Zigbee Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 4.87 Billion |

| Market Size (2029) | USD 6.51 Billion |

| CAGR (2024 - 2029) | 6.01 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Zigbee Market Analysis

The ZigBee Market size is estimated at USD 4.87 billion in 2024, and is expected to reach USD 6.51 billion by 2029, growing at a CAGR of 6.01% during the forecast period (2024-2029).

The low-cost and low-powered mesh network is widely deployed for controlling and monitoring applications, covering the range of 10-100 meters. This communication system is less expensive and more straightforward than the other proprietary short-range wireless sensor networks, such as Bluetooth and Wi-Fi connectivity.

- Due to the rising trend toward adopting smart devices, the increasing consumer electronics industry is expected to drive the application of ZigBee-based communication services used for monitoring and controlling devices based on IEEE 802.15.4 across emerging economies.

- Growing demand for the Zigbee broad-based deployment of wireless networks with low-cost, low-power solutions that can run for years on inexpensive batteries for a host of monitoring and control applications across smart energy/smart grid & building automation systems with significant advancements is expected to drive the market.

- The adoption of smart sensor technology, connectivity improvements, and advancements in cloud computing have helped drive the adoption and evolution of Industrial IoT. This trend is also expected to drive the growth of ZigBee in small industrial environments where factory devices have to communicate over a short distance.

- The Internet of Things has been growing across smart home applications. It is expected to become more customizable to give more control to users and enhance the appliance operating functions. For instance, Loup Ventures, a venture capital firm that invests in virtual reality, augmented reality, artificial intelligence, and robotics, the global smart speaker market's revenue is expected to reach USD 35.5 billion by 2025.

- ZigBee networks use a mesh topology where all devices ('nodes') can communicate with each other to form a wireless mesh network. The mesh network helps the devices share over numerous paths and regularly optimize their connections to other devices, enabling the mesh to recover from wireless interference or broken links automatically.

Zigbee Market Trends

This section covers the major market trends shaping the ZigBee Market according to our research experts:

Smart Homes & Building Sector is Gaining Traction Due to Emergence of Automation

- ZigBee network is primarily intended for low-duty cycle sensors, those active for less than 1% of the time. It is an IEEE 802.15.4-based suite for high-level communication across the smart home ecosystem due to its proximity, low data rate, and low power system features.

- Zigbee uses a variety of information transfer mechanisms, such as direct, group, and broadcasting addresses. Mesh network in this internet protocol can be established, which enables the long-distance communication of information across the building automation sector.

- Increasing investments in start-ups such as Hypervolt, HIXAA, SmartRent, and other SMEs help to gain new IoT-based projects in industries that are likely to create a need for a high-performance, low-power IoT MCUs market over the forecast period.

- For instance, in 2022, Renesas Electric Corporation introduced the 32-bit RA Family of microcontrollers (MCUs). The new product is based on the Arm Cortex-M23 core, which provides shallow power consumer MCUs explicitly designed for IoT endpoint applications such as industrial automation, medical devices, intelligent home appliances, and wearables.

- Further, with the increasing investments and adoption of innovative home technologies, consumers start to perceive products, such as voice-activated assistants and smart security systems, as standard household items rather than redundant luxuries, thereby driving the application of the Zigbee communication product integrated across the end-user industry.

North America to Account for the Most Significant Share in the Market

- Smart homes are on the rise across North America, where people in the region are increasingly looking to automate their homes. Dependence on smartphones and mobile apps is set to increase as smartphones offer an attractive and intuitive window into controlling smart home technology.

- For instance, in October 2021, The United States Department of Energy (DOE) announced $61 million in funding for ten pilot projects using new technology to transform thousands of homes and workplaces into cutting-edge, energy-efficient structures. These Connected Communities can interact with the electrical grid to optimize their energy consumption, significantly reducing carbon emissions and energy costs. Which further increases market growth.

- With nearly 30 million U.S. households projected to add smart home technology, the products consumers want to add to their homes include connected cameras, video doorbells, connected light bulbs, smart locks, and smart speakers that find the application of Zigbee standards for their communication medium.

- Also, the adoption of voice-powered smart speakers is taking off, with an estimate of smart devices such as the Amazon Echo, Google Home, and Sonos One that will be installed in most U.S. households, thereby driving the application of the Zigbee connectivity medium during the forecast period.

- According to a recent Stanford University and Avast study, North American homes have the highest density of IoT devices of any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices. Due to robust cloud infrastructure, an increasing number of connected devices, and advancements in artificial intelligence and machine learning technologies in the region, the market for ZigBee is expected to grow.

- The average household in the region would have an average of nine devices by 2022, and nearly half (48%) of total devices and connections will be video capable. Hence, with the growing adoption of IoT devices, the demand for ZigBee chips is expected to increase for these smart home devices over the forecast period.

Zigbee Industry Overview

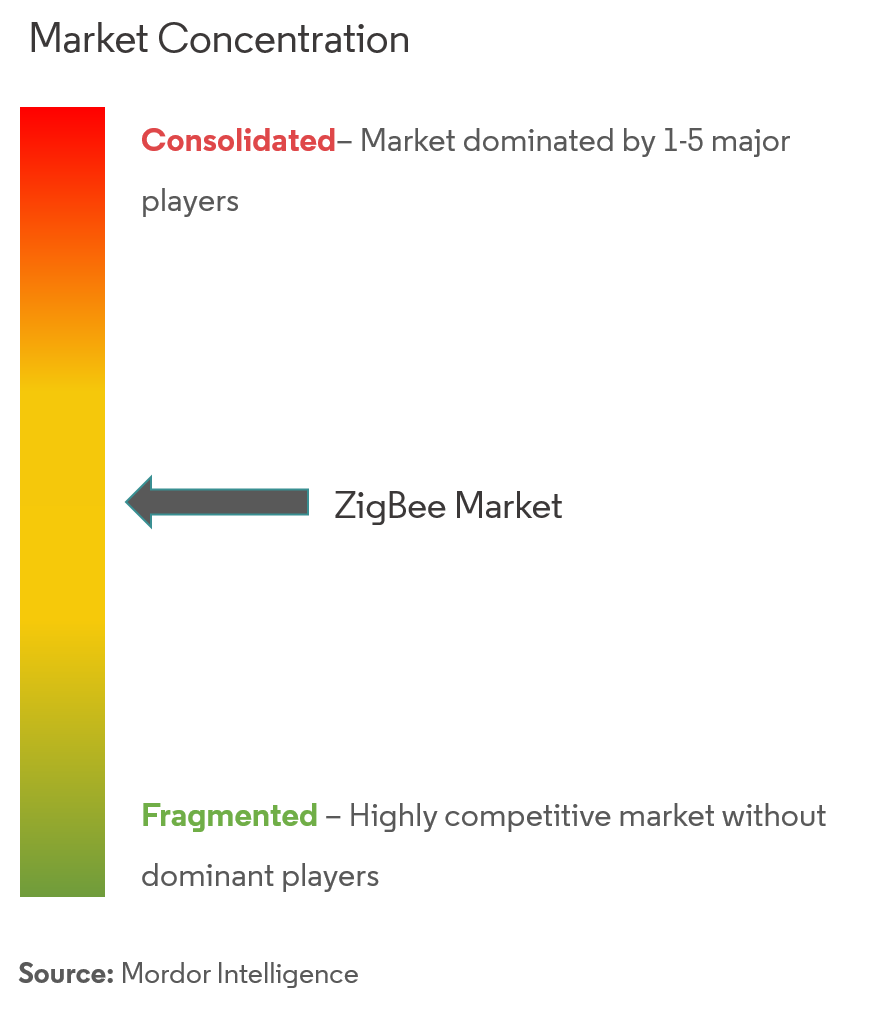

The ZigBee Market is moderately competitive and consists of a few major players. Some of the players currently dominate the market in terms of market share. However, with the advancement in communication technology across the connectivity medium, new players are increasing their market presence, thereby expanding their business footprint across the emerging economies.

- December 2021- Silicon Labs, a pioneer in secure, intelligent wireless technology for a more connected world, has introduced a first-of-its-kind 3D virtual smart home platform. This interactive journey guides users through innovative smart home solutions, applicable protocols, and ecosystem connections. Users can explore three use cases: home security, home automation, and health, as well as the protocols and ecosystems they work with and connect to on a self-guided tour.

- November 2021- Microchip Technology has announced the release of the second development tool in its Smart Embedded Vision initiative for designers who use its PolarFire RISC-V System on Chip (SoC) Field Programmable Gate Array (FPGA). The PolarFire device, the industry's lowest-power SoC FPGA in its class, is the only mid-range device that supports dual 4K video processing and quad-core RISC-V application-class processors running both the Real Time Operating System (RTOS) and rich operating systems such as Linux.

Zigbee Market Leaders

-

Texas Instruments Incorporated

-

NXP Semiconductors NV

-

Microchip Technology Inc.

-

Sena Technologies Inc.

-

Silicon Laboratories Inc

*Disclaimer: Major Players sorted in no particular order

Zigbee Market News

- January 2022- Silicon Labs, a pioneer in secure, intelligent wireless technology for a more connected world, has introduced the BG24 and MG24 families of 2.4 GHz wireless SoCs for Bluetooth and Multiple-protocol operations and a new software toolkit. This new co-optimized hardware and software platform will aid in delivering AI/ML applications and high-performance wireless connectivity to battery-powered edge devices. The ultra-low-power BG24 and MG24 families support multiple wireless protocols. They include PSA Level 3 Secure Vault protection, making them ideal for a wide range of smart home, medical, and industrial applications.

- December 2021- Digi International, a leading global provider of Internet of Things (IoT) connectivity products and services, has announced the release of Connect EZ, a next-generation family of device servers for business, commercial, and industrial automation applications. Connect EZ leapfrogs outdated serial-interface designs with the discovery and configuration tool Digi Navigator and the integration of the Digi Accelerated Linux (DAL) operating system to provide an easy-to-deploy, reliable, and innovative solution that ensures longevity and manageability for connectivity applications in manufacturing, retail, medical, and telecom.

Zigbee Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Growing Adoption of Connected Devices Across Industrial Automation & Smart Homes

- 5.1.2 Rising Trend of Low Cost with High Performance Equipment Across IoT Ecosystem

-

5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing of Networking Equipment With ZigBee Standards

-

5.3 Technology Snapshot

- 5.3.1 Zigbee Mesh Network

- 5.3.2 Zigbee 3.0

- 5.3.3 ZigBee RF4CE

- 5.3.4 ZigBee PRO

- 5.3.5 ZigBee IP

6. MARKET SEGMENTATION

-

6.1 By End-user Industry

- 6.1.1 IT & Telecommunication

- 6.1.2 Residential Automation

- 6.1.3 Industrial Automation

- 6.1.4 Healthcare

- 6.1.5 Retail (Digital Ecommerce)

- 6.1.6 Other End-user Industries

-

6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Italy

- 6.2.2.4 France

- 6.2.2.5 Russia

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Australia and New Zealand

- 6.2.3.6 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East and Africa

7. VENDOR MARKET SHARE

8. COMPETITIVE LANDSCAPE

-

8.1 Company Profiles

- 8.1.1 Texas Instruments Incorporated

- 8.1.2 NXP Semiconductors NV

- 8.1.3 Microchip Technology Inc.

- 8.1.4 Silicon Laboratories Inc

- 8.1.5 Digi International Inc.

- 8.1.6 Sena Technologies Inc.

- 8.1.7 Nordic Semiconductor ASA

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 Semiconductor Components Industries LLC (ON Semiconductor)

- *List Not Exhaustive

9. INVESTMENT ANALYSIS

10. FUTURE OF THE MARKET

** Subject To AvailablityZigbee Industry Segmentation

Zigbee is used in low data rate applications that require long battery life and secure networking. Zigbee communication is specially built to control the sensor networks on the IEEE 802.15.4 standard for wireless personal area networks (WPANs), which is the product of the Zigbee alliance. This communication standard defines the physical and Media Access Control (MAC) layers to handle many devices at low-data rates. These Zigbee's WPANs operate at 868 MHz, 902-928MHz, and 2.4 GHz frequencies, where the data rate of 250 kbps is considered best suited for periodic and intermediate two-way transmission of data between sensors and controllers.

| By End-user Industry | IT & Telecommunication | |

| Residential Automation | ||

| Industrial Automation | ||

| Healthcare | ||

| Retail (Digital Ecommerce) | ||

| Other End-user Industries | ||

| By Geography | North America | United States |

| Canada | ||

| By Geography | Europe | United Kingdom |

| Germany | ||

| Italy | ||

| France | ||

| Russia | ||

| Rest of Europe | ||

| By Geography | Asia Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Australia and New Zealand | ||

| Rest of Asia Pacific | ||

| By Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America | ||

| By Geography | Middle East and Africa |

Zigbee Market Research FAQs

How big is the ZigBee Market?

The ZigBee Market size is expected to reach USD 4.87 billion in 2024 and grow at a CAGR of 6.01% to reach USD 6.51 billion by 2029.

What is the current ZigBee Market size?

In 2024, the ZigBee Market size is expected to reach USD 4.87 billion.

Who are the key players in ZigBee Market?

Texas Instruments Incorporated, NXP Semiconductors NV, Microchip Technology Inc., Sena Technologies Inc. and Silicon Laboratories Inc are the major companies operating in the ZigBee Market.

Which is the fastest growing region in ZigBee Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in ZigBee Market?

In 2024, the North America accounts for the largest market share in ZigBee Market.

What years does this ZigBee Market cover, and what was the market size in 2023?

In 2023, the ZigBee Market size was estimated at USD 4.59 billion. The report covers the ZigBee Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the ZigBee Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Zigbee Industry Report

Statistics for the 2024 Zigbee market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Zigbee analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.