X-ray Film Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.40 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

X-ray Film Market Analysis

The X-ray film market is expected to register a CAGR of 5.4% over the forecast period 2021-2026. The continued adoption of traditional X-ray equipment in developing economies will drive the market in the forecast period.

- The growing occurrence of chronic diseases, coupled with the rising number of diagnostic imaging procedures and significant spending on healthcare across the world, has been instrumental in driving the medical X-ray market.

- X-ray techniques have been useful in the detection treatment of neurological problems, cancer, cardiac diseases, and bone-related problems. This has buoyed the adoption of X-ray equipment, and consequently the use of X-ray films.

- The strong consumer base in India and China, and the ageing population and the increasing demand for medical care have been instrumental in driving the market studied. However, over the forecast period, the establishment of new hospitals and medical facilities are expected to be in favour of the adoption of digital X-ray equipment, owing to the several benefits offered by them.

- Radiography in the medical field is undergoing a significant transition away from film and toward digital flat-panel detector technology(FDP), that has proved to be more affordable and efficient. With innovations, recent trends show that digital radiography over conventional systems is more effective in terms of image quality, further eliminating the need for X-ray films, chemicals, and darkroom setup, and thereby, improving the workflow and throughout.

X-ray Film Market Trends

This section covers the major market trends shaping the X-ray Film Market according to our research experts:

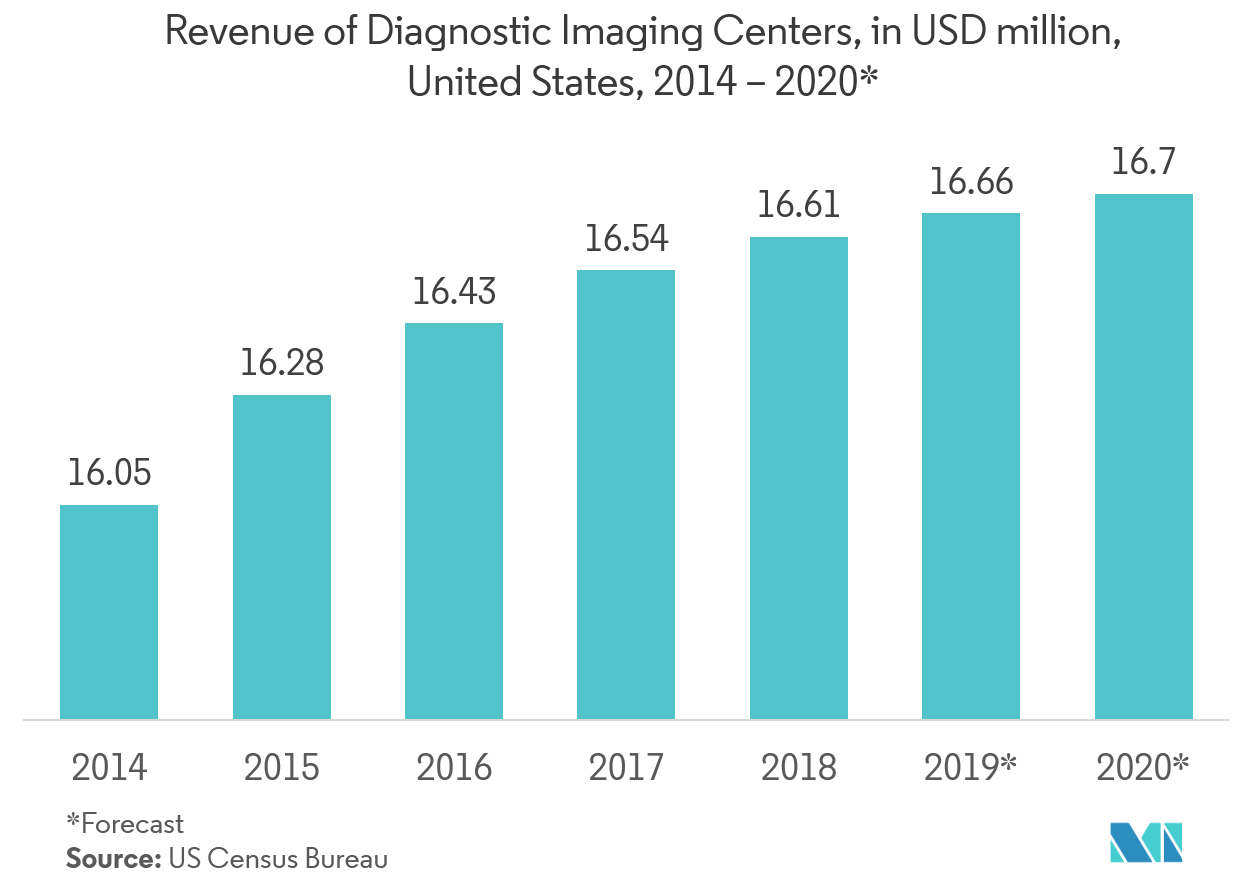

Diagnostic Centers Segment is Expected to Register a Significant Growth

- The demand for the diagnostic industry is expanding rapidly in developing economies. However, still, there are many major issues to be solved, which are test accuracy, quality, and cost, which is driving the demand for studies market in this segment.

- In developing economies, the major investment and essential technological developments are generated in the private sector, while in developed economies, like Europe, this is almost exclusive to the Public Sector. The public sector diagnostic imaging focuses on providing the highest possible coverage.

- For instance, in 2018, Dalian Wanda Group Co Ltd announced to invest USD10 billion in a health park in China. This investment is expected to be done after the government ease the norms for FDI in Chinese private healthcare sector.

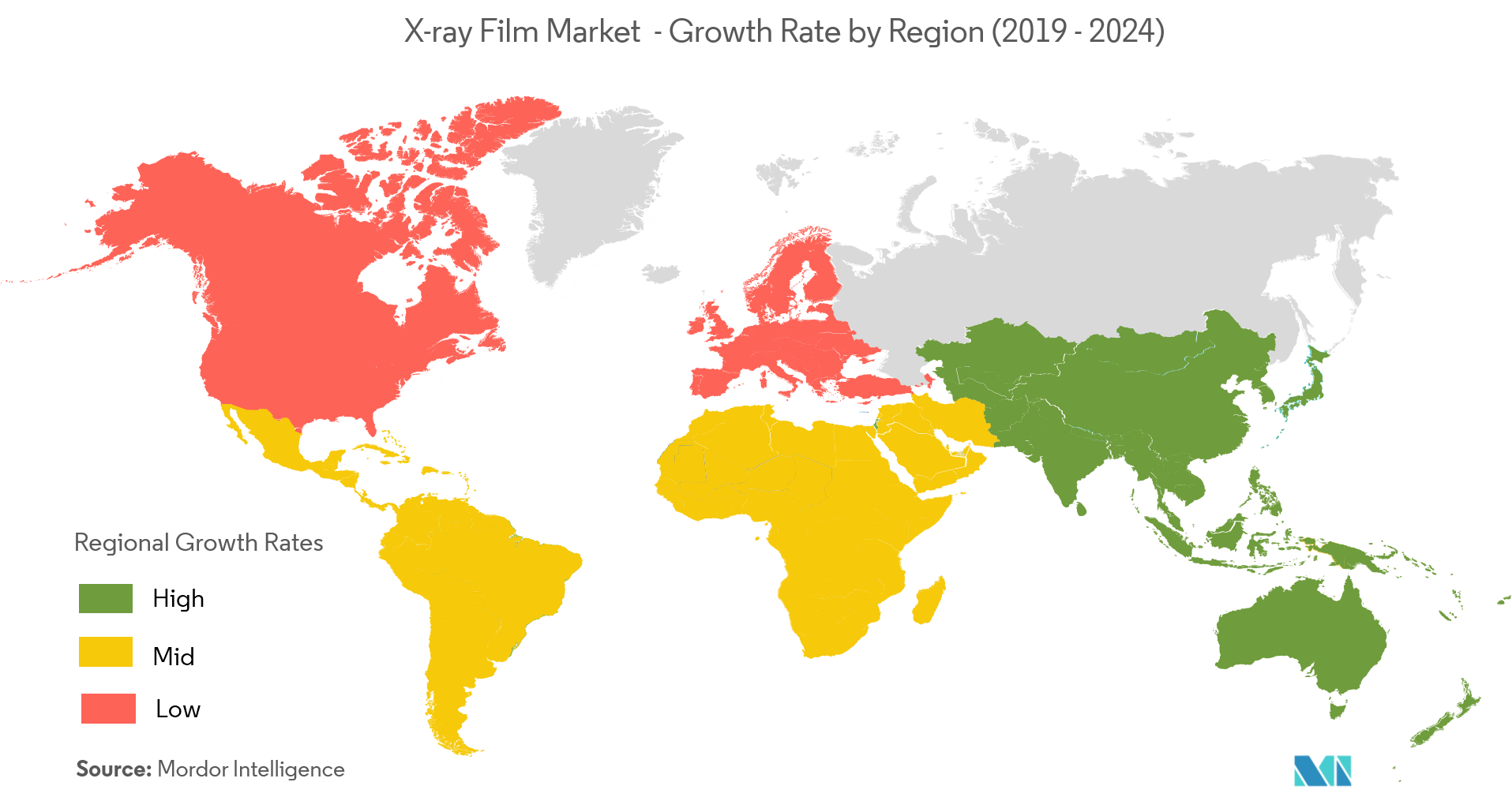

Asia-Pacific to Witness a Significant Growth Rate

- Asia-Pacific still relies on traditional x-ray solutions significantly. Due to the region’s increasing population and the number of patients suffering from ailments, who should be diagnosed or managed through the use of CT, the use of x-rays is on the rise. This growing pool of patients has led to high demand for medical imaging.

- In the Asia-Pacific region, hospitals play a crucial role in medical diagnostics. In China, the last recorded number of hospitals is on the rise, from 23,170 hospitals to 29,140 hospitals approximately, the National Bureau of Statistics of China reported an increase in the number of hospitals in the country.

- In addition to this, the move toward digital radiography is slow in the region when compared to other regions. This is because of the reliance on x-ray radiography to diagnose the ailment and diseases of the internal body parts. Thus, owing to the slower adoption of digital radiography, the market studied in APAC is expected to witness the fastest CAGR, over the forecast period.

X-ray Film Industry Overview

The major players include Carestream, Sony, Fujifilm, FomaBohemia, Konica Minolta, Flow Dental, and others. There is moderately intense competition in the market since theinnovation is at a slower pace as of now.

- January 2018 -Carestream healthcare displayed its medical imaging workflow portfolio at the 71st annual conference of the Indian Radiology and Imaging Association, Mumbai, India. The company displayed products like Managed Print Solutions (MPS), which automates the ordering, purchasing, and stocking of x-ray films.

X-ray Film Market Leaders

-

Carestream Health Inc.

-

Sony Corporation

-

Fujifilm Corporation

-

Foma Bohemia Ltd.

-

Konica Minolta Inc.

*Disclaimer: Major Players sorted in no particular order

X-ray Film Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Continued Adoption of Traditional X-ray Equipment in Developing Economies

-

4.4 Market Restraints

- 4.4.1 Emergence of Digital Radiography and Flat Panel Detector Technology

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By End User

- 5.1.1 Medical

- 5.1.1.1 Diagnostic Centers

- 5.1.1.2 Hospitals

- 5.1.1.3 Research and Educational Institutions

- 5.1.2 Industrial

- 5.1.3 Other End Users

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Carestream Health Inc.

- 6.1.2 Sony Corporation

- 6.1.3 Fujifilm Corporation

- 6.1.4 Foma Bohemia Ltd.

- 6.1.5 Konica Minolta Inc.

- 6.1.6 Flow Dental

- 6.1.7 Codonics Inc.

- 6.1.8 Agfa-Gevaert N.V. (AGFA)

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityX-ray Film Industry Segmentation

A medical X-ray film processor is the most important part of X-ray image processing. These processors are used to decipher the information carried by weakened X-ray beams when they are passed through tissues. They capture the invisible image and convert it into a visible form. The main part of an X-ray film is a radiation-sensitive, photographically active material made in the form of emulsion quoted on the supporting material called base.

| By End User | Medical | Diagnostic Centers |

| Hospitals | ||

| Research and Educational Institutions | ||

| By End User | Industrial | |

| Other End Users | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| Latin America | ||

| Middle East & Africa |

X-ray Film Market Research FAQs

What is the current X-ray Film Market size?

The X-ray Film Market is projected to register a CAGR of 5.40% during the forecast period (2024-2029)

Who are the key players in X-ray Film Market?

Carestream Health Inc., Sony Corporation, Fujifilm Corporation, Foma Bohemia Ltd. and Konica Minolta Inc. are the major companies operating in the X-ray Film Market.

Which is the fastest growing region in X-ray Film Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in X-ray Film Market?

In 2024, the North America accounts for the largest market share in X-ray Film Market.

What years does this X-ray Film Market cover?

The report covers the X-ray Film Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the X-ray Film Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

X-ray Film Industry Report

Statistics for the 2024 X-ray Film market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. X-ray Film analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.