VXI Test Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 23.65 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

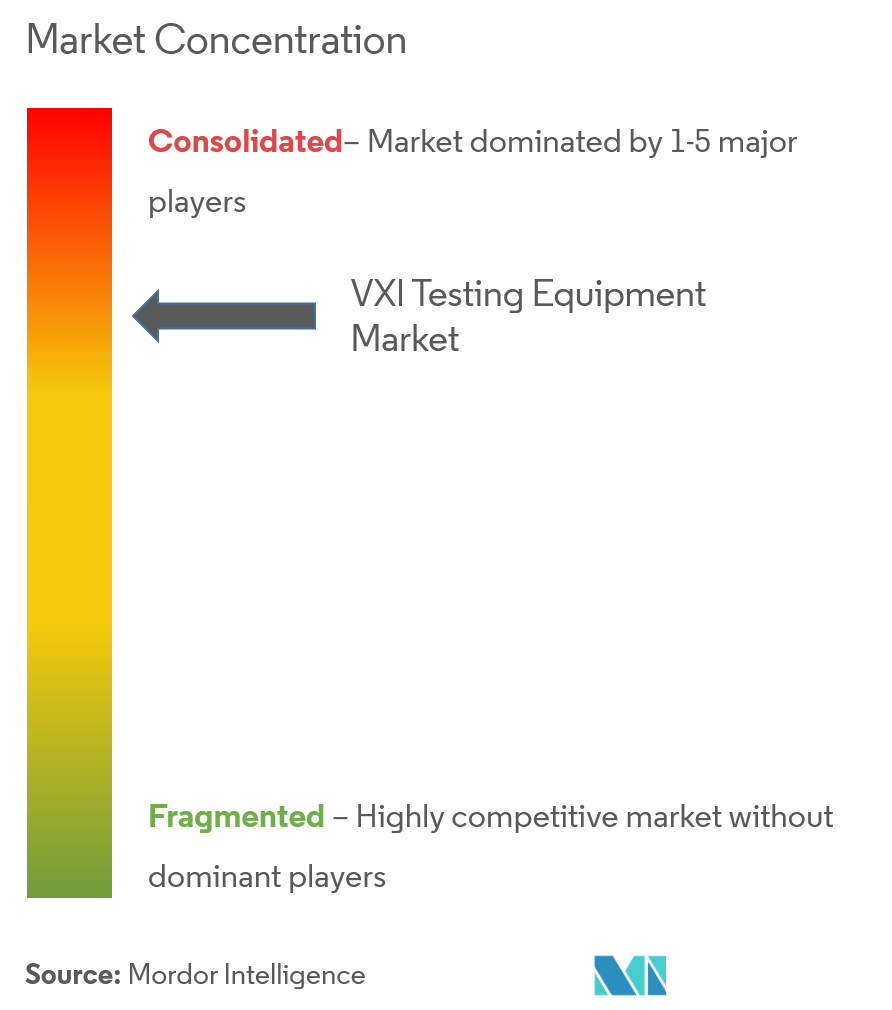

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

VXI Test Equipment Market Analysis

The VXI testing equipment market is expected to register a CAGR of 23.65% over the forecast period of 2021-2026. The primary purpose of the test equipment is to inspect the functionality of the device under test.VXI test equipment uses automated test equipment based on VMEbus.

- VXI chassis are based on chassis with 13 slots. Increasing the semiconductor chip volume can be the driving factor for the growth of VXI testing market. One of the primary goals of organizations is to have more products in their stock, delivering the custom products in optimum time, and to speed up the development processes for their new products.

- VXI testing equipment aids in the process of allocating more time for development, removing the hassle of checking for defects in products for a prolonged period.

- Ranging from test and measurement to data acquisition and analysis in both research and industrial automation VXI is used in many different applications.

- The increasing semiconductor chip volume is driving the demand for VXI test equipment. Moreover, a rise in the number of consumer electronics is also driving demand for semiconductors, which is leading to the rise in VXI test equipment to test various devices.

- VXI testing finds applications in the defense industry, as it verifies and calibrates the most complex electronics deployed. VXI testing checks the operating software by delivering high-performance, analogue, mixed-signal and serial bus testing for the entire overall hardware infrastructure setup installed.

VXI Test Equipment Market Trends

This section covers the major market trends shaping the VXI Test Equipment Market according to our research experts:

Growth of Consumer Electronics to Drive VXI Testing Equipment Market

- Consumer Electronics accounted for 3% of the global GDP and the forecast for the next six years puts it ahead of the global GDP growth rate. This sale of consumer electronics included 1.2 billion smartphones and 250 million tablets, which represents a major share of the global consumer electronics market.

- With the advent of the internet, some of these devices with applications, such as health monitoring, temperature control, security, and transportation systems will be wirelessly connected. It is also estimated that over 50 billion of these devices are expected to be wirelessly connected by 2020, and this is going to drive the market further.

- However, the CE industry is expected to be highly influenced by the emerging technologies, such as smart watches, smart thermostats, automotive electronics, UHD TVs, smart eyewear, fitness & activity trackers, and other high-end wearable devices, during the forecast period.

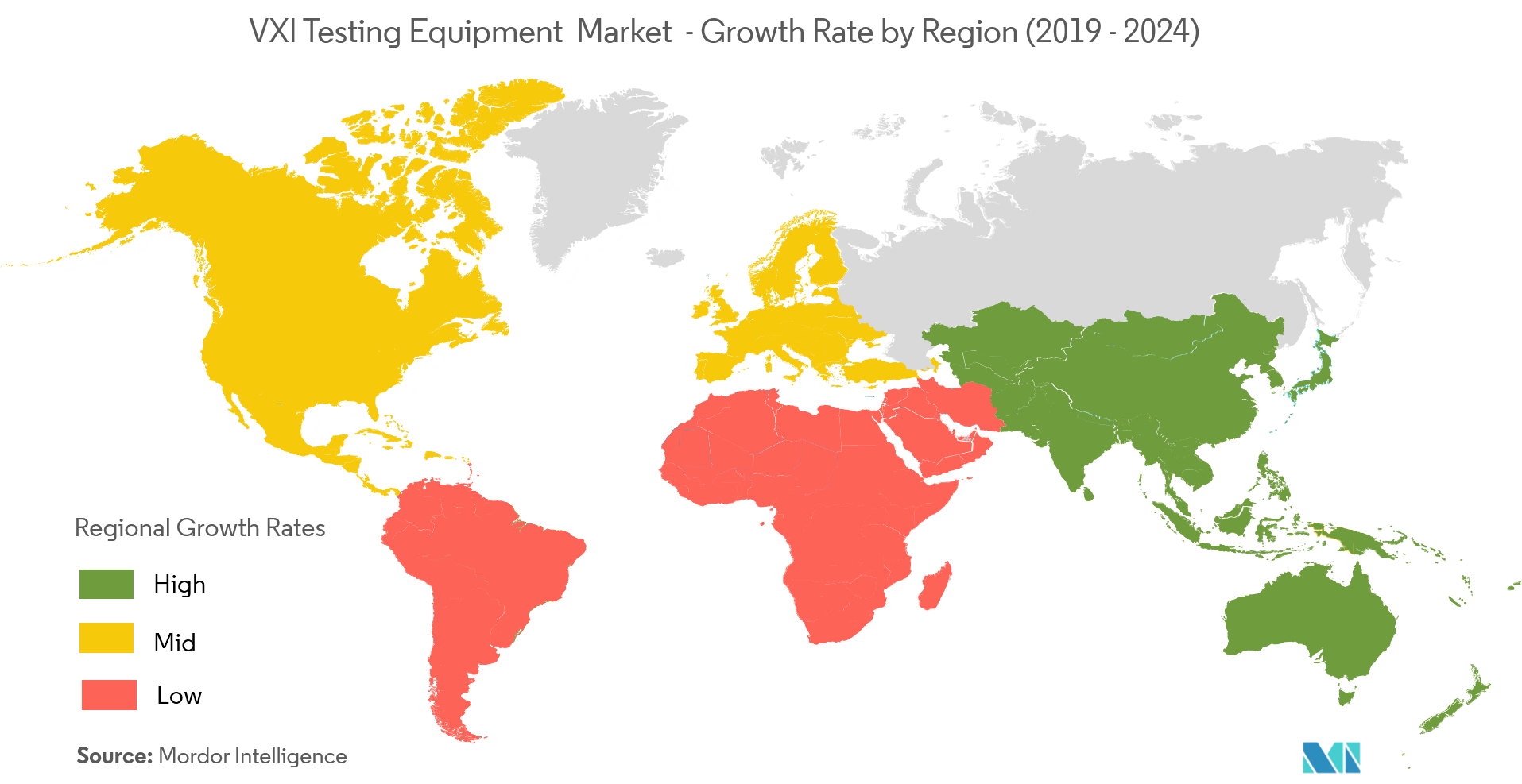

North America to Hold the Largest Market Share

- Increase in production of helicopters and commercial aircraft drives the market for testing. In North America, countries such as the United States has a huge aerospace industry which exports more than 60% of all the aerospace production.

- Many foreign firms are attracted to the United States aerospace market as it is the largest in the world, characterized by the skilled and hospitable workforce, diverse offerings and extensive distribution systems.

- According to the United States Department of Commerce, the country’s aerospace industry has contributed to about USD 118.5 billion to the United States economy, in the form of export sales. This huge demand from the independent aerospace industry relying on massive exports has been a major driver for the growth of the testing equipment in the market.

- Automated test equipment further finds application in the defense sector. The defense industry in the country has a budget allocation, which is more than the entire economy of more than half of the existing countries in the world.

VXI Test Equipment Industry Overview

The VXI testing equipment market is consolidated due to a major share of the market is occupied by top players. The competition among the established players is very high.Some of the key players includeNational Instruments, Kinetic Systems,Interface TechnologyInc.,Agilent Technologies, C&H Technologies Inc., Giga-tronicsInc.,AeroflexInc., among others.

- April 2019 -National Instruments, the provider of platform-based systems that help engineers and scientists solve the world’s greatest engineering challenges; Radisys, a global leader of open telecom solutions; and CommScope,a global leader in infrastructure solutions for communications networks, announced that they have collaborated to demonstrate a 28 GHz 5G New Radio (NR) network at the Brooklyn 5G Summit 2019. This first public demonstration of the three companies’ collaboration shows a 28 GHz base station or gNodeB built from a CommScope remote radio unit (RRU) running software developed by Radisys that communicates with a NI Test UE.

- November 2018 -Agilent Technologies Inc. completed the acquisition of ACEA Biosciences Inc., a developer of cutting-edge cell analysis tools, for USD 250 million in cash. This acquisition brings together two pioneers in cellular function and metabolism measurements focused on real-time, live cell analyses.

VXI Test Equipment Market Leaders

-

National Instruments

-

Agilent Technologies,

-

C&H Technologies Inc.

-

Giga-tronics Inc

-

Aeroflex Inc.

*Disclaimer: Major Players sorted in no particular order

VXI Test Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growth in Consumer Electronics Sale

- 4.3.2 Increased Focus on Sophisticated Testing Methods

-

4.4 Market Restraints

- 4.4.1 High Cost Associated with Testing Equipment

- 4.4.2 Fluctuations in the Semiconductor Industry

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Oscilloscopes

- 5.1.2 Function Generators

- 5.1.3 Power Suppliers

- 5.1.4 Other Product Types

-

5.2 By End User

- 5.2.1 Consumer Electronics

- 5.2.2 Communications

- 5.2.3 Aerospace, Military and Defense

- 5.2.4 Industrial Electronics

- 5.2.5 Other End Users

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 National Instruments

- 6.1.2 Kinetic Systems

- 6.1.3 Interface Technology Inc.

- 6.1.4 Giga-tronics Inc.

- 6.1.5 C&H Technologies Inc.

- 6.1.6 Agilent Technologies

- 6.1.7 Aeroflex Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityVXI Test Equipment Industry Segmentation

VXI and VXIbus are prevailing test instrumentation technology based around a rack system that is established on the 19-inch rack based VME bus. The VXI test equipment has wide application in the testing for production, field repair and maintenance, automated test systems controlled within a rack, in military and avionics applications. VXI testing equipment helps in allotting more time for development, eliminating the difficulty of checking for defects in products for the extended period.

| By Product Type | Oscilloscopes |

| Function Generators | |

| Power Suppliers | |

| Other Product Types | |

| By End User | Consumer Electronics |

| Communications | |

| Aerospace, Military and Defense | |

| Industrial Electronics | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

VXI Test Equipment Market Research FAQs

What is the current VXI Testing Equipment Market size?

The VXI Testing Equipment Market is projected to register a CAGR of 23.65% during the forecast period (2024-2029)

Who are the key players in VXI Testing Equipment Market?

National Instruments, Agilent Technologies,, C&H Technologies Inc., Giga-tronics Inc and Aeroflex Inc. are the major companies operating in the VXI Testing Equipment Market.

Which is the fastest growing region in VXI Testing Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in VXI Testing Equipment Market?

In 2024, the North America accounts for the largest market share in VXI Testing Equipment Market.

What years does this VXI Testing Equipment Market cover?

The report covers the VXI Testing Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the VXI Testing Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

VXI Testing Equipment Industry Report

Statistics for the 2024 VXI Testing Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. VXI Testing Equipment analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.