entire automotive industry is disrupted, impacting the production of automotive parts and components in the market.

However, the market is expected to have steady growth as demand for auto parts manufacturing is directly related to the performance of automakers, as they are the largest purchasers of industry products. The advantages of original replacement parts are one of the primary factors driving the growth of the automotive parts aftermarket in the US. The increasing availability of automotive parts on e-commerce platforms is one of the major aftermarket trends in the United States.

The emergence of 3D printing in the automotive aftermarket industry and the growing demand for hybrid and all-electric vehicles are likely to further boost the market growth during the forecast period. Furthermore, the rise in the sales of used cars is likely to create numerous opportunities for the key players operating in the US aftermarket automotive parts and components market.

USA Aftermarket Automotive Parts & Components Market Trends

This section covers the major market trends shaping the US Aftermarket Automotive Parts & Components Market according to our research experts:

Rising Online Aftermarket Automotive Parts and Components Sales

The US aftermarket automotive parts and components market is projected to have optimistic growth due to increased online activities by people. Advancement in technology, coupled with rapid improvement in logistics, has allowed manufacturers to offer high-quality goods faster and further boosts the growth of the market. E-commerce activities grow at a higher rate than the forecast rate due to the ongoing pandemic.

Despite the global COVID-19 pandemic, the automotive aftermarket once again demonstrated its resilience in 2020 with a greater-than-anticipated performance. The industry rebounded strongly in 2021. It is estimated that the overall light-duty vehicle aftermarket sales in the United States will rise around 11.2% to USD 325 billion in 2021. In general, the growth rate of online parts sales has historically been about 16% per year, but in 2021, due to the coronavirus pandemic, e-Commerce activities surged to a 30% increase. This includes replacement parts, aftermarket parts, and accessories. Thus, this pandemic has created lucrative opportunities for the major players in the market during the forecast period.

Automotive parts and components online shopping is growing. As automotive technology is changing, more hybrids and electric vehicles are entering the market, boosting the growth of the US aftermarket automotive parts and components market. In addition, mobile shopping is on the rise, and online platforms like Amazon and eBay are likely to influence the US online aftermarket automotive parts and components market.

Increasing Electric Vehicle Sales Likely to Impact Market

The market for electric vehicles is increasing year on year, impacting the growth of the automotive industry. The annual sales of plug-in electric vehicles in the United States crossed 172.1 thousand units in 2021, indicating the high demand for parts and components to cater to the needs of this market. In addition, the United States is the largest manufacturer of plug-in hybrid vehicles in the North American region. The country is also the largest market for these vehicles, with manufacturers such as Cadillac, GMC, Tesla, and Chrysler, leading the market.

With the automobile industry's continuous shift towards e-mobility, the sale of plug-in electric vehicles has been increasing in the United States for the past few years. While conventional powertrain vehicles have more than 2,000 components within them, electric vehicles have far fewer. For instance, Tesla revealed that in its drivetrain, there are only 17 moving parts, including two in the motor. Since the drivetrain is the heart of any electric vehicle, it is expected that automotive component manufacturers will first start with their associated part manufacturing. Also, it is estimated that out of the 590,000 U.S. employees engaged in auto parts manufacturing, nearly 150,000 are in component manufacturing for Internal Combustion Engines (ICE).

This number is expected to change over the forecast period as companies will dedicate some of them toward EV parts and component production. Power Inverters, DC-DC Converters, Battery & related parts, and Motor Control Units (MCU) are some of the other important parts that will also be manufactured by companies over time to stay relevant in the market. The adoption of EV-related spare parts will be slow in the after-market space initially, but with the industry seeing a paradigm shift, the rate is expected to grow considerably after some years.

USA Aftermarket Automotive Parts & Components Industry Overview

The US aftermarket automotive parts and components market is neither consolidated nor fragmented due to the presence of major tier-1 and tier-2 component manufacturers and a large number of unorganized players in the market. Companies are focusing on marketing their products and tying up with local dealers to garner more market share. Some of the major players in the market include Magna International Inc., Continental AG, ZF Friedrichshafen AG, DENSO Corporation, and Lear Corporation. Players are partnering with other key players to gain market share. For instance, in March 2022, Meritor, Inc. announced a collaboration agreement with ConMet under which Meritor will develop custom trailer suspensions and brakes, as well as tire inflation systems, to work with ConMet's PreSet Plus eHub to enable the production of zero-emissions refrigerated trailers. Meritor is redesigning its trailer suspension and drum brake, as well as a specially engineered spindle package to be compatible with ConMet's eHub, to deliver this electrified trailer solution. The companies will also continue to evaluate the application of complementary advanced technologies that address evolving e-mobility market trends in collaboration.

USA Aftermarket Automotive Parts & Components Market Leaders

-

Magna International Inc.

-

Continental AG

-

ZF Friedrichshafen AG

-

DENSO Corporation

-

Lear Corporation

*Disclaimer: Major Players sorted in no particular order

USA Aftermarket Automotive Parts & Components Market News

- December 2022: BorgWarner Inc announced plans to spin off their Fuel Systems and Aftermarket businesses into a separate, publicly traded company, which they are currently calling "NewCo." NewCo also intends to capitalize on growth trends in gasoline direct injection (GDI) and hydrogen injection systems. With this announcement, BorgWarner believes it will eventually meet or exceed its stated target of 25% revenue from EVs by 2025.

- August 2022: Cummins Inc. announced the completion of its acquisition of Meritor, Inc. Cummins would be positioned as a leading provider of integrated powertrain solutions across internal combustion and electric power applications with the integration of Meritor's products and capabilities in the axle and brake technology. Cummins plans to provide market-leading ePowertrain solutions to global customers by accelerating Meritor's electrification investment and integrating development into its New Power business. Cummins intends to use its new global footprint to accelerate the growth of its core axle and brake businesses by serving customers in commercial trucks, trailers, off-highway, defense, specialty, and aftermarket.

- June 2022: Meritor, Inc. launched the ProTec Independent Front Suspension (IFS) for motorcoach applications. Meritor's first suspension specifically designed for the ride quality and heavy load requirements of motorcoaches is the new IFS MIS-20E. This product is Meritor's first fully integrated suspension and steering system designed to be a drop-in replacement for bus and coach manufacturers. It is based on field-proven technology. The ProTec IFS has a GAWR of up to 20,000 pounds and twin-tube performance dampers for control and comfort while providing excellent overall tire life.

USA Aftermarket Automotive Parts & Components Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in USD Billion)

-

5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

-

5.2 Application

- 5.2.1 Engine Components

- 5.2.2 Transmission

- 5.2.3 Interior

- 5.2.4 Exterior

- 5.2.5 Other Applications

-

5.3 Sales Channel

- 5.3.1 Online

- 5.3.2 Offline

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles *

- 6.2.1 Magna International Inc.

- 6.2.2 Continental AG

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 Lear Corporation

- 6.2.7 Flex-N-Gate Corporation

- 6.2.8 Panasonic Automotive Systems Company of America

- 6.2.9 Aisin World Corp. of America

- 6.2.10 American Axle & Manufacturing Holdings Inc.

- 6.2.11 Yazaki North America Inc.

- 6.2.12 Adient PLC

- 6.2.13 Faurecia

- 6.2.14 Aptiv PLC

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityUSA Aftermarket Automotive Parts & Components Industry Segmentation

The automotive aftermarket is the automotive industry's secondary market, dealing with the manufacturing, remanufacturing, distribution, retailing, and assembly of all vehicle parts, chemicals, equipment, and accessories following the sale of the automobile to the consumer by the original equipment manufacturer (OEM). The OEM may or may not manufacture the parts, accessories, and so on for sale.

The United States Aftermarket Automotive Parts & Components Market has been segmented based on Vehicle Type (Passenger Vehicles and Commercial Vehicles), Application (Engine Components, Transmission, Interior, Exterior, and Other Applications), and Sales Channel (Online and Offline). The report offers market size and forecasts for the United States aftermarket automotive parts and components market in value (USD billion) for all the above segments.

| Vehicle Type | Passenger Cars |

| Commercial Vehicles | |

| Application | Engine Components |

| Transmission | |

| Interior | |

| Exterior | |

| Other Applications | |

| Sales Channel | Online |

| Offline |

USA Aftermarket Automotive Parts & Components Market Research FAQs

What is the current United States Aftermarket Automotive Parts & Components Market size?

The United States Aftermarket Automotive Parts & Components Market is projected to register a CAGR of 2% during the forecast period (2024-2029)

Who are the key players in United States Aftermarket Automotive Parts & Components Market?

Magna International Inc., Continental AG, ZF Friedrichshafen AG, DENSO Corporation and Lear Corporation are the major companies operating in the United States Aftermarket Automotive Parts & Components Market.

What years does this United States Aftermarket Automotive Parts & Components Market cover?

The report covers the United States Aftermarket Automotive Parts & Components Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the United States Aftermarket Automotive Parts & Components Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the major challenges faced by the US Aftermarket Automotive Parts Market?

Major challenges faced by the United States Aftermarket Automotive Parts Market are a) Stringent regulations b) Increasing complexity of automotive parts c) Competition from OEM parts suppliers

What are the key factors driving the growth of US Aftermarket Automotive Parts Market?

Key factors driving the U.S. Aftermarket Automotive Market are a) Increasing average age of vehicles b) Technological advancements in automotive parts c) Rising preference for vehicle maintenance d) Growing demand for vehicle customizations

USA After Automotive Parts & Components Industry Report

The U.S. automotive aftermarket is on a significant growth path, fueled by the increasing demand for vehicle maintenance, parts replacement, and the stringent emission norms set by the government. This sector is witnessing a revolution through digitization, enhancing the way car owners access repair services and order parts online, thus driving the automotive aftermarket market share upwards. Innovations and the adoption of e-commerce strategies are pivotal, catering to the needs of installers and optimizing operations. The market's expansion is also propelled by the rising popularity of electric and hybrid vehicles, alongside the growing online sales of automotive components. As the industry trends towards internationalization and consolidation, suppliers and distributors are scaling operations to stay competitive. For detailed insights, including the market share, size, revenue growth rate, and a forecast outlook of the USA After Automotive Parts & Components, download a free report PDF from Mordor Intelligence™ Industry Reports, offering a comprehensive analysis and historical overview of this dynamic sector.