Vietnam Agricultural Tractor Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 623.83 Million |

| Market Size (2029) | USD 798.46 Million |

| CAGR (2024 - 2029) | 5.06 % |

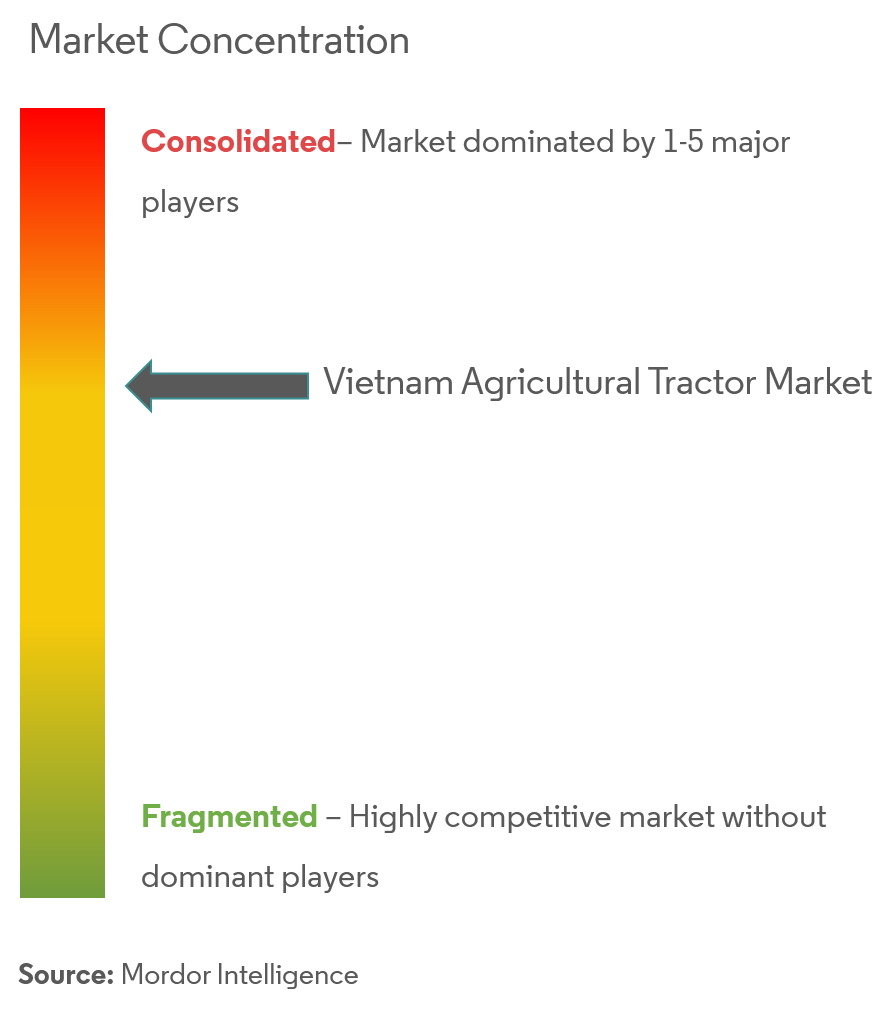

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Vietnam Agricultural Tractor Market Analysis

The Vietnam Agricultural Tractor Market size is estimated at USD 623.83 million in 2024, and is expected to reach USD 798.46 million by 2029, growing at a CAGR of 5.06% during the forecast period (2024-2029).

- More than 70% of the cultivated area in Vietnam is mechanized. The rapid adoption of mechanization in the agriculture industry is driving the market growth. Agricultural machinery has played a crucial role in increasing agricultural productivity and efficiency in Vietnam. With the increasing shortage of laborers in rural areas, farmers have turned to mechanization to overcome this challenge and improve their yields. The increasing shortage of laborers in rural areas of Vietnam has been a driving force behind the growth of the agricultural machinery market. Farmers can improve productivity and efficiency, reduce production costs, and increase their yields by adopting agricultural machinery.

- The government initiatives to promote the mechanization of farms to increase the cost and time efficiency of crop production are one of the major drivers of the market. The agriculture sector of Vietnam has witnessed a substantial decline in the use of animal and human power in the agriculture sector. About 53% of agricultural tractors in the country have a capacity of less than 12 HP, and 35% have 12 to 35 HP, while 12% have a capacity of more than 35 HP.

- Tractors in the country are mainly used in mechanized land preparation for crop production of rice, corn, and sugarcane. In the Mekong Delta of Vietnam, wetland rice is the most important crop. The increasing farm mechanization rates, rising costs of farm labor, and shorter replacement cycles of tractors are the major factors attributing to the growth of tractor sales.

Vietnam Agricultural Tractor Market Trends

Shortage of Agricultural Labor

- In Vietnam, people prefer industrial jobs over agriculture, as agricultural production is declining. This situation is leading to a shortage of agricultural labor in Vietnam during the farming season. With the decline in family farm workers, farmers have been hiring labor. But since the labor supply is low, wages have crept up, increasing the cost of farming, so this is another factor shifting farmers towards mechanization.

- The Vietnamese market is facing challenges due to an overproduction of low-quality products and increased competition for exporting these products. As a result, prices for crops have decreased, which is negatively impacting farmers who are struggling to cover their labor costs and see a return on their investments.

- There is a continuous decline in the labor force that depends on agriculture in Vietnam. By considering these factors, the government is promoting the mechanization of farms with an aim to rank among the world's top 15 most developed agricultural countries and become a global hub for agricultural logistics and processing. Thus, the shortage of agricultural labor is acting as a primary driver for the growth of the tractor market, as the laborers' efforts can be replaced with tractors.

Less than 35 HP Dominates the Market in terms of Revenue

- Farm mechanization is increasing due to a need for more farm laborers in Vietnam. Farmers prefer small and customized tractors for agricultural purposes due to small farmland sizes. Additionally, lesser fuel consumption by small tractors helps to empower small and marginal farmers. In this segment, consumer bargaining power is high compared to high-powered tractors due to the availability of a wide range of options and substitutes.

- Tractors with less than 35 HP are compact with a mass of fewer than 3,500 lbs and use less than 35 PTO HP to run the attachments and serve multiple functions, including mowing, landscaping and gardening, horticultural practices, animal management, and other activities because of their compact size and ability to carry different cultivation practices due to this the farmers mostly prefer compact tractors.

- Crop production in Vietnam is carried out easily with the help of tractors having less than 35 HP. Crop production volume increased in 2021, depicting the country's demand for tractors. According to Food and Agriculture Organization (FAO), the total production volume of the crop was 108 million metric tons in the year 2021. Less than 35 HP tractors occupy less space and can be used flexibly. The ease of customization makes the farmers more amenable to experimentation, and consequentially. Therefore, manufacturers are willing to try new components and technologies in this segment before moving on to high-powered ones. Hence, these factors lead the less than 35 hp tractors to hold the major market share in the country.

Vietnam Agricultural Tractor Industry Overview

The Vietnamese agricultural tractor market is consolidated with the presence of global players in the country. Kubota, CLAAS, Yanmar, CNH Industrial, and VEAM are some of the major players operating in the industry. These companies are expanding their business activities by focusing on new product launches, partnerships, and investments. However, more than 70% of the tractors in Vietnam are imported for domestic use in agriculture.

Vietnam Agricultural Tractor Market Leaders

-

CLAAS KGaA mbH

-

Vietnam Engine and Agricultural Machinery Corporation

-

Yanmar America Corporation

-

Kubota Tractor Corporation

-

CNH Industrial

*Disclaimer: Major Players sorted in no particular order

Vietnam Agricultural Tractor Market News

- January 2023: New Holland revealed a prototype T7 methane power tractor that runs on a liquified version of the gas, giving longer working times to fill. The new tractor has four times the fuel storage of the firm's existing methane-powered T6, which utilizes compressed gas (CNG).

- January 2023: Yanmar opened the DUC NAM Agent branch to serve customers in Kim Thanh district, Hai Duong province. This will expand the business and improve sales in the region.

- January 2022: Yanmar expanded its business by opening dealerships in 3 provinces of Thanh Hoa, Binh Dinh, and Binh Thuan. With the establishment of new dealers in 3 provinces, various types of tractors are available for sale.

Vietnam Agricultural Tractor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 Engine Power

- 5.1.1 Less than 15 HP

- 5.1.2 15 to 30 HP

- 5.1.3 31 to 45 HP

- 5.1.4 46-75 HP

- 5.1.5 More than 75 HP

6. Competitive Landscape

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Kubota Tractor Corporation

- 6.3.2 CLAAS KGaA mbH

- 6.3.3 Vietnam Engine and Agricultural Machinery Corporation

- 6.3.4 Yanmar America Corporation

- 6.3.5 Belarus

- 6.3.6 CNH Industrial

- 6.3.7 ShanDong Huaxin Machinery Co. Ltd

- 6.3.8 AGCO Corporation

- 6.3.9 Tong Yang Moolsan Co. Ltd

- 6.3.10 Truong Hai Auto Corporation (THACO)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityVietnam Agricultural Tractor Industry Segmentation

A tractor is an industrial vehicle with one or two small wheels in front and two large wheels at the back for agricultural and other functions. It is used to move the attached implement that plows the field or performs other activities. For the purpose of this report, tractors used in agricultural operations have been considered. The report does not cover other agricultural machinery and attachments to tractors. Tractors used for industrial and construction purposes are also excluded from the study.

The Vietnam agricultural tractors market is segmented by engine power (less than 15 HP, 15 to 30 HP, 31 to 45 HP, 46-75 HP, and More than 75 HP).

The report offers market estimation and forecasts in value (USD) for the above-mentioned segments.

| Engine Power | Less than 15 HP |

| 15 to 30 HP | |

| 31 to 45 HP | |

| 46-75 HP | |

| More than 75 HP |

Vietnam Agricultural Tractor Market Research FAQs

How big is the Vietnam Agricultural Tractor Market?

The Vietnam Agricultural Tractor Market size is expected to reach USD 623.83 million in 2024 and grow at a CAGR of 5.06% to reach USD 798.46 million by 2029.

What is the current Vietnam Agricultural Tractor Market size?

In 2024, the Vietnam Agricultural Tractor Market size is expected to reach USD 623.83 million.

Who are the key players in Vietnam Agricultural Tractor Market?

CLAAS KGaA mbH, Vietnam Engine and Agricultural Machinery Corporation, Yanmar America Corporation, Kubota Tractor Corporation and CNH Industrial are the major companies operating in the Vietnam Agricultural Tractor Market.

What years does this Vietnam Agricultural Tractor Market cover, and what was the market size in 2023?

In 2023, the Vietnam Agricultural Tractor Market size was estimated at USD 593.78 million. The report covers the Vietnam Agricultural Tractor Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Vietnam Agricultural Tractor Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Vietnam Agricultural Tractor Industry Report

Statistics for the 2024 Vietnam Agricultural Tractor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Vietnam Agricultural Tractor analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.