US Hazardous Goods Logistics Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2020 - 2022 |

| CAGR | 6.53 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

US Hazardous Goods Logistics Market Analysis

The United States hazardous goods logistics market is estimated to witness a steady growth over the forecast period, due to the presence of robust infrastructure and growing oil trade in the United States. The presence of industry leaders in the US hazardous goods logistics market provided a thrustto the market movement. Pipeline accounts for a large amount of transportation of hazardous goods in the United States.

- The oil industry in the United States has recently saw an increase in capacity.The US oil production is expected to increase by 1.3 million barrels a day in 2019.

- Texas, California, and Florida are among the major states accounting for the highest hazardous goods shipments by any mode.

US Hazardous Goods Logistics Market Trends

This section covers the major market trends shaping the US Hazardous Goods Logistics Market according to our research experts:

The US Oil Industry Growth

The shale oil boom in the United States is a result of an unparalleled growth in recent years, owing to the development of hydraulic fracturing and an administration that has promoted a more conducive environment for fossil fuel development. The United States is currently the largest international crude oil producer, with output estimated to exceed 12 million barrels per day in 2019 and reach 12.9 million by 2020.

With the deregulation of environment protection laws and softening of different laws restricting the access to sensitive ecosystems and relating to the emissions, the oil and gas industry has flourished, additionally, offshore drilling has also grown in the United States.

The United States already ships out more natural gas than it imports. Next year, gas production are expected to grow by another 8% to a new all-time high at 90.2 billion cubic feet per day. With the United States increasing its oil and gas exports internationally, the market is expected to observe upward growth.

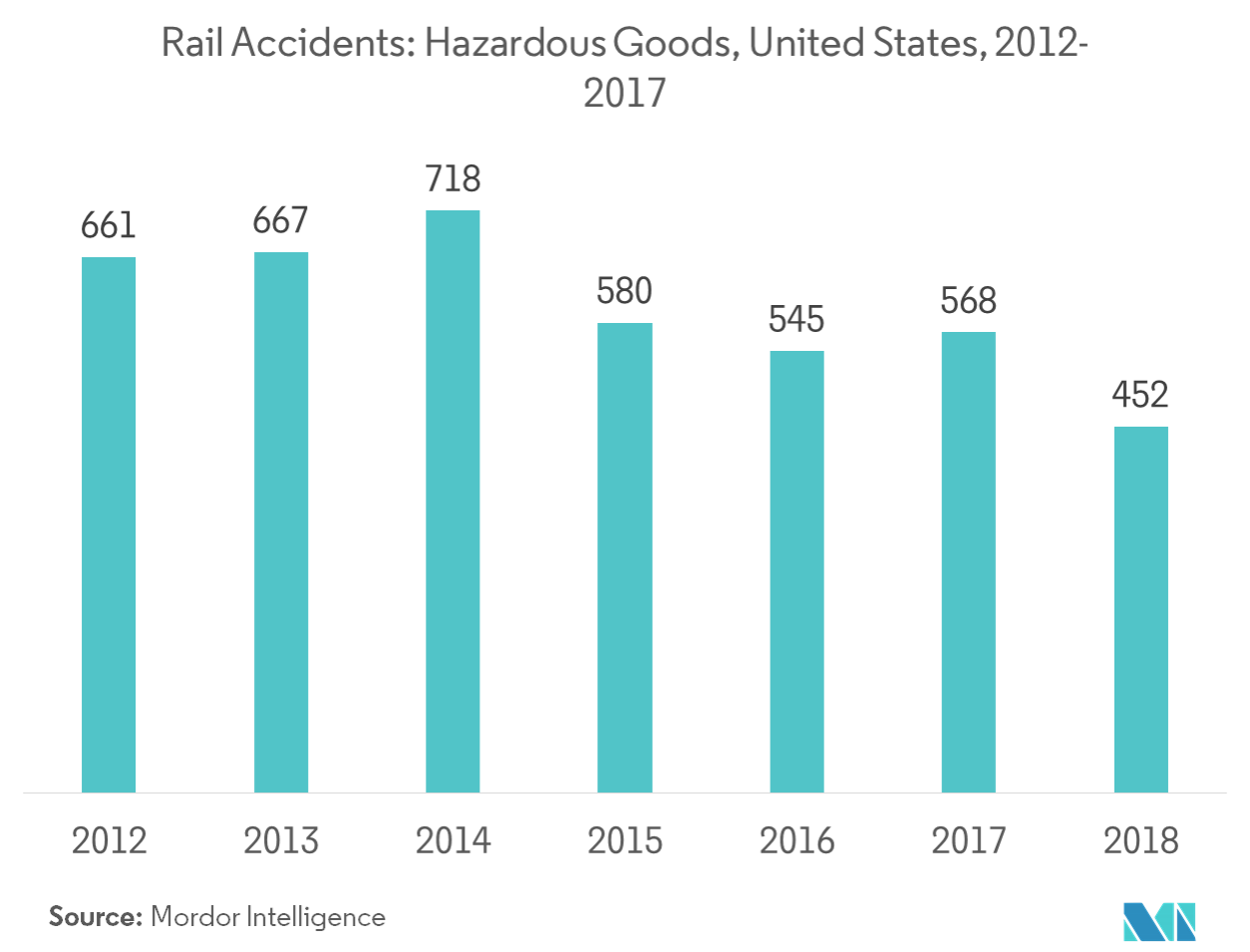

Rail is Regarded as the Safest Mode of Transport for Hazardous Goods

In 2017, more than 99.9% of rail hazardous material shipments reached the destination without a release caused by a train accident. Thus, railroads are much safer for moving hazmat compared to trucks. Additionally, railroads have approximately 10% of the hazmat accidents compared to trucks, despite roughly equal hazmat ton-mileage. Less than 1% of all derailments in 2017 accounted for cars transporting crude oil and the accident rate for rail hazardous goods transportation has dropped by 41%, since 2008.

Increasing investment in the rail network has been a significant influence on the rail network getting safer. Record levels of spending of more than USD 25 billion annually, help freight railroads make the rail network even safer. The US rail is the most capital-intensive industry, this helps the industry to achieve the safest era, with the train accident rate down by 23%, since 2008.

Implementing innovative technologies to continuously inspect track, bridges, equipment, and components may help in identifying issues and scheduling maintenance before accidents occur.

Such technologies include the use of drones to investigate inaccessible areas, ultrasound technology to detect flaws within the track, and specialized monitors mounted along the route, which identify faulty or worn railcar components as train passes.

US Hazardous Goods Logistics Industry Overview

The US hazardous goods logistics market consists of local and international players. The market is slightly fragmented, as a large number of players are operating in the market. Deutsche Post DHL Group, FedEx Corporation, XPO Logistics, and Kuehne + Nagel are among the major players in the US hazardous goods logistics market. As the market is slightly fragmented with top 10-15 players accounting for a third of the total market share, the market may move toward strategic mergers and acquisitions to gain leverage. The growth of oil and gas transportation in the United States is also expected to further boost partnerships among logistics and oil and gas producers.

US Hazardous Goods Logistics Market Leaders

-

Deutsche Post DHL Group

-

FedEx Corporation

-

XPO Logistics

-

Kuehne + Nagel

-

DB Schenker (The Americas)

*Disclaimer: Major Players sorted in no particular order

US Hazardous Goods Logistics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Brief on Dangerous Goods Classes

- 4.3 Review and Commentary on Goods Transport Regulations and Standards (Hazardous Materials Transportation Act (HMTA), International Air Transport Association Dangerous Goods Regulations (IATA DGR), etc.)

- 4.4 Focus on Key Stakeholders in Supply Chain (Freight Forwarders, Ground Handling Agents, Carriers, Advisers and Consultants, etc.)

- 4.5 Key Information - Documentation, Special Permissions, and Safety Checklists

- 4.6 Spotlight - Equipment and Accessories Associated with Transport of Dangerous Goods (Air, Sea, and Road)

- 4.7 Potential Risk Involved in Shipment of Hazardous Materials

- 4.8 Insights on Packaging

- 4.9 Technology Snapshot (Digitalization and Process Optimization and Management Software, e-Dangerous Goods Declaration (eDGD), etc.), Transport and Storage, and Equipment Manufacturing

5. MARKET DYNAMICS (DRIVERS, RESTRAINTS, AND OPPORTUNITIES)

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Porter's Five Forces Analysis

- 5.5 Industry Value Chain Analysis

6. MARKET SEGMENTATION

-

6.1 BY FUNCTION

- 6.1.1 Transportation

- 6.1.1.1 Road

- 6.1.1.2 Rail

- 6.1.1.3 Water

- 6.1.1.4 Pipeline

- 6.1.1.5 Air

- 6.1.2 Warehousing and Distribution

- 6.1.3 Value-added Services (Packaging, Customs Clearance, Freight Brokerage, and Other Services)

-

6.2 BY DESTINATION

- 6.2.1 Domestic

- 6.2.2 International

7. COMPETITIVE LANDSCAPE

- 7.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 7.2 Market Concentration Overview

- 7.3 Strategies Adopted by Major Players

8. COMPANY PROFILES (OVERVIEW, FINANCIALS**, PRODUCTS AND SERVICES, RECENT DEVELOPMENTS, AND ANALYST VIEW)

-

8.1 Company Profiles

- 8.1.1 Deutsche Post DHL Group

- 8.1.2 FedEx Corporation

- 8.1.3 XPO Logistics

- 8.1.4 Kuehne + Nagel

- 8.1.5 DB Schenker (The Americas)

- 8.1.6 DSV

- 8.1.7 United Parcel Service Inc.

- 8.1.8 Schneider Logistics

- 8.1.9 GEODIS

- 8.1.10 APL Logistics

- 8.1.11 Landstar System Inc.*

- *List Not Exhaustive

9. APPENDIX

- 9.1 US Freight Transportation Statistics

- 9.2 Macroeconomic Statistics

- 9.3 Transportation and Storage Sector Contribution to GDP

- 9.4 Insights on Capital Flows

US Hazardous Goods Logistics Industry Segmentation

The US hazardous goods logistics market is segmented by function and destination. The report also covers insights on the different classes of dangerous goods, regulations and rules governing transportation of hazardous goods, technology involved, and packaging of hazardous goods, among others.

| BY FUNCTION | Transportation | Road |

| Rail | ||

| Water | ||

| Pipeline | ||

| Air | ||

| BY FUNCTION | Warehousing and Distribution | |

| Value-added Services (Packaging, Customs Clearance, Freight Brokerage, and Other Services) | ||

| BY DESTINATION | Domestic | |

| International |

US Hazardous Goods Logistics Market Research FAQs

What is the current US Hazardous Goods Logistics Market size?

The US Hazardous Goods Logistics Market is projected to register a CAGR of 6.53% during the forecast period (2024-2029)

Who are the key players in US Hazardous Goods Logistics Market?

Deutsche Post DHL Group, FedEx Corporation, XPO Logistics, Kuehne + Nagel and DB Schenker (The Americas) are the major companies operating in the US Hazardous Goods Logistics Market.

What years does this US Hazardous Goods Logistics Market cover?

The report covers the US Hazardous Goods Logistics Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the US Hazardous Goods Logistics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

US Hazardous Goods Logistics Industry Report

Statistics for the 2024 US Hazardous Goods Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. US Hazardous Goods Logistics analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.